It was a positive month for the cryptocurrency markets in March as Bitcoin and Ethereum closed the month at $45,523 and $3,283 (up 5.40% and 12.4% since February), respectively. Cryptocurrency exchanges saw an increase of 6.72% in volumes across both derivative and spot markets.

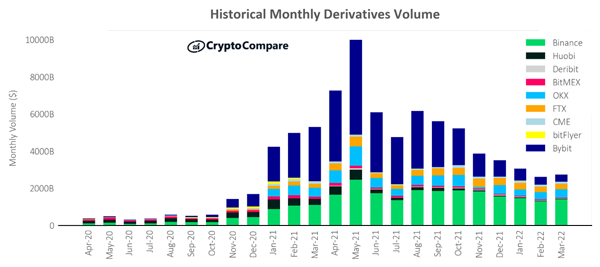

Derivative volumes accounted for 62.8% of total centralized exchange volumes in March, compared to 37.2% market share for spot volumes. This was a welcomed increase in activity in derivatives markets, which had previously seen six straight months of decreased volumes.

Download the full report here.

Key takeaways:

- Derivative markets saw their volumes increase 4.58% to $2.74tn in March reversing a six-month downward trend in volumes. However, derivative market volumes still remain significantly below the all-time high of $9.99tn that was reached in May 2021.

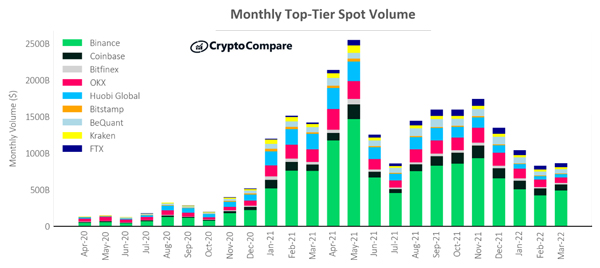

- In March, Binance's spot market volumes reached $490bn, a 15.7% increase from the month prior. As a result, Binance captured 30.2% of the total spot market volumes in March, marginally below their record market share of 33.7% reached in November 2021.

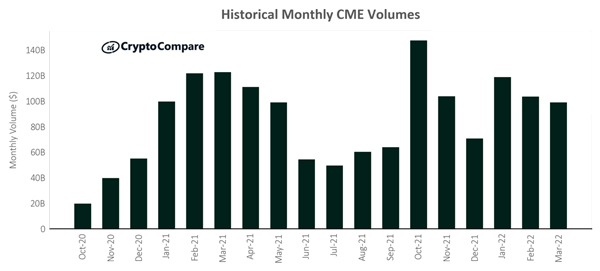

- CME’s monthly futures volumes across BTC and ETH contracts totalled $48.7bn in March, a 0.18% increase from the month prior. BTC volumes account for 79.8% of these, compared to 20.2% for ETH. Futures volumes in CME have remained stable so far in 2022, but remain notably below the all-time highs reached in October 2021, when volumes totalled $94.7bn.

Derivative Volumes Remain Significantly Below All-Time Highs

Derivative markets saw their volumes increase 4.58% to $2.74tn in March reversing a six-month downward trend in volumes. However, derivative volumes still remain significantly below the all-time high of $9.99tn that was reached in May 2021.

Binance Attains Over 30% Spot Volumes Market Share

In March, spot volume from the 15 largest Top-Tier exchanges increased 4.23% compared to February, with total spot volumes of $927bn.

Considering individual exchanges, Binance (Grade AA) was the largest Top-Tier spot exchange by volume in March, trading $490bn (up 15.7%). This was followed by Coinbase (Grade AA) trading $81.9bn (down 11.7%), and OKX (Grade BB) trading $75.9bn (down 26.4%).

CME Futures Volumes Remain Stable in 2022

Monthly derivative volumes at CME fell 4.24% to $99.0bn in March, the lowest monthly volumes for the exchange thus far in 2022.

CME’s monthly futures volumes across BTC and ETH contracts totalled $48.7bn in March, a 0.18% increase from the month prior. BTC volumes account for 79.8% of these, compared to 20.2% for ETH.