Concerns over the insolvency of FTX initially started circulating on Wednesday 2nd of November when the balance sheet of Alameda Research, a hedge fund closely associated with FTX and founded by Sam Bankman-Fried, (SBF) was leaked.

Following this, FTX faced a liquidity crisis while fulfilling the sudden spike in withdrawal demands from users, eventually resulting in the halting of withdrawals. The saga ended with Binance announcing an intention to acquire FTX and its underlying asset.

Below, CryptoCompare details the events of the last few days, the repercussions, the aftermath, and what's next for the space. You can access the full report here.

In the last three days:

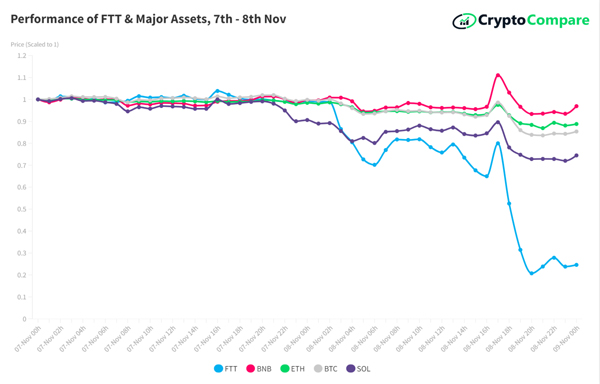

- FTT’s volatility jumped from 53.3% on November 7th to 492% on November 8th after a 73.2% decline in price on the day to $5.93. The token fell as low as $2.57, and has kickstarted a freefall in price of other digital assets, illustrated in the chart below.

- FTT's open interest in FTX rose 66.2% to $130mn over the last three days, reaching its highest record since April 2022

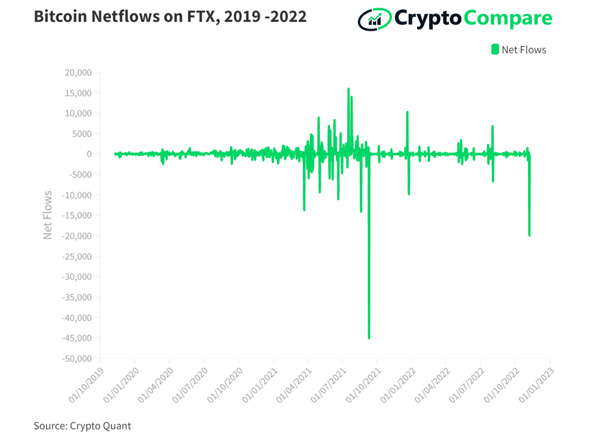

- FTX recorded a net flow of -19,947 BTC on November 7, the largest net flows recorded since September 10, 2021.

Binance Acquires FTX

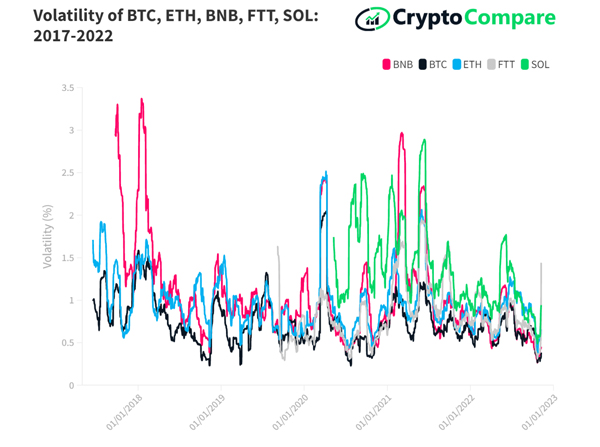

One of the major observations when evaluating the state of digital asset markets over the last few months has been the steadily declining volatility. As we enter deeper into a bear market where digital assets have become more sensitive to macroeconomic data, a lack of catalysts has meant a severe reduction in volatility, shown in the chart below:

Out of the five coins above, BNB and SOL hit their lowest ever 30 day volatility on October 22nd – at 26.4% and 48.7% respectively. ETH also saw its lowest volatility since 2017 on the same date, at 31.9% vol. BTC even closed October with lower volatility than the S&P500 and NASDAQ equity indices, at 32.2%, 33.6%, and 39.8% respectively.

FTT’s volatility jumped from 53.3% on November 7th to 492% on November 8th after a 73.2% decline in price on the day to $5.93. The token fell as low as $2.57, and has kickstarted a freefall in price of other digital assets, illustrated in the chart below.

|

|

|

|

|

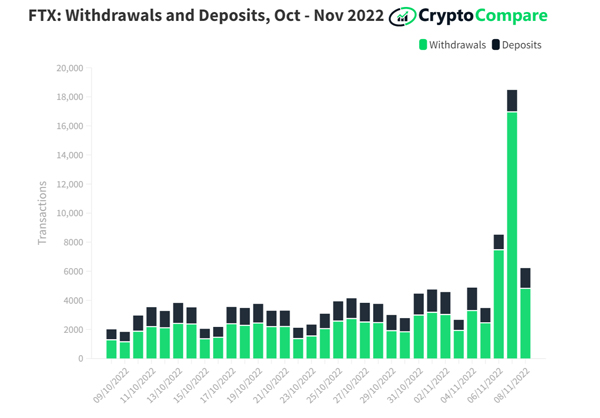

Meanwhile, the exchange recorded a net flow of -19,947 BTC on November 7, the largest net flows recorded since September 10, 2021.

The exchange also recorded the largest number of withdrawal transactions in its history on November 7. This suggested that users were concerned about the current situation and are possibly migrating to other venues.

|

|

|

|

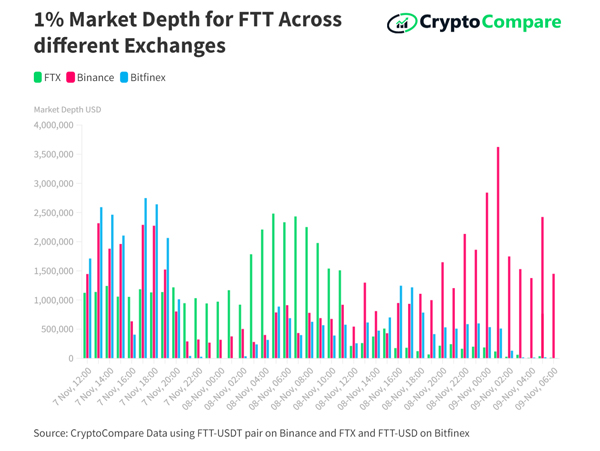

After the sharp drop in FTT price, liquidity saw a similar drop on all exchanges including Binance, FTX and Bitfinex; 1% market depth falling from around $6m for the analyzed exchanges on 5:00pm November 7th to $1.3m on midnight.

Shortly after, while Binance and Bitfinex bid & ask quantities remained low, FTX's liquidity increased dramatically driven by new ask orders, which reached double the $ value of bid side orders. The increased liquidity failed to keep FTT at its support level, as it dropped further to a low of $14.36 prior to Binance's announcement - a 35.0% drop from the daily open. The token closed the day at $5.48.

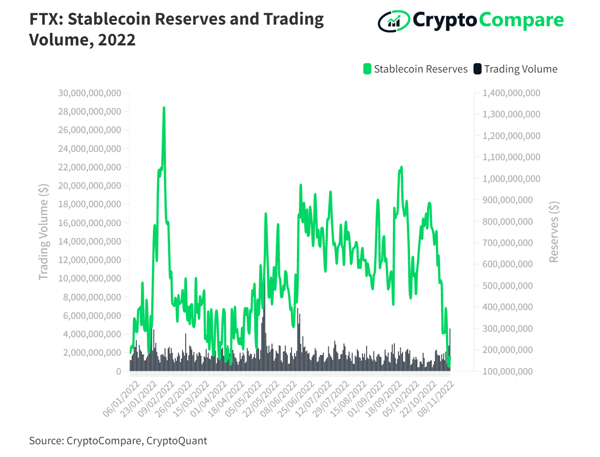

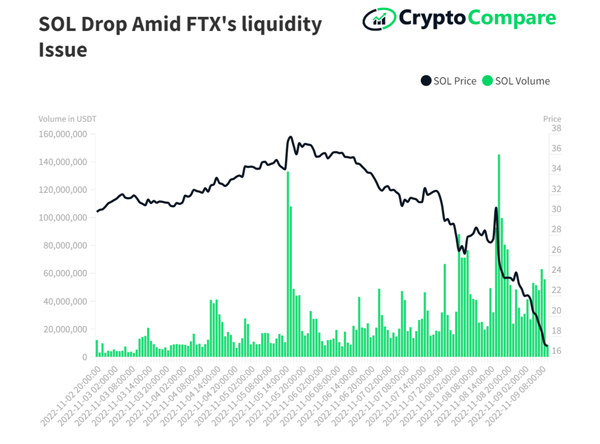

Many argue that the increase in FTT's liquidity came from their stablecoin reserve, which saw a significant drop as highlighted above. There also appeared to be intense selling of FTX's SOL reserve; a cryptocurrency that has historically received significant support from FTX's founder Bankman-Fried. Solana has been one of the worst performers of the last two days, falling 25.5% since the 7th of November.

Looking Forward

Considering the scale of the impact that’s caused by the collapse of FTX and Alameda, it is highly unlikely that SBF comes out of this unscathed. It is to be noted that the current situation can be compared to the Terra implosion after which multiple lawsuits were filed against its founder Do Kwon.

For CZ, he has once again proved his claim to the throne, as his influence in the industry grows after adding another exchange to his ever-growing kingdom. Binance, the largest exchange by trading volume, has now increased its market share and dominance even further with the acquisition of FTX. But, one can also question his intentions on whether he could have addressed this issue with less damage to the markets, considering there was an offer for the sale of their FTT tokens at $22. From the regulatory perspective, yesterday’s events could be reminiscent of a hostile takeover and anti-monopoly laws might yet prevent the acquisition agreement from being completed.

Assuming that the user funds are safe and the withdrawal process will be resumed in the coming days, the ultimate winners from today’s event are the retail users - as Binance’s intention to acquire FTX means that customer funds are protected from a potential black hole in FTX’s balance sheet. Consumer protection is a hugely debated topic in crypto and today is one example of how two large entities made the best decision for the benefit of retail users, thus avoiding collateral damage to the industry.

Nevertheless, the second-order effect of the collapse of FTX and Alameda Research is going to spill over into all the ecosystem funds associated with them. It is likely that Solana and their DeFi ecosystem will take a hit in the short term, along with other layer 1s backed by FTX ventures such as Aptos and Sui.

This is a move that very few had anticipated, with the majority of individuals believing that FTX would recover from its liquidity issues without outside aid. We look forward to monitoring the situation over the next couple of days.