The cryptocurrency markets failed to recover from Terra’s collapse in May as insolvency threats loomed over major crypto lending companies, spreading fear among market participants.

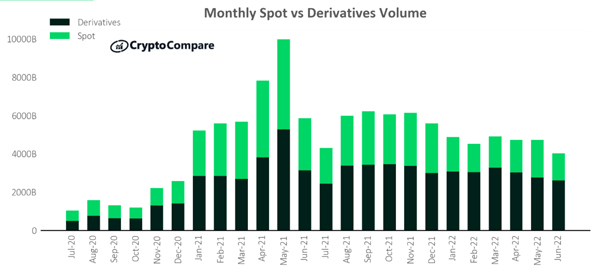

Bitcoin and Ethereum closed the month of June at $19,908 and $1,070, falling 37.4% and 44.9%. This was their largest monthly drop since February 2014 and March 2018 respectively. Spot and derivatives volumes across centralised exchanges declined from the highs reached in May, falling 15.2% to $4.16tn, the lowest figure recorded since January 2021.

Download the full report here for all the latest insights.

Key takeaways:

-

Spot and derivatives trading volumes reach record lows in 2022. Spot trading volumes across all centralised crypto exchanges fell 27.5% to $1.41tn, the lowest figure recorded since December 2020. Meanwhile, the derivatives trading volume, which represents 66.1% of the market, fell 7.01% to $2.75tn. This was the lowest derivatives volume recorded since July 2021.

-

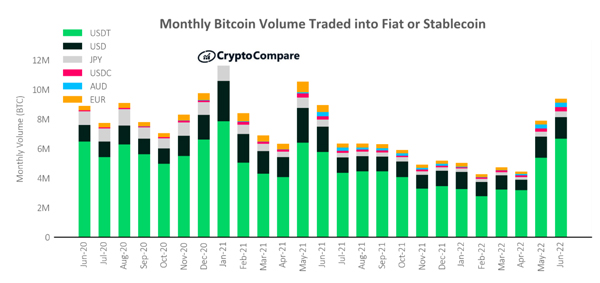

BTC spot trading into stablecoins continued to rise in June as investors remained cautious amid fears of a liquidity crisis in striking crypto lending companies. BTC trading into USDT rose 24.3% to 6.67mn BTC, remaining as the dominant stablecoin/fiat pair with a market share of 67.2%.

-

Over the last couple of months, FTX has seen a significant rise in spot trading volume. Binance remains the dominant exchange with a market share of 49.7%. However, in comparison to its other competitors – Coinbase, OKX, Bitfinex and Bitstamp - FTX has become the leader in trading volume for the last two months (since May). Its market share among the five has risen to 36.8% in June from 18.7% at the start of the year.

-

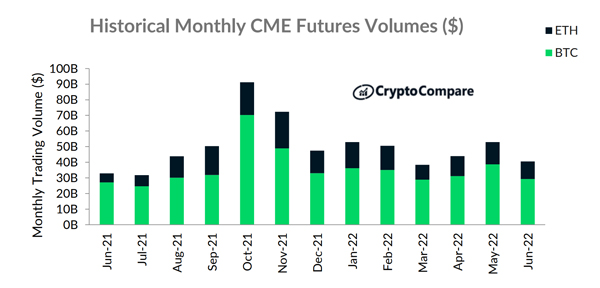

CME’s monthly futures volumes across BTC and ETH experienced a decline in June, indicating a fall in speculative activity. BTC futures contracts in CME recorded the lowest volume traded since July 2021 with a volume of $29.3bn. Meanwhile, ETH futures contracts volumes saw a decline of 21.1% in June to $11.3bn.

Total Spot Volumes Decline 27.5% in June

Derivatives volumes decreased by 7.01% in June to $2.75tn. Meanwhile, total spot volumes decreased by 27.5% to $1.41tn. The derivatives market now represents 66.1% of the total crypto market (vs 60.3% in May).

Bitcoin Trading Into Stablecoin Jumps

BTC spot trading into USDT increased 24.3% in June to 6.67mn BTC as investors continued to prefer the safety of stablecoin assets following the current downward trend in price action. BTC spot trading into USD remained similar to last month, increasing 0.37% to 1.44mn BTC. BTC trading into Japanese Yen (JPY) and USDC, however, saw significant rises of 17.8% and 41.8% to 387k and 306k BTC respectively.

Monthly CME Volumes Reach Lowest Level Since July 2021

BTC futures contracts in CME recorded the lowest volume traded since July 2021 with a volume of $29.3bn. Meanwhile, ETH futures contract volumes decreased 21.1% to $11.3bn. The declining price of the assets meant 253,579 BTC contracts were traded, the highest level since February 2021. An all-time high of 177,117 ETH contracts were also traded in June.