The July edition of CryptoCompare’s Digital Asset Management Review is now live. This monthly report provides readers with an in-depth look at the key developments in the global digital asset investment product landscape. The report tracks the adoption of these products by analysing assets under management, trading volumes and price performance.

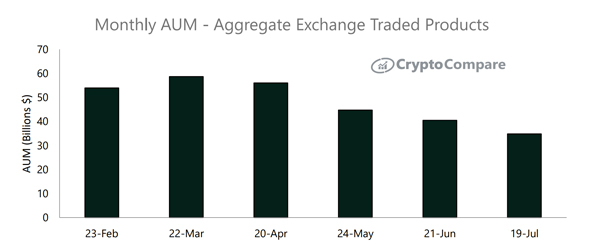

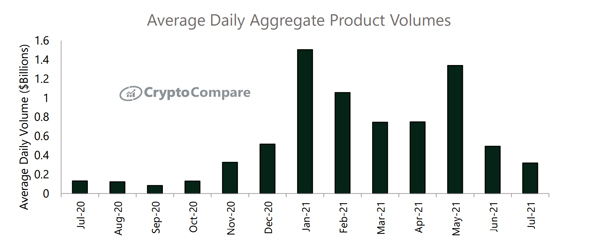

Markets continued to decline throughout July as Bitcoin and Ethereum fell below $30,000 and $2,000 respectively. Assets under management (AUM) also declined 14% compared to the month prior, as did aggregate trading volumes which dwindled by 35.4% across all investment product markets.

Despite this decline, average investment flows have been net positive in July to date, with Bitcoin and Ethereum accounting for the majority of inflows.

Key Takeaways:

- Since June 2021, total AUM across all digital asset investment products has decreased 14.0% to $34.8bn.

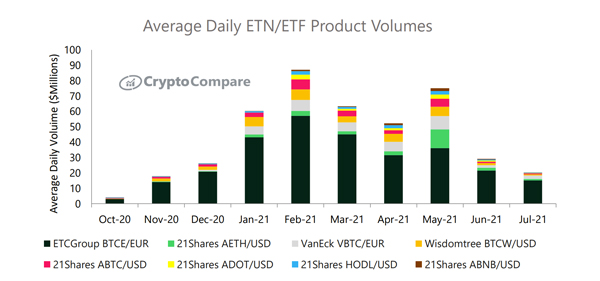

- Average daily volumes of all ETNs/ETFs fell by an average of 50.4% in July. 21Shares Polkadot ETN (ADOT) experienced the largest percentage drop in trading volume, down 71.2% to $235,000.

- Aggregate daily volumes across all digital asset investment product types decreased by an average of 35.4% from June to July. Average daily volumes now stand at $319mn.

AUM – Assets Under Management

Since June 2021, total AUM across all digital asset investment products has decreased 14.0% to $34.8bn.

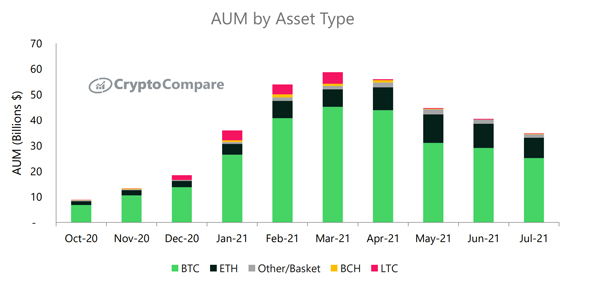

Bitcoin’s AUM fell 13.7% to $25.1bn, however, it gained market share (now 72.1% of total AUM vs. 71.9% last month) as other assets experienced more dramatic declines. Ethereum’s AUM fell 15.6% to $8.0bn while Baskets fell 14.6% to $1.4bn.

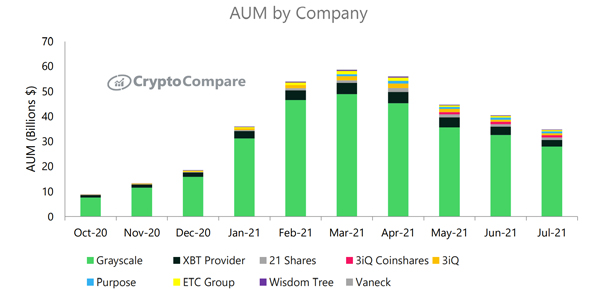

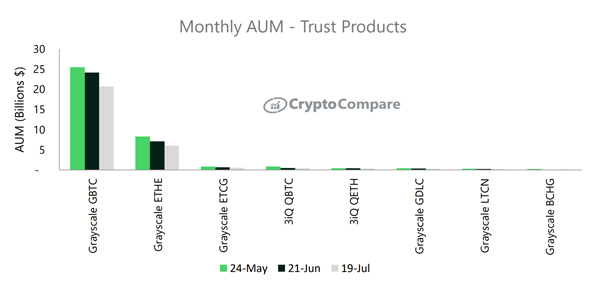

In terms of product type, AUM in trust products (dominated by Grayscale) decreased by 14.3% to $28.6bn (82.3% of total AUM). Similarly, AUM represented by ETCs (dominated by XBT Provider) fell 16.9% to $2.7bn (7.8% of total AUM).

Trading Volumes

Aggregate daily volumes across all digital asset investment product types decreased by an average of 35.4% from June to July. Average daily volumes now stand at $319mn.

In July, average daily volumes across all ETNs/ETFs fell by an average of 50.4%. Among the top ETNs/ETFs, ETC Group’s BTCE product traded the highest daily volume in July at $15.1mn (down 29.4%), followed by VanEck’s Bitcoin product (VBTC) at $2.3mn (down 30.2%).

Trust Products

The majority of AUM for trust products continues to reside in Grayscale’s Bitcoin (GBTC - $20.7bn – down 14.2% since June) and Ethereum (ETHE - $6.0bn – down 15.7%) products.

Price Performance

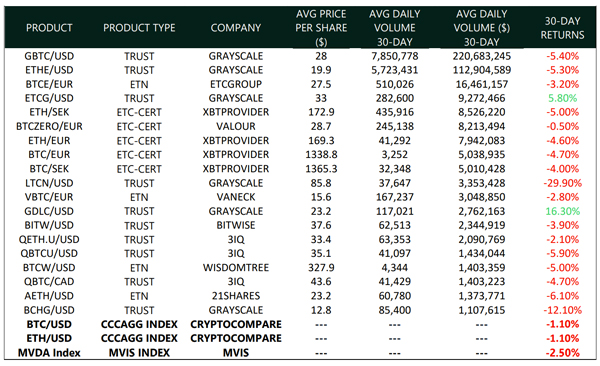

Both BTC and ETH-based products experienced losses over the last 30 days, ranging from 0.5% to 6.1% across the top products.

Grayscale products such as GDLC and ETCG experienced positive returns of 16.30% and 5.80% over the same period.

ETP News

June 23rd 2021

State Street plans to offer crypto ETF administration services

June 25th 2021

21Shares launches the first Solana ETP on SIX, Switzerland’s largest stock exchange

June 28th 2021

Compound Labs introduces Treasury product which guarantees a 4% annual interest rate

July 8th 2021

Elizabeth Warren gives SEC deadline to decide its role in crypto regulation

July 13th 2021

S&P Dow Jones launches 5 more crypto indexes

July 13th 2021

BNY Mellon reaches agreement to become asset servicing provider for Grayscale’s Bitcoin Trust

July 14th 2021

21Shares partners with Comdirect to offer crypto ETPs in Germany

The MVIS CryptoCompare Digital Assets Indices can be licensed to clients for a variety of purposes, including:

- Performance measurement and attribution

- Investment product development, as the basis for structured products such as ETPs and futures contracts

- Asset allocation

- Research