January was another record month for crypto – spot and derivatives volumes doubled to all-time monthly highs of $2.34tn and $2.89tn respectively, CME reached its highest ever BTC futures contract volume at over $50bn, and Binance topped the charts in terms of aggregate open interest across all derivative products with $2.6bn on average.

Below are some of the key highlights from CrtptoCompare's January Exchange Review:

Key Market Insights

Spot and derivatives volumes double to all-time monthly highs – New daily volume records set on the 11th of Jan

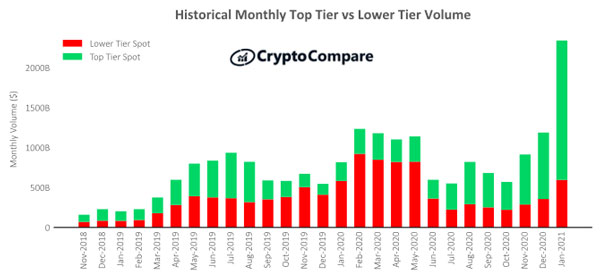

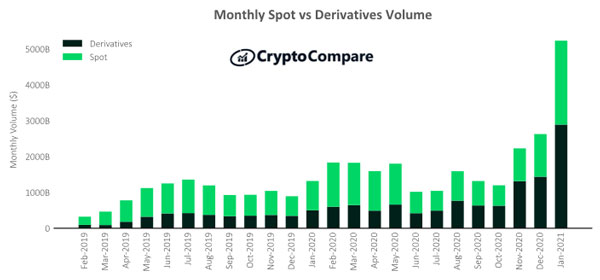

Derivatives volumes increased 101% in January to an all-time monthly high of $2.89tn. Meanwhile, total spot volumes increased by 97% to $2.34tn. Across January, volume from the 15 largest Top-Tier exchanges increased 151.6% on average (vs December).

Spot markets set a new daily volume maximum of $122.95bn on the 11th of January, double that of December’s $67.42bn. This occurred during a sharp 25% correction in Bitcoin’s price to $30,000 following its all-time high.

Meanwhile, derivatives markets saw a new daily record of $187.5bn, which is double that of the previous record set on the 26th of November ($93.36bn).

CME sets record number of monthly BTC futures contracts traded and maintains highest open interest

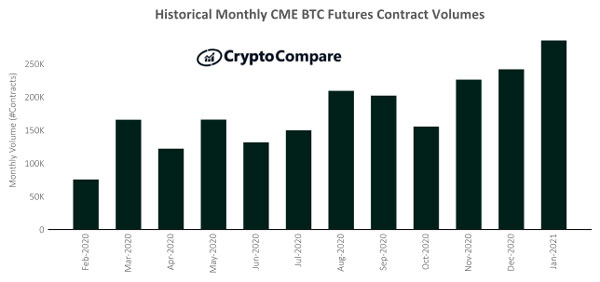

In terms of monthly contract volumes, roughly 285,000 contracts were traded in January (up 18.0% since December) to a new monthly record. In dollar terms, CME’s BTC volumes increased by 108.6% to $50.1bn.

CME also maintained the highest open interest for BTC futures at $2.0bn (up 53.2%) followed by OKEx at $1.6bn (up 44.1%).

.jpg)

Binance tops aggregate open interest

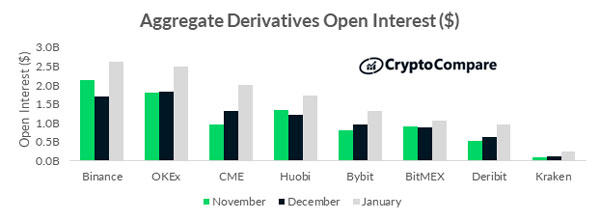

In January, Binance had the highest open interest across all derivatives products on average at $2.6bn (up 53.7% since December). This was followed by OKEx ($2.5bn, up 36.4%) and CME ($2.0bn, up 53.2%).

Top-Tier exchanges continue to gain market share over Lower-Tier exchanges

In January, Top-Tier volumes increased 109.4% to $1.71tn while Lower-Tier volumes increased 67.6% to $596bn. Top-Tier exchanges now represent 74.2% of total volume (vs 69.7% in December).