Cryptocurrency prices diverged in November as Bitcoin and Ethereum closed the month at $58,158 and $4,687 (down 4.0% and up 10.1% since October), respectively.

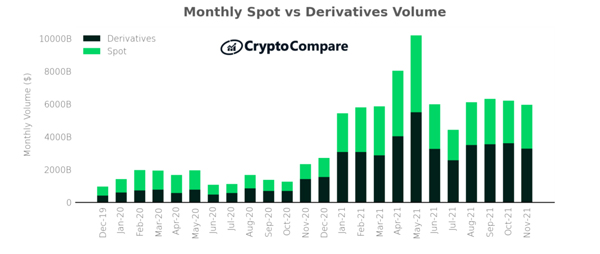

Spot volumes increased 3.3% to $2.7tn in November, whilst derivative volumes fell 9.2% to $3.3tn. A daily maximum of $131bn was traded on November 9th, up 9.6% from the intra-month high in October.

The full report is available here.

Key takeaways:

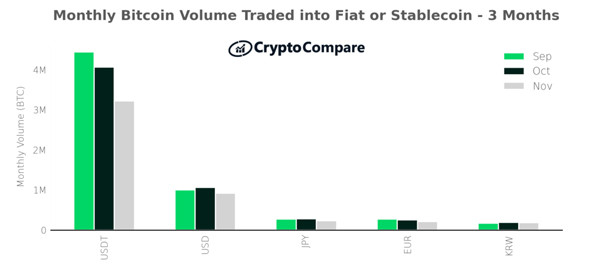

- Bitcoin trading volumes into USDT continued to trend downward for the third month in a row, trading only 3.2mn BTC (down 20.7% from October and 27.8% from a recent high in August).

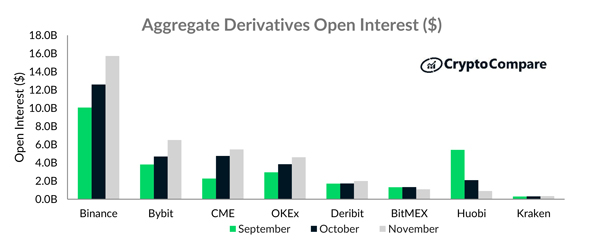

- Open interest reached a record level in November with a daily average of $36.6bn (up 16.8% from October). Binance maintained its dominance, reaching $15.7bn open interest across all derivative products,(up 24.1% since October) and now accounting for 44.1% of all open interest.

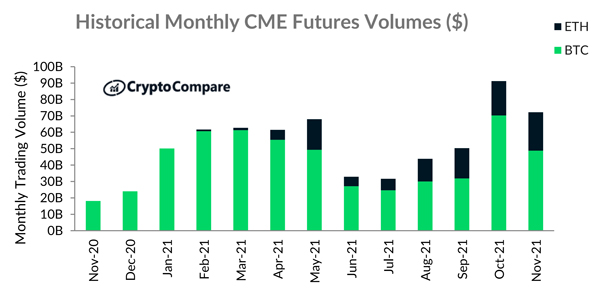

- BTC futures volumes fell in favour of ETH futures on CME. In November, CME’s BTC futures volumes decreased by 30.5% to $48.8bn, whilst ETH futures increased 11.6% to $23.4bn.

- CME’s average open interest figures for BTC futures increased 12.8% to $4.3bn in November while ETH open interest averaged $1.2bn (up 23.4% against October). This is the first time the exchange has seen ETH open interest average over $1bn in any given month.

| Download Report |

Spot Volumes Increase While Derivatives Slow

Derivatives volumes decreased by 9.2% in November to $3.3tn. Meanwhile, total spot volumes increased by 3.3% to $2.7tn. The derivatives market now represents 54.8% of the total crypto market.

Bitcoin to Fiat and Stablecoin Volumes Tumble

BTC spot trading into USDT decreased by 20.7% in November to 3.2mn BTC. Trading into USD, JPY and EUR also fell significantly, to 916k (down 13.7%), 229k (down 18.4%) and 211k (down 15.3%), respectively.

BTC Futures Volumes Drop in Favour of ETH Futures on CME

CME’s ETH futures reached $23.4bn in November (up 11.6% since October), surpassing the previous month’s peak ($21.0bn). Meanwhile, CME’s BTC futures volumes decreased by 30.5% to $48.8bn. On aggregate (ETH + BTC futures) volumes fell 20.8% to $72.3bn.

Binance Maintains Dominance as Open Interest Continues to Grow

November was a record month for total, aggregate open interest as it increased from a daily average of $31.4bn in October to $36.6bn in November (16.8% increase).

Binance had the highest open interest across all derivative products on average at $15.7bn (up 24.1% since October).

November Exchange News

Binance

Binance Labs Participates in the Series C Funding of Mythical Games

Coinbase

Coinbase Wallet is Now Available As a Standalone Browser Extension

Crypto.com

Crypto.com Exchange Is Now Integrated with Cronos

Crypto.com Secures Naming Rights to LA Staples Center

FTX US

FTX US Reports Third Quarter 2021 Trading Results and Provides Operational Update

Bitstamp

ADA, the Token Behind Cardano, Is Making Its Appearance on Bitstamp

Kraken

Free Bank Withdrawals Are Live for US Clients

Faster Funding Now Live in Germany, the UK & France