2022 was an unprecedented year for digital assets, with major headwinds and severe idiosyncratic events dictating the narratives of the industry, including the collapse of Terra Luna, FTX and more.

Join CryptoCompare as it analyses the key events of the last year through their award-winning research, reflect on key highlights for CryptoCompare, their predictions for 2023 and more.

You can read CryptoCompare's full review here!

In March, CryptoCompare welcomed both the traditional finance and digital asset community back to London for its event CCDAS, Europe's flagship institutional event for digital assets. The event was a huge success, bringing together key institutional players and leading names in finance who are adopting and embracing the digital asset revolution.

CCDAS will be returning in May 2023 next year for another unmissable event. Sign up here for sponsorship opportunities and register for first access to Early Bird tickets here.

CryptoCompare's award-winning research has kept market participants informed and up to date with the latest developments, through what has been an unprecedented year for the digital asset industry.

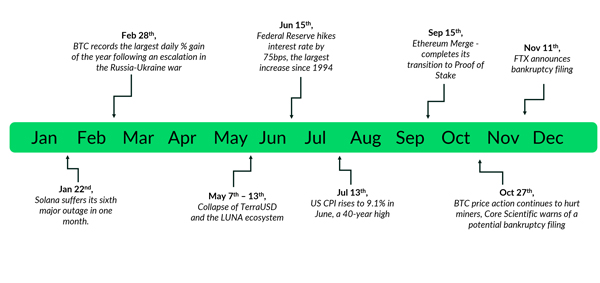

Below are some of the major developments CryptoCompare has covered this year:

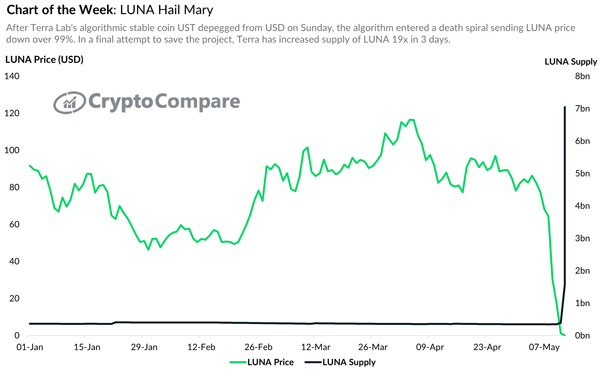

UST/Luna Fall From Grace:

The collapse of the Terra ecosystem in May was one of the most catastrophic events in crypto's history - comparable to the collapse of Mt. Gox in 2014 and the sharp market crashes that occurred in January 2018 and March 2020.

The cause of the event and the immediate aftermath was covered in CryptoCompare's UST Fall From Grace report, shedding light on UST's peg falling to a low of $0.071 within 5 days of depegging, and LUNA's market capitalization collapsing from $41.2bn to $6.6mn, the largest destruction of wealth in this amount of time in a single project in crypto's history.

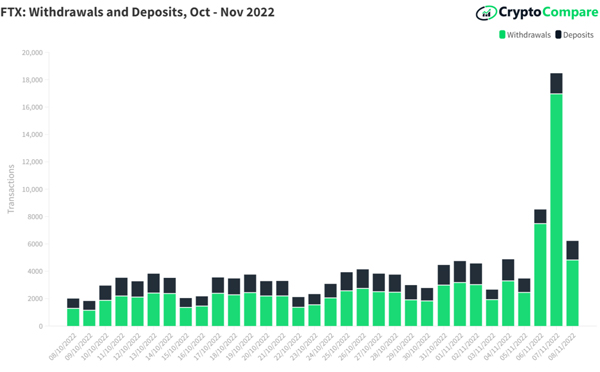

FTX Collapse

On November 11, FTX Group announced that the exchange and an additional 130 associated companies, including FTX.US and Alameda Research, had filed for bankruptcy protection after failing to secure a bailout from potential investors.

CryptoCompare's Market Spotlight blog provided an in-depth analysis of the events and how it affected the markets in the days before and after the bankruptcy. FTX recorded net flows of -19,947 BTC on November 7, the largest net outflows since September 10, 2021. The full contagion effects of the collapse of the FTX ecosystem have yet to be felt, but CryptoCompare will continue to analyse the impact through its Research Reports and Blogs.

CryptoCompare's chart from 'Market Spotlight: Diving Into FTX’s Insolvency, FTT & Binance'

CryptoCompare continued to provide insight through its monthly research, including:

- The Exchange Benchmark, CryptoCompare's flagship report for ranking the risk associated with digital asset exchanges, has seen significant enhancements to its methodology this year. This includes the addition of Proof of Reserves, and an expansion of order book data metrics to assess market quality.

- To accompany CryptoCompare's Exchange Benchmark, CryptoCompare released an industry-first DEX Benchmark methodology to assess the risk associated with decentralised exchanges. In the first iteration, Uniswap achieved the highest grade!

- CryptoCompare's monthly Exchange Review has highlighted the downward trend in spot and derivative markets in centralised exchanges, identifying FTX’s rise over the last two years and subsequent decline.

- The Digital Asset Management Review tracks crypto investment products and has shown the severe fall in activity in these products compared to the CEX market, as well as other unique trends, including the heavy discounts of Grayscale’s trust products and the growth and success of short products in 2022.

- Every month, the Asset Report provides a data-driven analysis of the most important developments in some of the largest layer-1 assets. We have covered the Ethereum Merge, Bitcoin miner activity in this turbulent year, Solana’s recurring outages, and more.

- CryptoCompare's new quarterly Outlook Report provides readers with insight into the latest developments within the crypto space, with a particular focus on macroeconomics and decentralised finance. Here, Cryptoompare discusses increased scrutiny from regulators, contagion from Terra’s collapse, lessons from previous bear markets, and more.

It’s been a successful year for CryptoCompare and its partners, both old and new. From strengthening existing relationships with long-standing partners such as MarketVector Indices to establishing new collaborations with a wide range of organizations from Blockdaemon to SIX and the Financial Times. See what CryptoCompare and its partners achieved together below.

CryptoCompare partnered with SIX, Switzerland’s principal stock exchange, to provide its clients with access to real-time and historical pricing data, order book data, and cryptocurrency derivatives data built on our proprietary aggregate pricing methodology.

Blockdaemon Staking Yield Index Family

CryptoCompare partnered with Blockdaemon to develop the Staking Yield Index Family — a collection of industry-first, regulated staking yield indices that allows institutional users to get streamlined exposure to staking yield.

Crypto Market Integrity Coalition

CryptoCompare pledged its commitment to advancing the integrity of the digital asset markets by joining the Crypto Market Integrity Coalition.

Launch of the Financial Times Digital Asset Dashboard

CryptoCompare were delighted to collaborate with the Financial Times and Wilshire, providing its market-leading data to power the FT Digital Asset Dashboard. The dashboard acts as a hub for FT readers to gain insight and access to institutional-grade data surrounding the digital asset markets. You can try it for yourself here.