The cryptocurrency markets experienced their first sustained rally since March as the majority of digital assets began their recovery from the grim price action of the last few months.

In July, Bitcoin and Ethereum closed the month at $23,310 and $1,679, rising 22.0% and 62.8%, with the latter capitalizing on the Merge hype. Trading volumes across centralised exchanges rose 8.39% to $4.51tn with derivatives volume rising 13.4% to $3.12tn, suggesting an increase in speculative activity.

Download the full report here for all the latest insights.

Key takeaways:

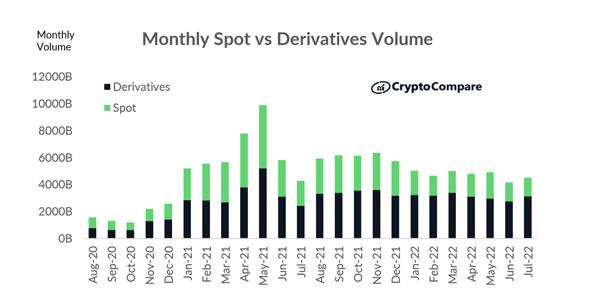

- Spot trading volumes across all centralised crypto exchanges declined 1.34% to $1.39tn, the lowest monthly trading volume recorded since December 2020. Meanwhile, derivatives trading volume experienced a rise for the first time since March, increasing 13.4% to $3.12tn.

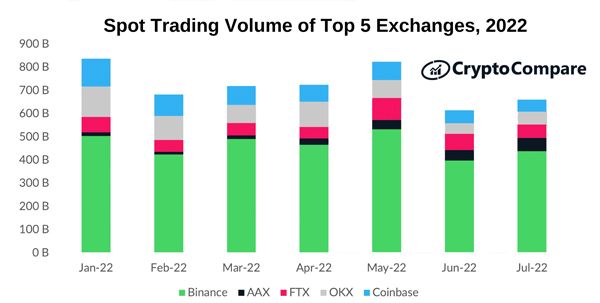

- Spot trading volume on Atom Asset Exchange (AAX) rose 26.5% to $57.2bn, making it the largest exchange by volume after Binance for the first time in its history. AAX is currently the only exchange in the top 15 that has seen its trading volumes grow since the start of the year.

- Binance, FTX, OKX and Coinbase have all recorded a decline in spot trading volume since the start of the year, falling 12.9%, 15.5%, 57.6% and 57.2% respectively. In July, Coinbase’s decline in spot trading volume continued, falling 12.8% to $51.5bn.

- BTC trading into BinanceUSD saw its volume spike by 80.2% to 2.13mn BTC, recording the first instance where it surpassed the BTC spot trading into USD volume. BTC trading into USDT, which has a market share of 62.8%, also rose 31.5% to 8.78mn BTC.

Spot Volumes Reach Lowest Level Since December 2022

Spot trading volumes across all centralised crypto exchanges declined 1.34% to $1.39tn, the lowest monthly trading volume recorded since December 2020. Meanwhile, derivatives trading volume experienced a rise for the first time since March, increasing 13.4% to $3.12tn.

The derivatives market now represents 69.1% of the total crypto market (vs 66.1% in June).

Binance USD (BUSD) Trading Volumes Spike

BTC trading into BinanceUSD saw its volume spike by 80.2% to 2.13mn BTC, recording the first instance where it surpassed the BTC spot trading into USD volume. BTC trading into USDT, which has a market share of 62.8%, also rose 31.5% to 8.78mn BTC.

BTC spot trading into USDT increased by 31.4% in July, to 8.78mn BTC, as investors continue to prefer safety under uncertain macroeconomic conditions. BTC spot trading into BinanceUSD (BUSD) followed, rising 80.2% to 2.13mn BTC.

AAX Exchange Volumes Reach All-Time High

In July, the spot trading volume in Atom Asset Exchange (AAX) rose 26.5% to $57.2bn, an all-time high for the exchange.

Binance, FTX, OKX and Coinbase have all recorded a decline in volume since the start of the year, falling 12.9%, 15.5%, 57.6% and 57.2% respectively. AAX is the only exchange in the top 15 that has seen its trading volumes grow since the start of the year.