In February, the digital asset markets experienced significant volatility. Although BTC and ETH had marginal positive returns of 0.02% and 1.21% respectively, their volatility was higher than in previous months. Both cryptocurrencies saw a maximum drawdown of 25.1% and 29.9% respectively during the month.

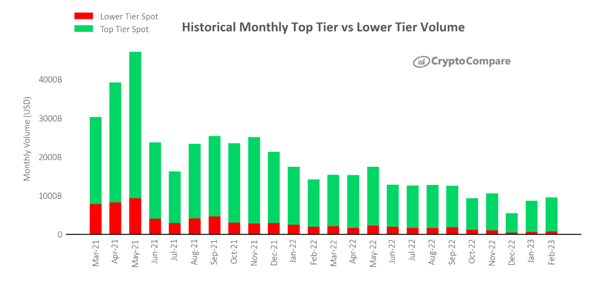

During this period, cryptocurrency exchanges saw volumes across both derivative and spot markets increase by 4.01%. However, it is important to put this into context – with volumes still 71.0% below the all-time highs reached in May 2021.

Download the full report here for all the latest insights.

Key takeaways:

- In February, total spot trading volumes increased 10.0% to $946bn, the second month of consecutive volume increases. Despite the increase, trading volumes remain at historically low levels.

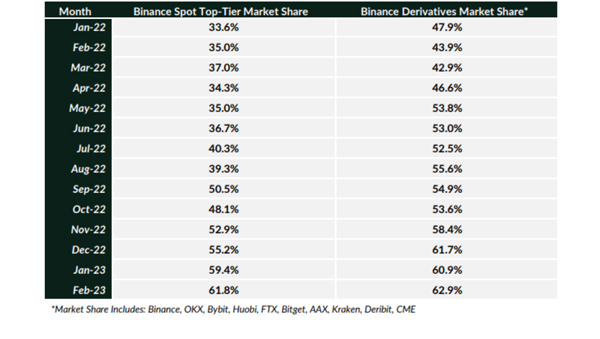

- Binance’s spot market share across Top-Tier exchanges grew for the fourth consecutive month, increasing from 59.4% in January to 61.8% in February, after the exchange saw a 13.7% increase in its spot volumes to $540bn. This is an all-time high market share for the exchange.

- Binance’s market share across Top-Tier derivative exchanges also grew to 62.9%, its highest-ever recorded monthly market share.

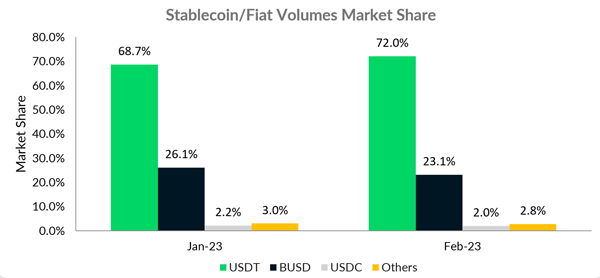

- BUSD’s market cap fell 32.6% in February from $15.7bn to $10.6bn. However, volumes have not reacted in a similar fashion, with BUSD remaining the second most used stablecoin/fiat option across all centralised crypto exchanges. In February, total BUSD volumes fell 2.43% to $176bn

Binance Spot & Derivatives Market Share Reach New All-Time Highs

Binance’s spot market share across Top-Tier exchanges grew for the fourth consecutive month, increasing from 59.4% in January to 61.8% in February, after the exchange saw a 13.7% increase in its spot volumes to $540bn. This is an all-time high market share for the exchange. Binance’s market share across derivative exchanges also grew to 62.9%, its highest-ever recorded monthly market share.

BUSD Sees a Marginal Fall in Volumes in February

Total BUSD volumes fell 2.43% to $176bn in February, a lower-than-expected fall given the regulatory pressures suffered by BUSD over the last month. This includes an investigation by the NYDFS, an instruction by the regulator to cease the minting of new BUSD tokens, and a Wells Notice from the SEC.

This has resulted in a collapse of BUSD’s market capitalisation, as BUSD holders redeem the token in exchange for USD, while no new tokens are able to be minted. As a result, BUSD’s market cap fell 32.6% in February from $15.7bn to $10.6bn. However, volumes have not reacted in a similar fashion, with BUSD remaining the second most used stablecoin/fiat option across all centralised crypto exchanges

USDT appears to be the clear winner from BUSD’s debacle, with an increase in market share from 68.7% to 72.0% month on month. Surprisingly, USDC’s market share fell by 20 basis points over the same period.

Trading Volumes Rise MoM, yet Remain at Historically Low Levels

In February, total spot trading volumes increased 10.0% to $946bn, the second month of consecutive volume increases. Top-Tier spot volumes increased 9.23% to $873bn, and Lower-Tier spot volumes increased 20.4% to $72.1bn. Despite the increase, trading volumes remain at historically low levels.

Top-Tier exchanges now represent 92.4% of total spot volume based on CryptoCompare’s October 2022 Exchange Benchmark Ranking, compared to 93% in January.

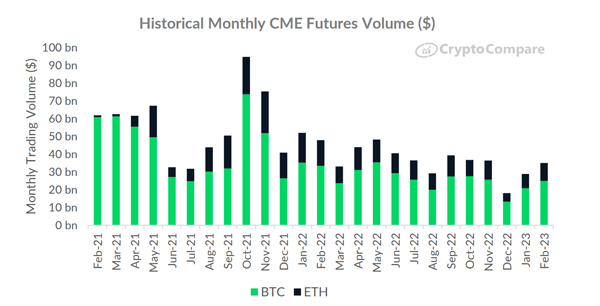

CME Futures Volumes Rise 21.2% Month on Month

Regarding total USD trading volume, CME’s ETH futures reached $10.1bn in February (up 24.4% since January). Meanwhile, CME’s BTC futures volumes rose 20.0% to $25.0bn. On aggregate ETH + BTC futures volumes rose 21.2% to $35.0bn. This does not include Micro Futures.

A combined volume of $4.05bn in BTC and ETH futures was traded on the 21st of February – a maximum for the month, up 25.1% from the intra-month high in January.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.