We are delighted to announce the release of CryptoCompare’s latest Stablecoins & CBDCs Report. Stablecoins have grown to become a prominent subsector of the digital asset industry, growing significantly in size and interest over the last few years.

In this report, we provide insight into the latest developments in the stablecoin and CBDC sector, focusing on analysis that relates to market capitalisation, trading volume, and stablecoins, segmented by their type based on collateral, type of pegged asset, and more.

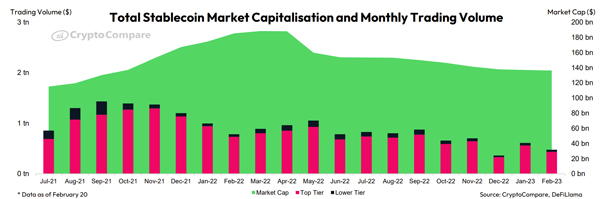

In February, the total market capitalisation of stablecoins fell 0.68% to $136bn, the lowest stablecoins market cap since September 2021. The market share dominance of stablecoins has also declined, currently at 11.4%, falling from 12.31% in January and recording the lowest market share since April 2022.

You can access the report here.

- In February, the total market capitalisation of stablecoins fell 0.68% to $136bn (up to 20th February), the lowest stablecoins market cap since September 2021 and the eleventh consecutive month of decline.

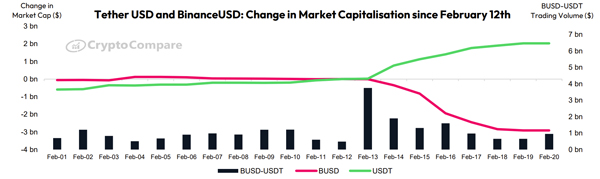

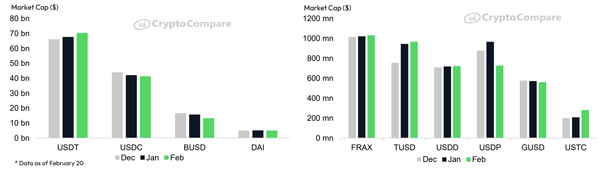

- The SEC’s charge against Binance USD led to large outflows of Paxos stablecoins, with BinanceUSD (BUSD) and Pax Dollar (USDP) seeing their market cap fall 18% and 24.37% to $13.3bn and $729mn, respectively.

- The market capitalisation of BUSD, which is the third largest stablecoin, has fallen 15.8% to $13.2bn since the Paxos announcement. Meanwhile, the market capitalisation of USDT has increased by $2bn in the same period.

- In February, TetherUSD (USDT) and TrueUSD (TUSD) were beneficiaries of BUSD's decline, with their market capitalisation rising 3.85% and 2.31% to $70.4bn and $968mn, respectively. In light of this change and the declining market cap of BUSD, USDT's stablecoin dominance increased from 48.7% to 51.7% in February - the highest market share for the stablecoin since October 2021.

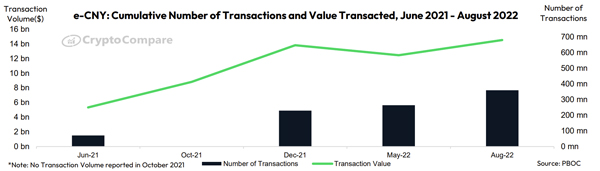

- The Chinese CBDC, e-CNY, which is the most widely adopted CBDC in the world is now included in the latest money supply statistics, released in February. As of December 31st, 2022, there were 13.6bn e-CNY in circulation, which represented 0.13% of the 10.5tn yuan in the economy.

Download Report

Stablecoin Market Cap Falls for 11th Consecutive Month

In February, the total market capitalisation of stablecoins fell 0.68% to $136bn, the lowest stablecoins market cap since September 2021. This is the eleventh consecutive month of decline in stablecoins market capitalisation.

Stablecoin market share is currently at 11.4%, falling from 12.31% in January and recording the lowest market share since April 2022. The decline in stablecoin dominance highlights the recent rally in the prices of crypto assets and the declining stablecoin market cap.

USDT Stablecoin Dominance Reaches Highest Level Since October 2021 Following BUSD Decline

The market capitalisation of BUSD, which is the third largest stablecoin, has fallen 18% to $13.2bn since the Paxos announcement. Meanwhile, the market capitalisation of USDT has increased by $2bn in the same period.

This, combined with the 676% rise in BUSD-USDT volume on February 13th, suggests that a large part of the BUSD has been swapped for USDT on the exchange. USDT's stablecoin dominance increased from 48.7% to 51.7% in February - the highest market share for the stablecoin since October 2021.

USDT

The SEC’s charge against Binance USD led to large outflows of Paxos stablecoins, with BinanceUSD (BUSD) and Pax Dollar (USDP) seeing their market cap fall 15.8% and 24.37% to $13.3bn and $729mn, respectively. USDD overtook USDP as the 7th largest stablecoin, rising 0.57% to $724mn in February.

TetherUSD (USDT) and TrueUSD (TUSD) were likely beneficiaries of the BUSD decline with their market capitalisation rising 3.85% and 2.31% to $70.4bn and $968mn, respectively. Meanwhile, USD Coin (USDC) saw its market cap fall 1.76% to $41.4bn.

Chinese CBDC e-CNY: Transaction Count and Value

China officially included its CBDC (e-CNY) circulation data in their financial statistics for the first time in February. As of December 31st, 2022, there were 13.6bn e-CNY, which represented 0.13% of the 10.5tn yuan in circulation.

However, the transaction volume and transaction value data as of August 2022, suggest that the adoption of the CBDC has been largely inactive with the value transacted only rising 14.1% to $14.5bn from the start of the year.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.

CryptoCompare is an FCA authorised and regulated global leader in digital asset data, providing institutional and retail investors with high-quality real-time and historical data. Leveraging its track record of success in data expertise, CryptoCompare’s thought-leadership reports and analytics offer objective insights into the digital asset industry.