The August edition of CryptoCompare’s Digital Asset Management Review is now live. This monthly report provides readers with an in-depth look at the key developments in the global digital asset investment product landscape.

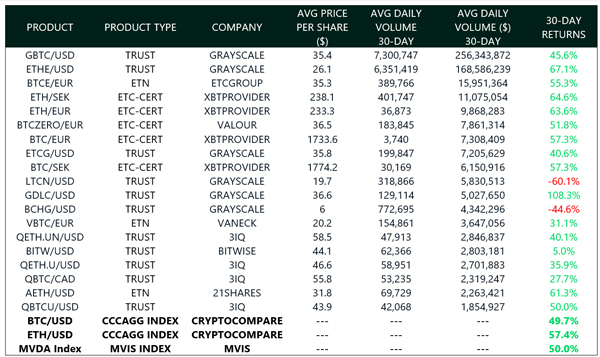

Cryptocurrency markets saw their prices rebound over the last 30 days as Bitcoin and Ethereum rose 49.7% and 57.4% respectively (data up to 23 August), triggered by the implementation of the Ethereum London Hard Fork on 5 August. Average daily trading volumes followed suit, increasing by 46.6% across all exchanges and OTC-traded investment product markets.

Key takeaways:

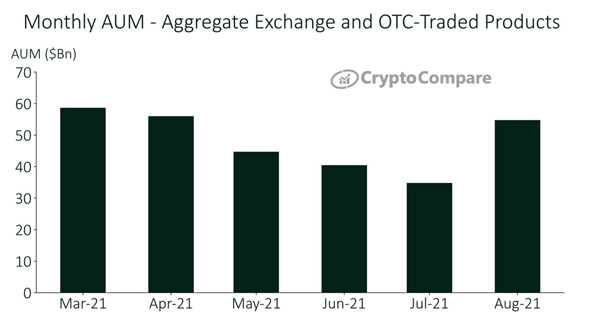

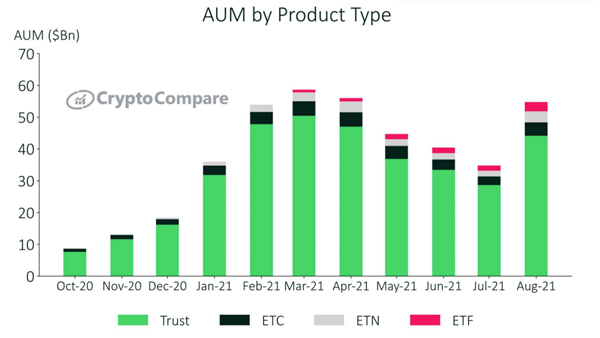

- Since July 2021, total AUM across all digital asset investment products increased 57.3% to $54.8bn

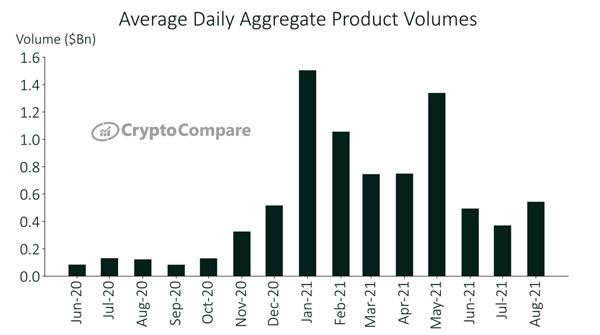

- Average daily aggregate product volumes rose 46.6% to $544mn, the largest month-on-month increase since May.

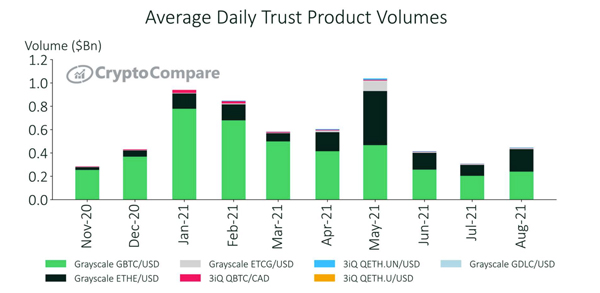

- Grayscale’s ETHE trust product saw its average daily volume increase 105.9% to $193.3mn. Its Digital Large Cap product (GDLC) also increased 117.4% in July to $6.0mn, the largest increase in any trust product for the same period.

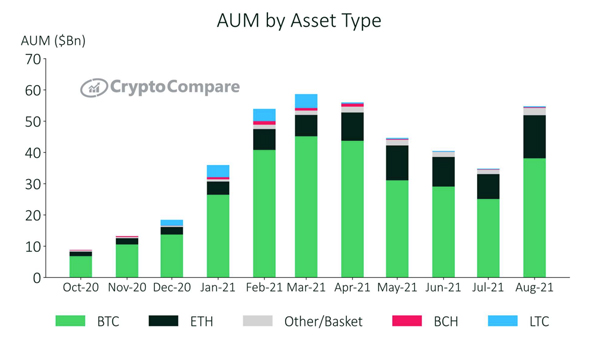

- Bitcoin’s AUM increased 51.9% to $38.1bn, however, Ethereum experienced a larger increase, with its AUM rising 72.8% to $13.8bn.

Additional insight can be found below and please do let CryptoCompare know if there is any additional information or data that you would like to see included in this report.

Trading Volumes

Aggregate daily volumes across all digital asset investment product types increased by an average of 46.6% from July to August. Average daily volumes now stand at $544mn.

Average daily volume for GBTC and Grayscale’s ETHE stood at $240mm (up 17.4%) and $193.3mn (up 105.9%) respectively. All trust product volume rose by an average of 45.3%. to a total of $469mn.

Volume in Grayscale’s Digital Large Cap product (GDLC) also increased by a staggering 117.4% in July to $6.0mn, the largest increase in any trust product for the same period.

AUM – Assets Under Management

Since July 2021, total AUM across all digital asset investment products has increased 57.3% to $54.8bn (as of 24 Aug).

While Bitcoin’s AUM increased 51.9% to $38.1bn, it lost market share (now 69.6% of total AUM vs. 72.1% last month) as other assets saw greater increases. Ethereum’s AUM rose 72.8% to $13.8bn while Baskets increased 67.6% to $2.3bn.

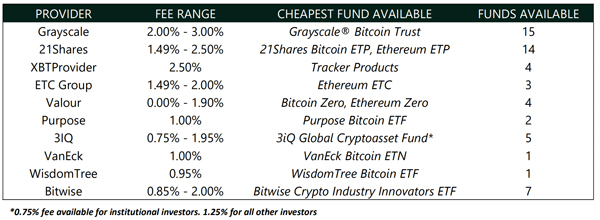

ETNs and ETFs saw large increases of 91.4% and 79.1% respectively, to $3.4bn and $2.9bn of AUM. As a result, these products saw their market share increase to 6.3% and 5.3% respectively.

Price Performance

Both BTC-based and ETH-based products experienced significant gains over the last 30 days, ranging from 36% to 67% for ETH products and 28% to 57% for BTC products.

Grayscale’s GDLC basket product experienced the highest positive returns of 108% over the same period amongst the largest products by volume, while the company’s Litecoin and Bitcoin Cash based products (LTCN and BCHG) experienced losses of 60.1% and 44.6% respectively.

The MVDA index experienced 50% returns. The MVDA index is a market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets. The index serves as a benchmark and universe for the other MVIS CryptoCompare Digital Assets Indices.

ETP News

July 19th 2021

ETC Group Listing Entire Crypto ETP Portfolio on Vienna Bourse Exchange including Vienna’s First Listing of a Carbon Neutral Crypto ETP

July 26th 2021

Goldman Sachs Applies for a DeFi ETF

July 28th 2021

World’s First Active Cryptocurrency ETP Provided by FiCAS ists on SIX Swiss Exchange

August 11th 2021

Germany Allows Spezialfonds Holding $1.8 Trillion To Invest In Bitcoin

August 11th 2021

Vaneck Files for Bitcoin Strategy ETF Tied to BTC Futures Products

August 16th 2021

Grayscale ETH Holdings Top $10 Billion

August 20th 2021

Eurex Announces Launch of Bitcoin ETN futures for September 13th

CryptoCompare Index Products

The MVIS CryptoCompare Digital Assets Indices family tracks the financial performance of the largest and most liquid digital assets and serves as the underlying platform for financial products globally. See all available indices here. Get in touch to learn more about how our indices can help you build innovative products.

The MVIS CryptoCompare Digital Assets Indices can be licensed to clients for a variety of purposes, including:

- Performance measurement and attribution

- Investment product development, as the basis for structured products such as ETPs and futures contracts

- Asset allocation

- Research

Contact CryptoCompare to learn how its indices can help you.