Cryptocurrency prices fell in December as Bitcoin and Ethereum closed the month at $46,197 and $3,676 (down 18.9% and 20.6% since November respectively). Spot volumes also decreased to $2.6tn. A daily maximum of $174bn was traded on December 4th, up 32.6% from the intra-month high in November.

Inflation worries also remained a concern for financial markets as the latest US CPI report included a 6.8% annual inflation – the highest level since 1982.

The full report is available here.

Key takeaways:

- In December, Bitcoin closed the month at $46,197 (-18.9% from November) - its largest month-on-month loss since the crash in May 2021, when it fell 49.2% from a high of $58,943 to $29,925 in just 19 days.

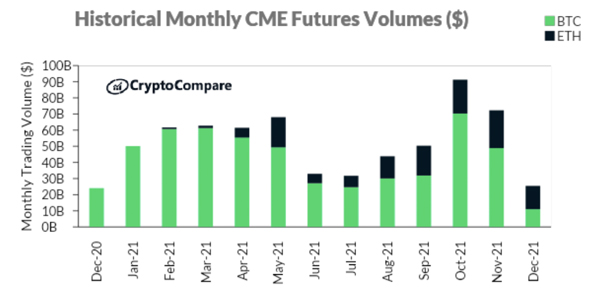

- CME BTC futures volumes experienced their biggest monthly decrease - falling 77.4% to $11.0bn. CME ETH futures volumes on the exchange also fell 38.4% to $14.4bn.

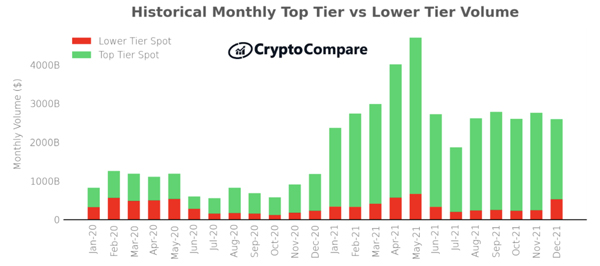

- Spot volume from the 15 largest Top-Tier exchanges decreased 22.6% compared to November, with spot volumes totalling $1.4tn. Lower-Tier spot volumes, however, increased 117.8% to $518bn, its highest level in 7 months

- A total of 1,464 BTC option contracts were traded in the month of December, up 20.6% from November. This is the highest level that has been reached since May when 1,472 contracts were traded.en 1,472 contracts were traded.

Top-Tier Spot Volumes Decline Alongside Cryptocurrency Prices

Top-Tier spot volumes fell 17.9% to $2.1tn whilst Lower-Tier spot volumes inscreased 117.8% to $518bn. Top-Tier exchanges now represent 80.0% of total spot volume (vs 92.1% in November).

BTC & ETH Futures Contracts on CME Fall Whilst Options Volumes Rise

Aggregate ETH + BTC futures volumes fell 64.8% to $25.5bn in December - the lowest level reached in 2021. However, CME's BTC options contract volumes increased 20.6% to 1,464 contracts in December.

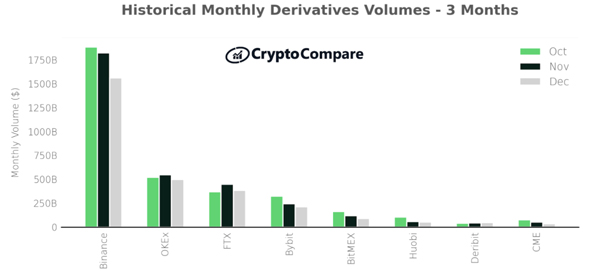

Binance Maintains its Position as Largest Derivatives Exchange

Binance was the largest derivatives exchange in December by monthly volume, trading $1.6tn (down 14.4% since November) followed by OKEx ($498bn, down 8.8%), FTX ($385bn, down 13.9%) and Bybit ($213bn, down 12.1%).

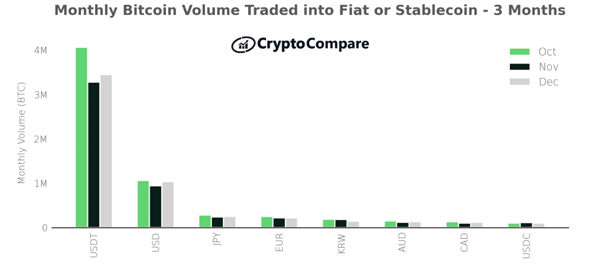

BTC Spot Trading into Largest Stablecoin Market Increased in December

BTC spot trading into USDT increased by 5.0% in December to 3.4mn BTC, trading into USD, JPY and EUR also increased, to 1.0mn (up 10.0%), 249k (up 6.1%) and 220k (up 1.6%), respectively.

December Exchange News

BitMEX

Introducing BitMEX EARN: Start Earning Up to 100% APR on Tether

Crypto.com.

Crypto.com App Now Offers Instant Deposit to U.S Users

Gemini

Gemini to Offer Crypto Trading to Bancolombia Customers

FTX

Nuvei Announces Payment Solutions Partnership with FTX

KuCoin

KuCoin Integrates Chainlink Price Feeds for OTC Market Pricing

Uniswap

Auto Router V2 Release Improves Pricing & Optimize Gas Cost of Swaps