The September edition of CryptoCompare’s Digital Asset Management Review is now live. This monthly report provides readers with an in-depth look at the key developments in the global digital asset investment product landscape.

In September, the price of Bitcoin and Ethereum fell 9.1% and 14.7%, respectively (data up to 24th September), following regulatory concerns from the U.S. Securities and Exchange Commission and a declaration from the People’s Bank of China on the 24th stating that all crypto-related transactions are illegal.

These announcements caused a decrease in AUM for digital asset investment products, although a rise in volumes in September coupled with positive weekly inflows for the first time in 3 months suggests there could be upside going into the last quarter of 2021.

Key takeaways:

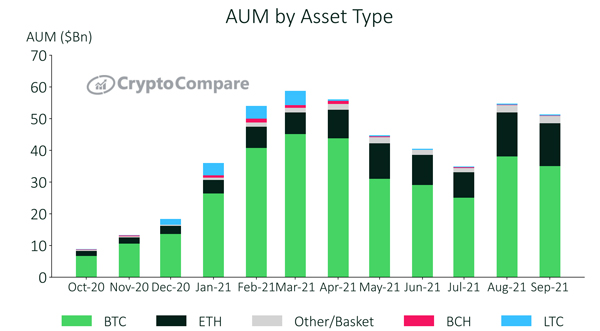

- Bitcoin AUM fell 7.8% in September to $35.1bn - its lowest share this year (67.9% of current total AUM).

- Ethereum-based products reached their highest market share of AUM at 25.9% - movement that suggests investors are seeking alternatives to Bitcoin for cryptocurrency exposure.

- Grayscale’s Ethereum Trust (ETHE) was the most traded digital asset product in September - with average daily volumes increasing 29.0% to $250mn (42.4% market share) - dethroning Grayscale’s Bitcoin Trust (GBTC) for the first time ever.

- Net flows turned positive in September after 3 months of net outflows.

- ETNs were the only product type to experience an increase in AUM in September, growing 7.2% to $3.7bn.

Additional insight can be found below

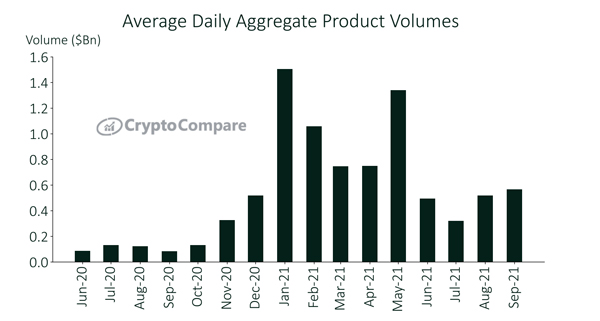

Trading Volumes

Aggregate daily volumes across all digital asset investment product types increased by an average of 4.1% from August to September. Average daily volumes now stand at $566mn.

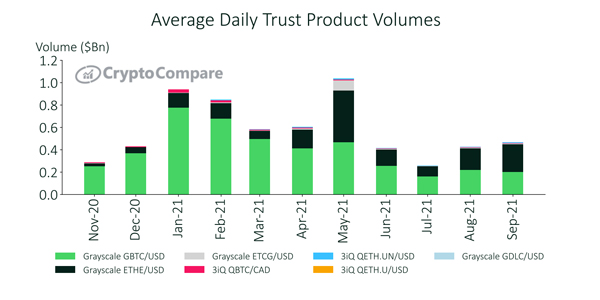

Grayscale’s Bitcoin trust product (GBTC) lost its majority market share of trust product volume in August at 40.1%.

Average daily volume for GBTC and Grayscale’s ETHE stood at $201mm (down 8.6%) and $225.3mn (up 29.9%) respectively. All trust product volume rose by an average of 11.5% to a total of $500mn.

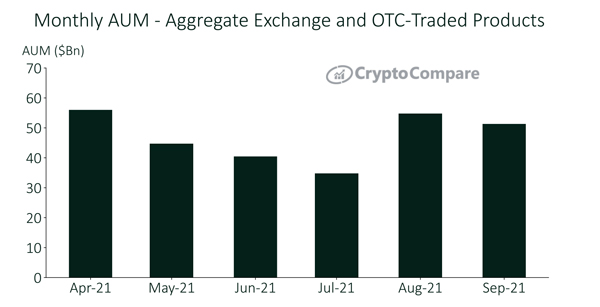

AUM – Assets Under Management

Since August 2021, total AUM across all digital asset investment products has decreased 6.3% to $51.3bn (as of the 24th of September).

In September, Bitcoin’s AUM fell 7.8% to $35.1bn. As a result, it continued to lose market share (now 67.9% of total AUM vs. 69.0% last month) – the asset’s lowest market share in 2021.

Ethereum’s AUM fell marginally (3.0%) to $13.4bn while Baskets also fell 1.3% to $2.8bn.

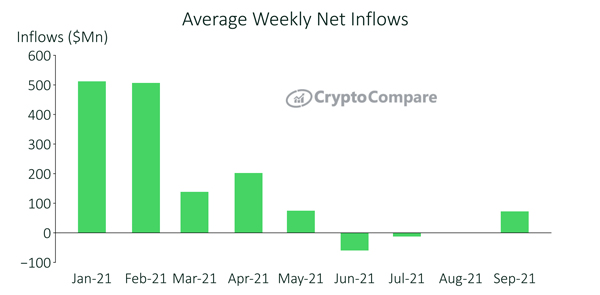

Average weekly net inflows were positive in September as inflows averaged $72.8mn, breaking a 3-month trend of average outflows (-$59.5mn in June, -$12.1mn in July, and -$0.6mn in August).

Price Performance

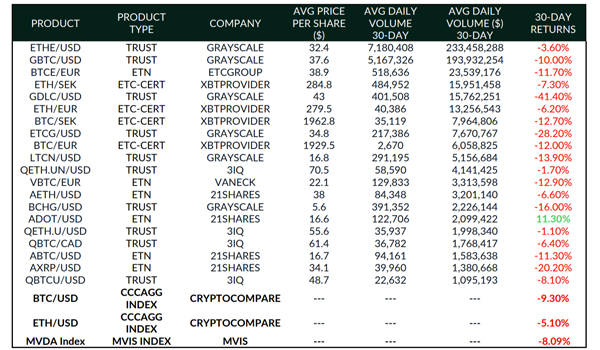

Both BTC and ETH-based products experienced losses over the last 30 days, ranging from -15% to -6% for BTC products and -8% to -1% for ETH products.

21Shares’ ADOT single-asset Polkadot product was the only product to see positive returns (11%) among the largest products by volume.

Grayscale’s GDLC basket product experienced a loss of 41% over the period.

The MVDA index experienced 50% returns. The MVDA index is a market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets. The index serves as a benchmark and universe for the other MVIS CryptoCompare Digital Assets Indices.

August 30th

US Global Investors Bought Crypto Exposure Through Grayscale Funds

September 10th

Bitwise Launches “Ex Bitcoin” Crypto Index Fund

September 10th

Three More Grayscale Crypto Trusts Have Been Designated SEC-Reporting Companies

September 14th

Valour Expands Crypto ETP Range with Solana Launch

September 14th

Bitwise Joins Hunt for Bitcoin ETH Approval With Futures Product Filing

September 20th

21Shares announces listing of Solana and Polkadot ETPs on Euronext Paris and Amsterdam

September 21st

VanEck Launches Three Crypto ETNs Including World’s First TRON Exposure

September 23rd

Invesco & Galaxy Digital Partner To Develop Crypto ETFs