Following a relatively stable month in April, volatility returned to the cryptocurrency market in May. Bitcoin’s price pulled back to $29,925 (down 44.2% from May open), and closed at $37,291, 35.4% lower than the previous month - Ethereum and many other cryptocurrencies followed a similar trend.

Initial worries surrounding new cryptocurrency regulations by the People’s Bank of China, combined with Elon Musk’s environmental concerns on Bitcoin mining, and a series of futures contract liquidations on May 19th, are thought to have further exacerbated the fall in most cryptocurrencies.

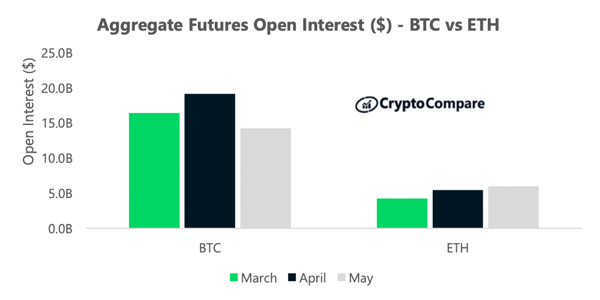

BTC Open Interest Fell 25.8% while ETH Rose 9.9%

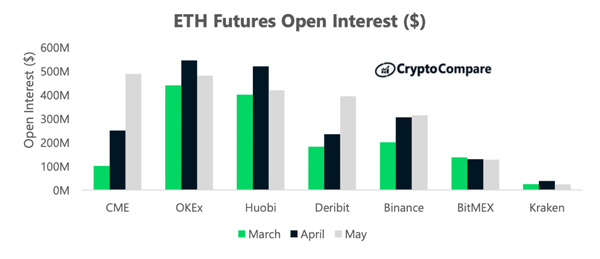

ETH’s price ended the month 2.5% down from the end of April but gained market share in the derivatives market as open interest increased 9.9% to $6.0bn (vs. $5.4bn in April).

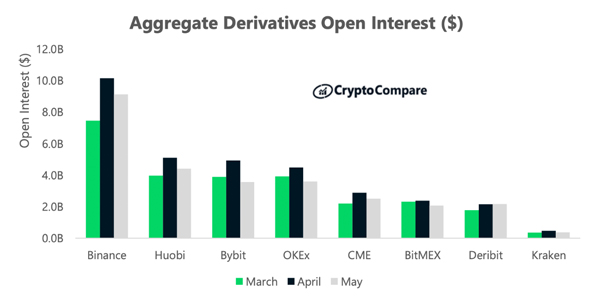

However, across all derivatives products open interest fell by 14.5% to $27.8bn (vs. $32.5bn in April). Binance had the highest open interest across all derivatives products on average at $9.1bn (down 10.1% since April). This was followed by Huobi ($4.4bn, down 13.5%) and OKEx ($3.6bn, down 20.0%).

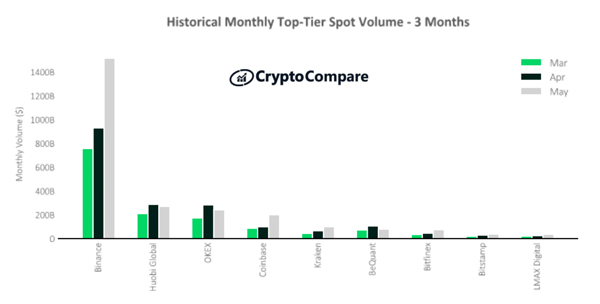

Volumes for Spot and Derivatives Increased by 26.5% and 40.4%

Total spot volume crossed $4.8tn (up 26.5%) in May. The top 3 exchanges Binance, Huobi Global and OKEx, saw monthly trading volumes of $1.5tn (up 63.0%), $271bn (down 6.0%) and $242bn (down 14.6%), respectively.

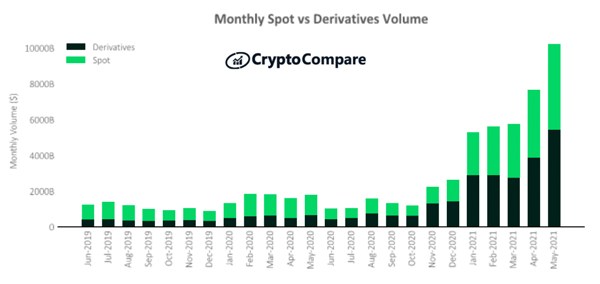

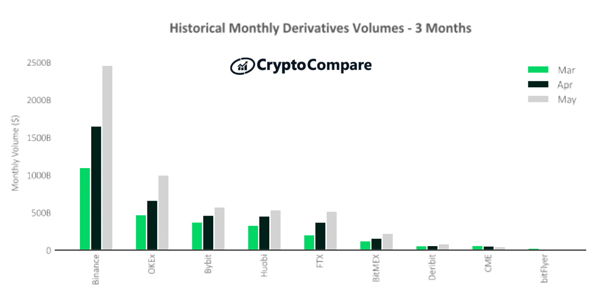

Total derivatives volume increased to $5.5tn (up 40.4%), as investors reacted to higher volatility. The top 3 exchanges, Binance, OKEx, and Bybit, saw monthly trading volumes of $2.5tn (up 48.9%), $999bn (up 50.8%) and $574bn (up 24.0%), respectively. The derivatives market now represents 53.3% of the total crypto market (vs 50.2% in April).

CME Became the Largest Exchange for ETH Futures

In May, CME became the largest exchange for ETH futures as open interest reached $489mn, up 66.2% since April. On the other hand, alternative derivatives exchanges saw an aggregate decrease in ETH futures open interest of 0.7%.

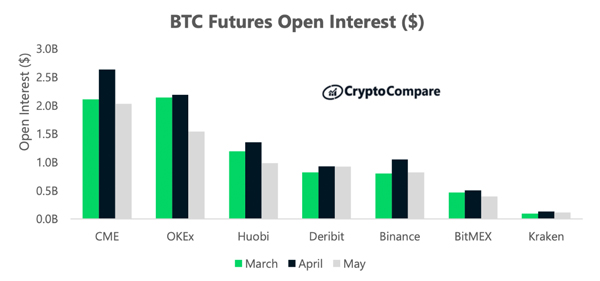

Similarly, CME remains the largest exchange for BTC futures, with 29.8% of open interest occurring on the exchange. This follows the exchange’s launch of Micro Bitcoin Futures earlier in the month, with the aim to attract smaller traders. As CME is the world’s largest derivatives exchange, this paves the way for the continued institutionalization of cryptocurrencies.

May Exchange News

Coinbase

The Internet Computer (ICP) will be launching on Coinbase Pro and supported by Coinbase Custody

Uniswap

Uniswap V3 Mainnet Launch!

AAX

AAX Exchange Announces Plans to Buy Back 30% of AAB Supply from Secondary Markets

BitMEX

The BNBUSDT Quanto Perpetual Contract Comes to BitMEX

Binance

Binance Launches the NFT Innovative Creators Program

Bybit

New Launch: ETHUSD Futures Contracts

Gemini

Gemini Partners With WisdomTree and Onramp to Bring Crypto to Financial Advisors

Read more news in CryptoCompare's Exchange Review.