Cryptocurrency prices rose in February as Bitcoin and Ethereum closed the month at $43,189 and $2,919 (up 12.2% and 8.58% since January respectively). However, spot volumes on centralised exchanges fell 12.9% to $1.57tn, with a daily maximum of $106bn traded on February 24th. Derivative markets also fell 15.9% to $2.64tn with a daily maximum of $183bn traded on February 24th.

Download the full report here.

Key takeaways:

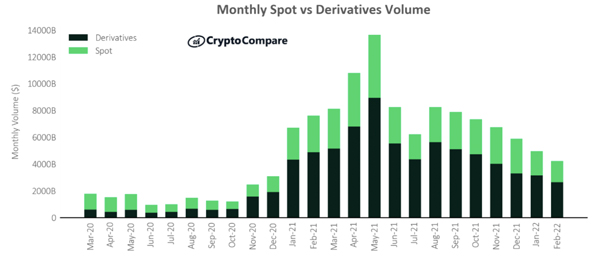

- Derivatives markets continued their downward trend in volume in February as total derivatives volumes fell 15.9% to $2.86tn. This marks the seventh consecutive month that these volumes have declined.

- After reaching their lowest levels since December 2020 in January, total spot volumes continued to decline in February as they fell 12.9% to $1.57tn. This drop consisted of a 11.1% drop in top-tier exchange volumes, and a 30.1% drop in lower-tier exchange volumes.

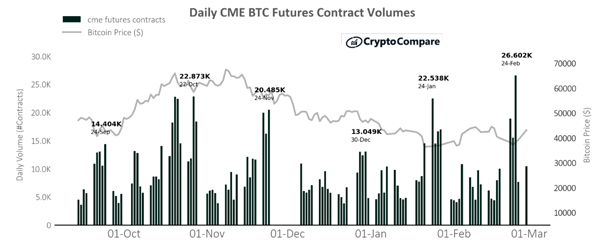

- CME’s BTC futures contracts recorded a daily maximum of 26,602 on February 24th - the highest daily volume of CME’s BTC futures contracts traded in nine months.

- CME's average open interest for both BTC and ETH futures dropped in February. Average interest for BTC futures decreased 7.1% to $2.2bn whilst open interest for ETH averaged $512mn (down 15.5% since January).

Derivative Markets Continue Downward Trend in Volume

Derivatives volumes decreased by 15.9% in February to $2.86tn. Meanwhile, total spot volumes decreased by 12.9% to $1.6tn. The derivatives market now represents 62.7% of the total crypto market (vs 63.5% in January).

CME's BTC Futures Contracts Record Highest Daily Volume in Nine Months

26,602 BTC futures contracts were traded on the 24th February - the highest daily volume since 19th May 2021 when 32,356 BTC futures contracts were traded. However, roughly 173,000 monthly contracts were traded in February, down 4.5% since January.

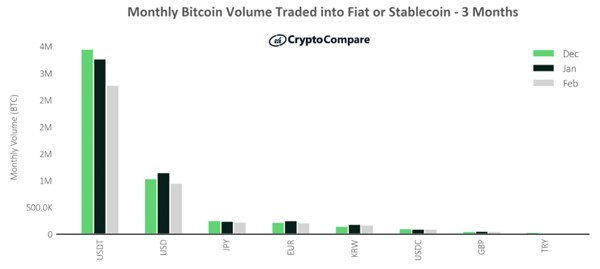

BTC Spot Trading into UDST Declines in February

BTC spot trading into USDT decreased by 14.9% in February to 2.8mn BTC. The decline in BTC spot trading was also seen in USD and JPY pairs, falling to 949k (down 16.9%) and 225k (down 6.0%). JPY trading surpassed EUR trading once again, having lost the position last month for the first time since May 2021.

|

|

|

|