The crypto markets rebounded in October with Bitcoin and Ethereum rising 5.49% and 18.4%, respectively. However, this failed to translate into increased trading activity as spot and derivatives trading volume on centralised exchanges recorded new lows in October.

More recently, it has been an unprecedented couple of weeks in the crypto industry, with investors still reeling from the aftermath of FTX’s insolvency. The collapse of FTX is set to have ripple effects on market participants, including other centralised exchanges.

Download the full report here for all the latest insights.

Key takeaways:

- In October, spot trading volume on centralised exchanges fell 25.4% to $929bn, recording the lowest monthly traded volume since October 2020. This coincided with the 30-day volatility of Bitcoin and Ethereum, which hit their lowest levels since 2020 at 26.6% and 31.9%.

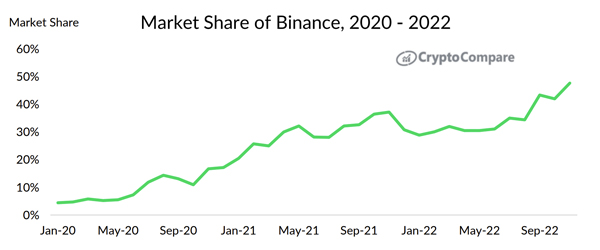

- Binance remains the largest centralised exchange by spot trading volume, with a market share of 42.0%. However, spot trading volume on the exchange fell 27.8% to $390bn, the lowest volume since December 2020.

- Derivatives trading volume on centralised exchanges fell 23.9% to $2.22tn in October, the lowest monthly derivative trading volume since December 2020.

- In October, derivatives exchanges recorded the largest liquidation event in fifteen months - on October 26, $1.21bn worth of trades was liquidated. Interestingly, FTX recorded the largest short liquidation in its history, liquidating around $580mn of shorts on BTC.

- Trading volume on decentralised exchanges is also at record lows, falling 14.2% to $56.1bn in October, the lowest monthly volume since January 2021. However, 14 days into November, DEX trading volume has surpassed October's total, with Uniswap trading more in volume than all CEXs bar Binance during the weekend commencing November 11.

Spot Trading Volume Hits Record Lows

In October, spot trading volume on centralised exchanges fell 25.4% to $929bn, recording the lowest monthly traded volume since October 2020. This coincided with the 30-day volatility of Bitcoin and Ethereum, which also reached its lowest since 2020 at 26.6% and 31.9%, respectively.

Binance remains the largest centralised exchange by spot trading volume, with a market share of 42.0%. However, spot trading volume on the exchange fell 27.8% to $390bn, the lowest volume since December 2020.

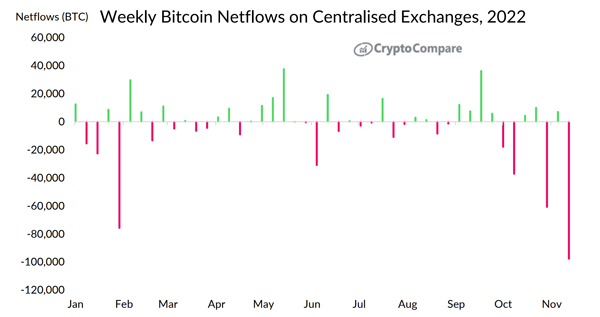

Centralised Exchanges Record Largest Ever Weekly BTC Outflows

Weekly Bitcoin net flows from centralised exchanges recorded their largest ever outflow, with 97,805 BTC moving off exchanges in the 7 day period ending on November 13. The extent of the outflow of Bitcoin from exchanges exemplifies the damage done to investor's trust in centralised exchanges as more users look to custody their assets on-chain or via hardware wallets.

DEX Volumes Surpass October Total In Two Weeks

Trading volume on decentralised exchanges is also at record lows, falling 14.2% to $56.1bn in October, the lowest monthly trading volume since January 2021. However, 14 days into November, DEX trading volume has already surpassed the total of October, with Uniswap trading more in volume than all CEXs bar Binance during the weekend.

Binance Market Share Reaches 42% In October

Binance remains the largest centralised exchange by spot trading volume, with a market share of 42.0%. However, spot trading volume on the exchange fell 27.8% to $390bn, the lowest volume since December 2020.