The markets continued to decline in September as the Consumer Price Index (CPI) exceeded the consensus forecast and the US Federal Reserve announced its decision to raise the interest rate by 75bps.

The crypto assets endured a market-wide sell-off in September, with the macroeconomic factors continuing to weigh down on risk assets. This was reflected in spot trading volumes, with BTC/USDT spot volumes rising 30.4% to 13.2mn.

Download the full report here for all the latest insights.

Key takeaways:

- In September, the spot trading volume on Coinbase fell 17.6% to $48.1bn, recording the lowest volume on the exchange since January 2021. Meanwhile, its competitors Binance, OKX and FTX saw their spot trading volumes rise 23.5%, 8.26% and 5.49% to $541bn, $58.1bn and $51.8bn, respectively.

- AAX has continued its incredible rise in market share, with its monthly spot trading volume increasing by 29.3% to an all-time high of $71.1bn in September.

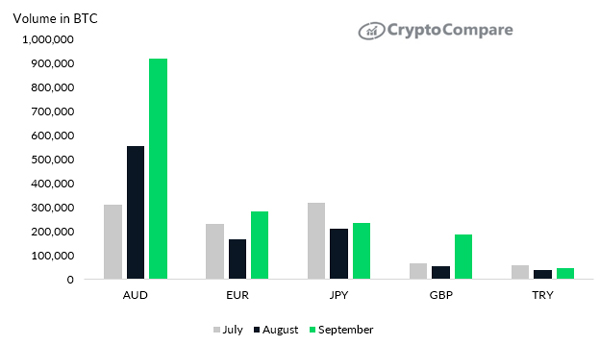

- Fiat trading pairs saw an increase in BTC spot trading volume amid the weakening of several currencies worldwide. BTC spot trading volume to USD rose 29.5% to 1.70mn BTC. Spot trading to Australian Dollars, Euros, and Great British Pounds also rose 65.1%, 68.3% and 233%, to 919k, 282k, and 188k BTC, respectively

- Top-Tier exchanges now represent 93.6% of total spot volume. This is the highest market share of Top-Tier exchanges recorded since November 2017.

- The number of Ethereum futures contracts trading on CME rose 53.8% to 163k. A daily maximum of 14.9k ETH futures contracts were traded on the 15th of September when Ethereum successfully transitioned from Proof of Work consensus to Proof of Stake - reflecting the sell-the-news nature of the event.

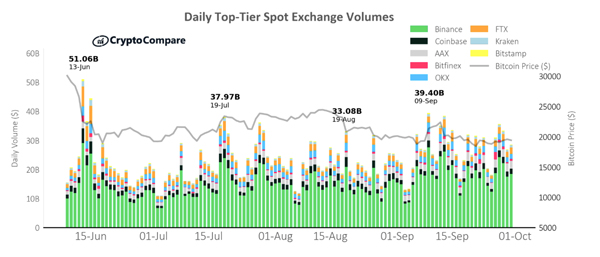

Top Tier Exchanges Reach Highest Market Share Since November 2017

In September, total spot trading volumes rose 3.58% to $1.56tn. Top-Tier spot volumes increased 4.48% to $1.46tn, and Lower-Tier spot volumes decreased 8.10% to $99.5bn. Top-Tier exchanges now represent 93.6% of total spot volume. This is the highest market share of the Top-Tier exchanges recorded since November 2017.

Top-Tier Spot Exchange Volumes on The Rise

Considering individual exchanges, Binance (Grade AA) was the largest Top-Tier spot exchange by volume in September, trading $541bn (up 23.5%). This was followed by AAX (Grade BB) trading $71.1bn (up 29.3%) and OKX (Grade BB) trading $58.1bn (up 8.26%).

FTX (Grade A) and Coinbase (Grade AA) followed, trading $51.8bn (up 5.49%) and $48.1bn (down 17.6%) respectively.

BTC Trading Volume Against Weakening Currencies Sees a Spike

Coincidently, BTC trading volume against these has spiked in recent months, including the BTC-GBP pair, which rose 233% in September after the reserve currency fell to an all-time low of £1.03 against USD earlier. The abnormal jump in trading volume suggests investors and traders could be hedging their weakened currencies with bitcoin and stablecoin.