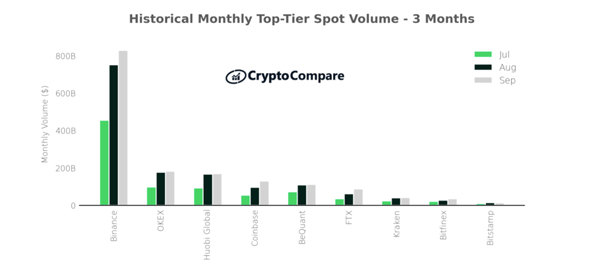

In September, the price of Bitcoin and Ethereum fell to $43,829 (down 7.1%) and $3,001 (down 12.6%) respectively. Despite this, exchanges continued to see an increase in trading volume - with spot volumes rising 6.2% to $2.5tn. Binance remained the top player in terms of spot volume, recording the highest volume for the 15th consecutive month.

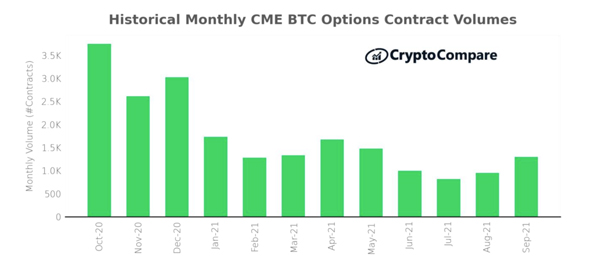

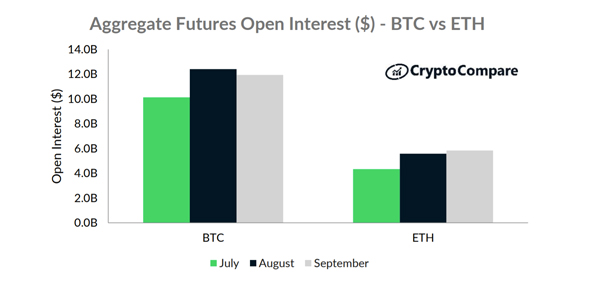

CME's institutional exchange also experienced growing volumes and open-interest - with its BTC options volume rising 36% month on month. Ethereum open-interest on the exchange also grew 10.5% to 678mn - an all-time high for the exchange.

You can access the full report here.

Key takeaways:

- Binance continues to lead spot exchange volume - trading $828bn (up 10.2%) in September - Binance has now recorded the largest monthly spot volume for 15 consecutive months.

- BTC traded into fiat or stablecoins totaled 6.9mn BTC in September, the lowest amount since April 2021 (6.8mn BTC).

- Institutional investors continue to seek exposure to crypto, with trading volumes of BTC CME options up 36% month on month - the largest increase since June 2020.

- Average daily open interest for ETH perpetual futures grew 3.7% in September to an all-time high of $4bn.

- Ethereum open-interest on the institutional exchange CME grew 10.5% to 678mn, also an all-time high.

Trading Volumes Continued To Rise In September

In September, Top-Tier spot volumes increased 6.2% to $2.5tn and Lower-Tier spot volumes increased 7.7% to $246bn. Top-Tier exchanges now represent 91.2% of total spot volume.

.jpg)

In September, spot volume from the 15 largest Top-Tier exchanges increased 10.8% on average compared to August.

Binance (Grade BB) was the largest Top-Tier spot exchange by volume in September, trading $828bn (up 10.2%). This is the 15th consecutive month that Binance has led spot trading volumes. Binance was followed by OKEx (Grade BB) trading $181bn (up 2.8%), and Huobi Global (Grade BB) trading $168bn (up 1.3%).

Trading of BTC CME Options up 36% MoM

In September, CME BTC options volume grew 36% to 1,295 BTC, the largest month-on-month increase since June 2020.

A maximum of 177 contracts were traded on September 24th, the highest single-day volume recorded since April 23rd (185).

ETH Continues to Outpace BTC Across Derivatives Open Interest

Aggregate open interest in Ethereum-based derivatives grew 4.7% to $5.8bn in September, while open interest in Bitcoin-based derivatives fell 3.7% month-on-month to $11.9bn.

September Exchange News

Coinbase

Coinbase Now Supports Security Keys for 2-Factor Authentication on Mobile

Now Get Your Paycheck Deposited Into Coinbase

Crypto.com

Crypto.com Expands Insurance Programme to one of the Industry’s Largest at USD 750 Million

Crypto.com Expands Free Crypto Tax Reporting Service to the U.K.

Kraken

Kraken Commits to Funding Open-Source Rust Bitcoin Development

Gemini

Gemini Launches Wrapped Filecoin (EFIL), Building a Bridge to DeFi

FTX

FTX.US Launches NFT Minting Platform

Uniswap

Introducing the Auto Router