The cryptocurrency market experienced mixed coverage in June - headwinds continued as China persisted with its crackdown on Bitcoin mining, while positive news arose as El Salvador became the first country to formally adopt Bitcoin as legal tender.

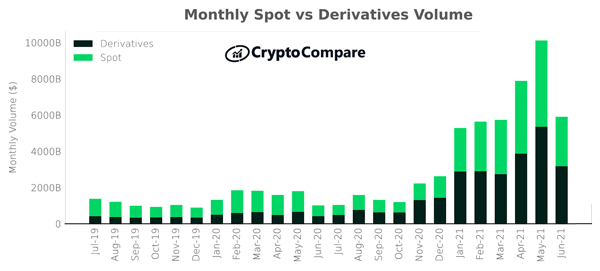

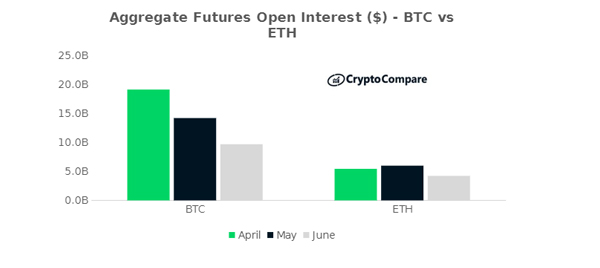

As a result of both lower prices and volatility, spot volumes decreased by an immense 42.7%, while total derivative volumes decreased 40.7%. This was also the case for BTC and ETH futures open interest, which were down 31.8% and 29.3% respectively.

In other news, Top-Tier spot volume dominance has been trending upwards since December 2019 - from a low of 47% to its current level of 88% - as Bitcoin continues to attract further high-grade investment.

Continue reading below to discover key insights and takeaways from our June Exchange Review. Alternatively, you can access the full report via this link.

Top-Tier Spot Volumes Reach Highest Dominance

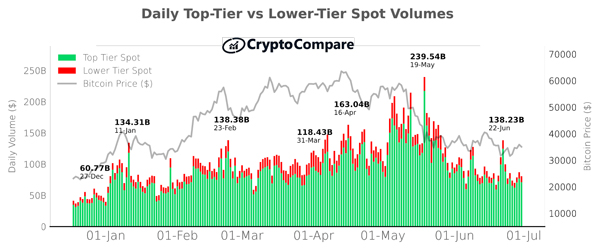

Since 2018Trading activity across all spot markets throughout June fell considerably compared to the previous month as the Bitcoin slump continued. A daily volume maximum of $138.23bn was traded on the 22nd of June, down 42.3% from the intra month high in May.

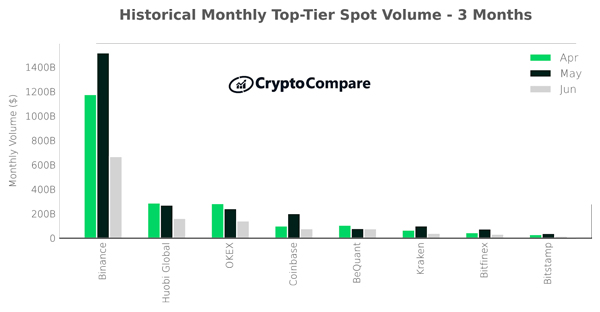

Binance (Grade A) was the largest Top-Tier spot exchange by volume in June, trading $668bn (down 56%). This was followed by Huobi Global (Grade A) trading $162bn (down 40.2%), and OKEx (Grade BB) trading $141bn (down 41.6%).

Derivatives Regain Volume Market Share over Spot as Volumes Decline

Derivatives volumes surpassed those of spot for the first time this year, with 53.8% market share, compared to 49.4% in May. Derivatives volumes decreased by 40.7% in June to $3.2tn while total spot volumes decreased by 42.7% to $2.7tn.

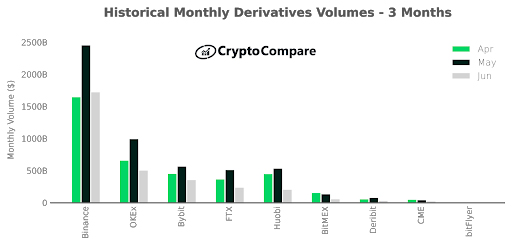

Binance was the largest derivatives exchange in June by monthly trading volume with $1.73tn (down 29.7% since May) followed by OKEx ($508bn, down 49.1%), Bybit ($360bn, down 37.0%) and FTX ($242bn, down 53.2%).

Futures Open Interest Across All Products Fell 40.9% MoM to $16.4bn - the Lowest Open Interest Level since January 2021

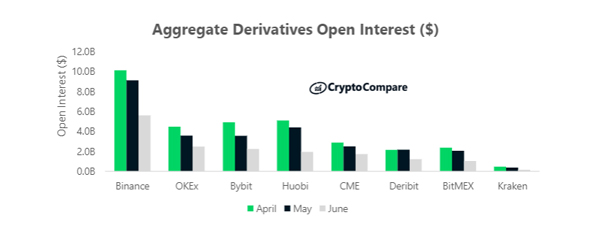

Aggregate open interest fell for a second month in a row, from a weekly average of $27.8bn in May to $16.4bn in June (40.9% decline).

Binance had the highest open interest across all derivative products on average at $5.6bn (down 38.4% since May). This was followed by OKEx ($2.5bn, down 30.8%)and Bybit ($2.2bn, down 37.2%

Aggregate open interest across BTC futures products fell 31.8% to $9.7bn while open interest across ETH futures products fell 29.3% to $4.2bn.

June Exchange News

Coinbase

Now use your Coinbase Card with Apple Pay® and Google Pay™

Kraken

The New Kraken App Is Here!

Kraken Breaks New Ground with First-of-its-Kind Parachain Auction Platform

Crypto.com

Formula 1® announce Crypto.com as Global Partner and Inaugural partner of the F1 ‘Sprint’ series

BitMEX

BitMEX Hires Marc Robinson as Head of Custody

Binance

Introducing “Featured by Binance”: A Decentralized NFT Platform From Binance

Bybit

Simplex Partners With Bybit

Gemini

Gemini Sponsors Bitcoin Core Developers Dhruv Mehta and Jarol Rodriguez

Read more news in our Exchange Review.