Last week, Silicon Valley Bank (SVB) was abruptly closed by U.S. regulators following a panic-induced bank run. SVB, which had strong ties to the venture capital industry and a reputation as a crypto-friendly bank, had been heavily utilised by many in the digital asset sector.

The sudden collapse of SVB placed Circle and its flagship stablecoin USDC under immense pressure, as the stablecoin issuer held ~$3.3 billion (about 8% of its total reserves) with the bank. The market reacted, with USDC declining below $0.90.

Key findings:

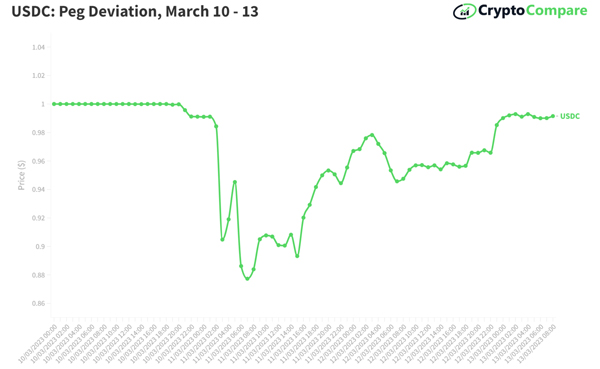

- USDC de-pegged to a low of $0.8726 (CCCAGG pricing) on March 11th before recovering to $0.9918 on March 13th.

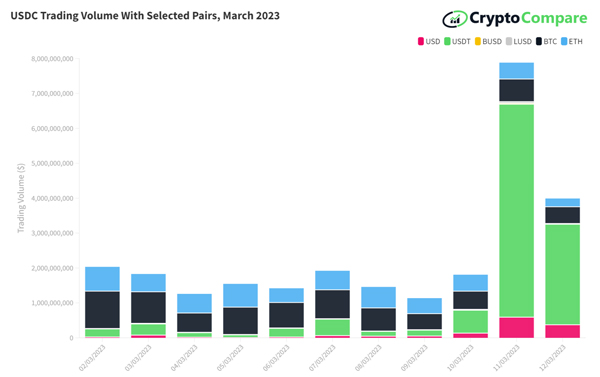

- USDC-USDT centralised exchange trading volumes soared 828% to $6.1bn, as market participants looked to flee USDC and migrate to a 'safer' stablecoin.

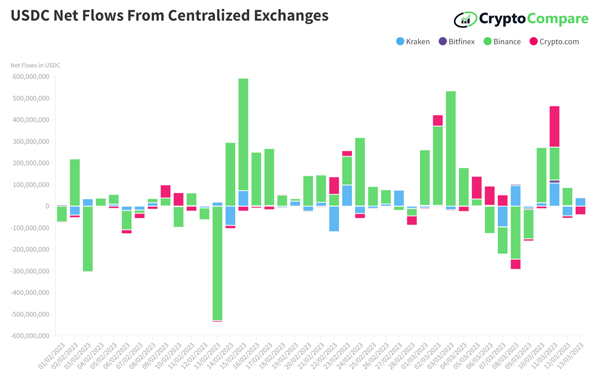

- Despite the liquidity crunch, there hasn't been any significant decline in exchanges' outflows, as both outflows and inflows witnessed spikes, resulting in a slight overall positive inflow for USDC.

- CryptoCompare trade data shows that panic-stricken traders converted USDC to USD at prices as low as $0.12 on centralised exchanges.

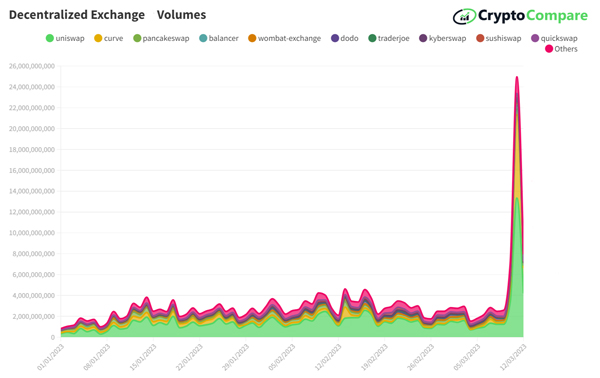

- DEX volumes rose from $7.14bn on March 10th to $25.0bn on March 11th; a 249% hike.

Below, CryptoCompare provides a summary of the events of the last few days, sharing key insights, market data and commentary. Key findings have been highlighted below and the full report can be accessed here.

USDC’s Peg Falls to an All-Time Low of $0.8726

USDC depegged to a low of $0.8726 (CCCAGG pricing) on March 11th before recovering to $0.9918 on March 13th, with the stablecoin still off its peg at the time of writing.

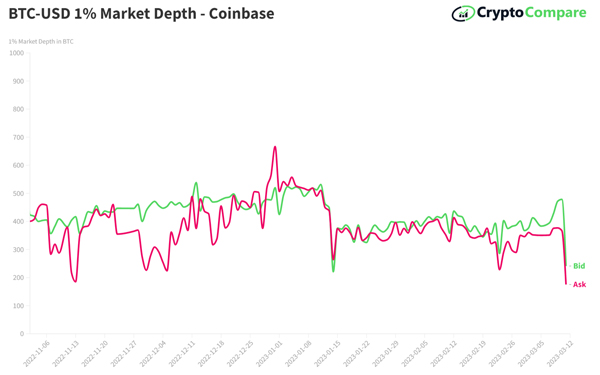

Exchange Liquidity Witnesses Sharp Fall for USDC Pairs

One of the major concerns during the turmoil was the illiquidity of USDC pairs on centralised exchanges. As USDC was not listed on Binance, the largest and most liquid exchange in the industry, traders had to resort to other non-liquid exchanges which are more susceptible to price volatility.

As a result, the liquidity on these exchanges witnessed a sharp fall for USDC pairs. Coinbase’s BTC-USD liquidity (which is a unified market for USD and USDC on Coinbase) saw a sharp decline of its 1% market depth which was more severe than when FTX collapsed. 1% market depth fell from 846 BTC on the 10th to 417 BTC on the 11th, a 50.7% Decline.

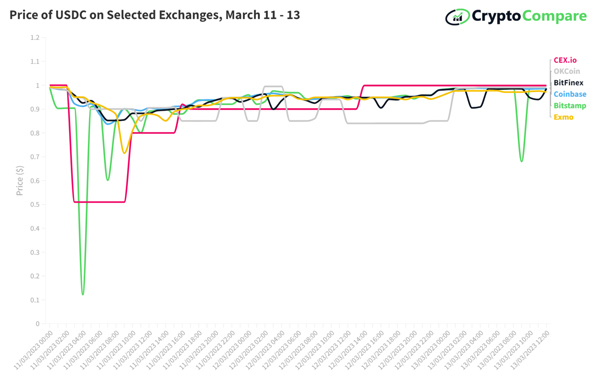

Liquidity Issues Drive USDC Volatility Higher

With the illiquidity adding to the high volatility in the price of USDC, CryptoCompare trade data shows that panic-stricken traders converted USDC to USD at prices as low as $0.12 on centralised exchanges.

On Kraken, the trades bottomed at 0.87 USDT with a buy order of USDC 112k, while on Coinbase trades bottomed at 0.84 USDT with fairly minor trades. Bitstamp saw a major drop in prices, however, with very small trades being executed at a low of $0.12.

USDC-USDT Exchange Volumes Soar 828%

On March 11, USDC-USDT centralised exchange trading volumes soared 828% to $6.1bn, as market participants looked to flee USDC and migrate to a 'safer' stablecoin. The USDC-USD trading pair also saw a substantial increase in trading volume during this time.

USDC Netflows Remain Positive Despite Liquidity Crunch

Despite the liquidity crunch, there hasn't been any significant decline in exchange outflows, as both outflows and inflows witnessed spikes, resulting in a slight overall positive inflow for USDC.

Decentralised Exchanges (DEXs) Also Experience Volume Spike

DEX volumes rose from $7.14bn on March 10th to $25.0bn on March 11th; a 249% hike. Gas fees on Ethereum also reached their highest level in 2023 so far, recording 101 Gwei, as blockchain network activity increased.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.