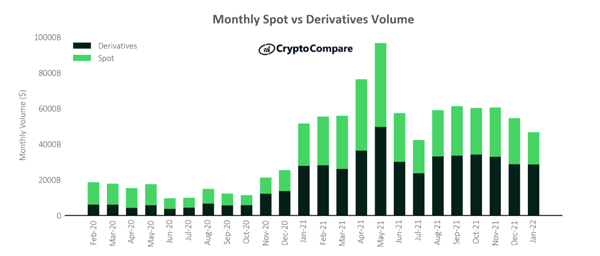

The majority of digital asset exchanges saw both spot and derivative volumes decrease in January as the cryptocurrency market continues to trend downwards - falling from a peak of $3.2tn in November 2021 to $1.9tn at the end of January.

Interestingly, the derivative markets saw increased activity in January despite the market downtrend, this suggests increased hedging and speculation from market participants as they shift to trading futures and options.

Download the full report here.

Key takeaways:

- Spot volumes declined significantly in January (down 30.2% to $1.81tn) whilst derivative volumes remained steady. As a result, derivative markets reached an all-time high market share of 61.2%, breaking the previous all-time high of 57.3% in November 2020.

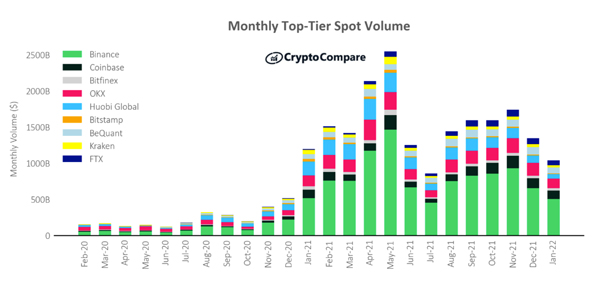

- Total spot volumes reached their lowest level since December 2020 ($1.17tn) as volumes declined 30.2% month-on-month to $1.81tn in January. This drop comprised of a 21.2% drop in top-tier exchange volumes, and a 66.3% drop in lower-tier exchange volumes.

- Trading activity across all spot markets dropped in January compared to the previous month, as cryptocurrency prices continued to decline. A daily volume maximum of $91.1bn was traded on the 24th of January, down 47.5% from the intra-month high in December.

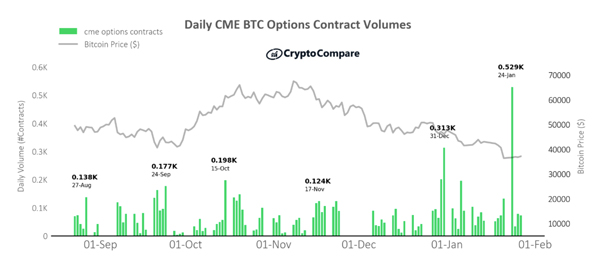

- CME’s BTC option contracts volumes grew 28.6% in January to 1,882 BTC option contracts traded. This is the highest amount of BTC options traded since December 2020, when 3,749 options were traded.

Spot Volumes Retract to Lowest Levels Since December 2020

In January, spot volume from the 15 largest Top-Tier exchanges decreased 22.6% compared to December, with total spot volumes of $1.1tn.

Considering individual exchanges, Binance (Grade BB) was the largest Top-Tier spot exchange by volume in January, trading $504bn (down 23.0%). This was followed by OKEx (Grade BB) trading $131bn (down 26.4%), and Coinbase (Grade AA) trading $120bn (down 12.1%).

Derivative Markets Reach an All-Time High in Market Share

Derivatives volumes decreased by 0.4% in January to $2.9tn. Meanwhile, total spot volumes decreased by 30.2% to $1.8tn. The derivatives market now represents 61.3% of the total crypto market (vs 52.5% in December).

Binance also leads the derivative markets with 51.6% ($1.5tn) of total volumes in January.

CME’s BTC Option Contracts Volumes Grow to Highest Level in 1 Year

CME’s BTC options contract volumes increased 28.6% in January to 1,882 contracts traded, an all-time high for the exchange. Options contract volumes reached a daily maximum of 529 contracts traded on the 24th of January, up 69.0% from the intra-month high in December.

CCDAS Summit - Early Bird Tickets Ending Soon!

CryptoCompare's Digital Asset Summit is returning on 30th March at Old Billingsgate, London. As Europe's flagship institutional summit for digital assets, this is the perfect opportunity to connect with key industry decision-makers and leading names in finance who are adopting and embracing the digital asset revolution.

There are now less than 2 weeks left to secure your Early Bird tickets for the summit! Check out the Summit website now to save over 20% with an Early Bird ticket.

|