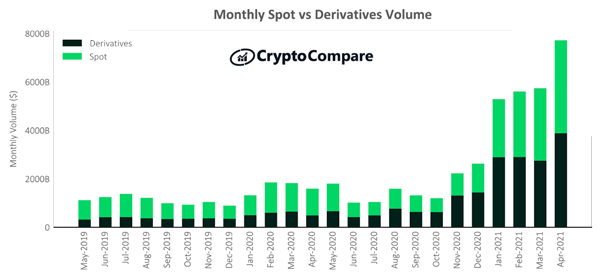

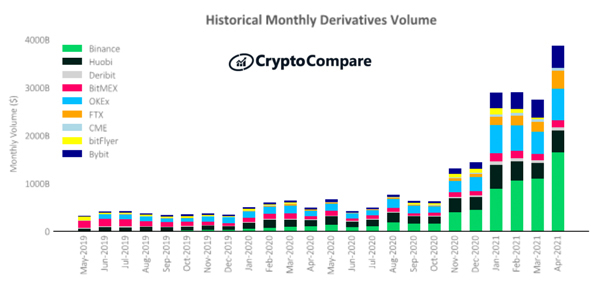

Trading volume boomed throughout April as derivatives volume surged 41.2% to $3.88tn. Spot volume followed suit, increasing 28.3% to $3.84tn. The derivatives market now represents 50.2% of the total crypto market (vs 47.8% in March).

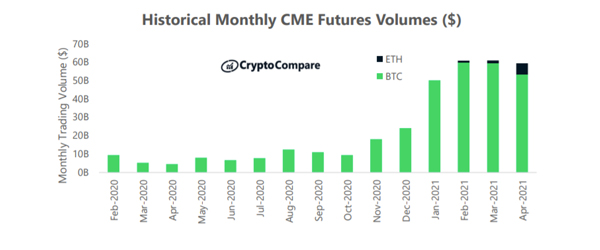

Although CME’s BTC futures volume decreased by 10.3% to $53.3bn in April, CME’s ETH futures reached a staggering $6.1bn (over a 300% increase since March). On aggregate, ETH + BTC futures volume reached $59.4bn - down 2.6%.

Click here to download CryptoCompare's April Exchange Review.

Key insights and takeaways from CryptoCompare's April Exchange Review.

Derivatives Volumes Surge 41.2% to $3.88tn in April While Spot Volumes Increase 28.3% to $3.84tn

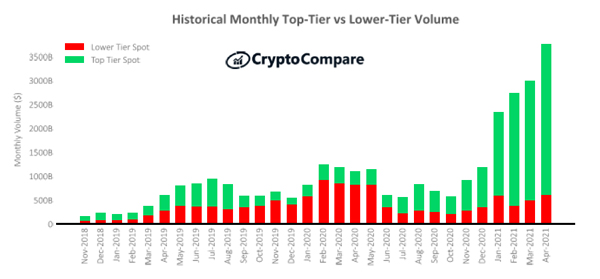

The derivatives market now represents 50.2% of the total crypto market (vs 47.8% in March). Top-Tier spot volumes increased 28.6% to $3.22tn while Lower-Tier spot volumes increased 26.7% to $618bn.

CME ETH Volume Quadruples While Open Interest Grows 146%

In terms of total USD trading volume, CME’s ETH futures reached $6.1bn in April (up 302% since March). Meanwhile, CME’s BTC futures volume decreased by 10.3% to $53.3bn. On aggregate (ETH + BTC futures), volumes reached $59.4bn (down 2.6%).

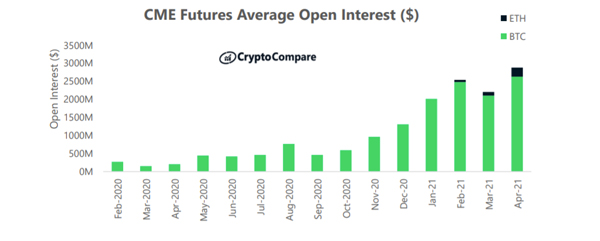

CME’s average open interest figures for BTC futures increased by 25% to $2.6bn in April. Meanwhile, ETH open interest averaged $250mn (up 146%).

Binance Tops 1 Trillion in Spot Volumes and 1.6 Trillion in Derivatives Volumes

Binance (Grade A) was the largest Top-Tier spot exchange by volume in April, trading $1tn (up 32.3%). This was followed by Huobi Global (Grade A) trading $288bn (up 36.9%), and OKEx (Grade BB) trading $282bn (up 63.2%). Exchanges BeQuant (BB), Coinbase (AA), and Kraken (AA) followed with $106bn (up 45.8%), $99bn (up 14.2%) and $66bn (up 50.3%).

.jpg)

Binance was also the largest derivatives exchange in April by monthly trading volume with $1.65tn (up 50% since March) followed by OKEx ($663bn, up 41%), Bybit ($463bn, up 24%) and Huobi ($453bn, up 37%). In April, Binance had the highest open interest across all derivatives products on average at $10.1bn (up 36.1% since March). This was followed by Huobi ($5.1bn, up 28.3%) and Bybit ($4.9bn, up 26.6%).

April Exchange News

Gemini

Gemini Builds Out UK Institutional Offering

Gemini Now Supports Apple Pay and Google Pay

Gemini Credit Card to Launch With Mastercard as Network Partner

Binance

Introducing Binance NFT, A Groundbreaking NFT Marketplace Launching June 2021

Trade Stock Tokens on Binance

Bitstamp

ETH staking coming to Bitstamp - sign up for early access

Coinbase

A new way to buy crypto on Coinbase using PayPal

Coinbase to acquire leading institutional data analytics platform, skew

Read more news in CryptoCompare's Exchange Review.