Despite the $1 trillion infrastructure bill containing mandates on cryptocurrency brokerages tax compliance, the bullish sentiment within the crypto-community remained largely unaffected - with new all-time highs and ecosystem firsts being achieved throughout August.

Bitcoin rose 18.3% in August, while Ethereum saw a larger monthly increase of 35.7% - following the London hard fork on August 5th. However, the spotlight was taken by Cardano and Solana, which increased 110.2% and 194.9% respectively.

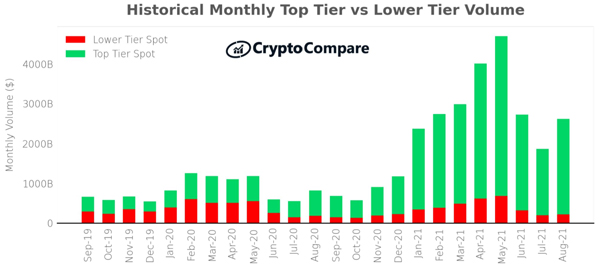

These large increases, combined with an NFT resurgence, led to a surge in trading volumes and open interest, with monthly Top-Tier spot volumes increasing by 43.6% to $2.4tn.

Click here to download CryptoCompare's latest Exchange Review.

Key takeaways:

- Top-Tier exchange volumes continued to rise, now accounting for 91.7% of total spot volume throughout August - the highest share of spot volume since June 2018

- Binance (Grade BB) was once again the largest Top-Tier spot exchange by volume - up 65.2% from July to $751bn August.

- ETH futures and perpetual futures open interest reached an all-time high in August, rising 41.0% to $5.6bn.

- CME’s perpetual and futures open interest grew by 47.2% and 78.3% to $1.7bn and $613mn respectively, both all-time highs for the exchange.

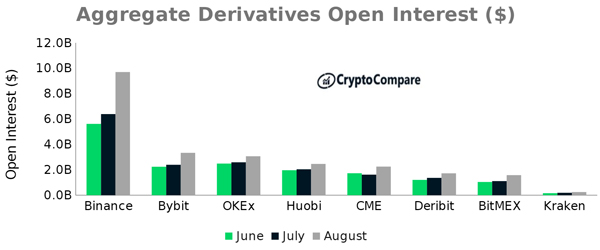

- Aggregate open interest rose 37.7% in the month of August to $24.4bn, the highest level recorded in the past three months.

- Binance open interest grew at the fastest rate (51.8% vs July) and now accounts for 39.8% of all derivative open interest, the highest dominance level recorded.

Additional insight can be found below.

Top-Tier Exchanges Represent the Highest Proportion of Spot Volume Since June 2018

In August, Top-Tier spot volumes increased by 43.6% to $2.4 trillion. As a result, Top-Tier volumes now represent 91.7% of total spot volume. Despite increasing in August, Lower-Tier volumes now represent less than 10% of total spot volume.

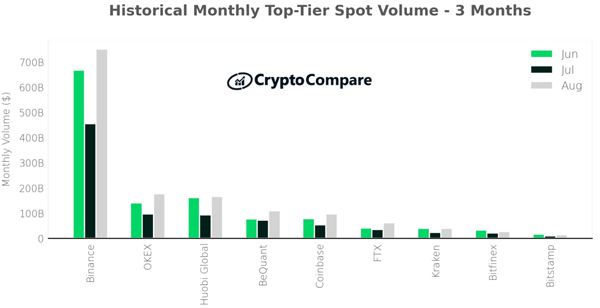

In August, spot volume from the 15 largest Top-Tier exchanges increased by 67.9% on average compared to July.

Binance (Grade BB) was once again the largest Top-Tier spot exchange by volume across the month. The exchange-traded $751bn in August, up 65.2% from July.

The two exchanges with the next largest trading volumes were OKEx and Huobi Global, who traded $177.8bn (up 82.4%) and $166bn (up 79.4%) respectively.

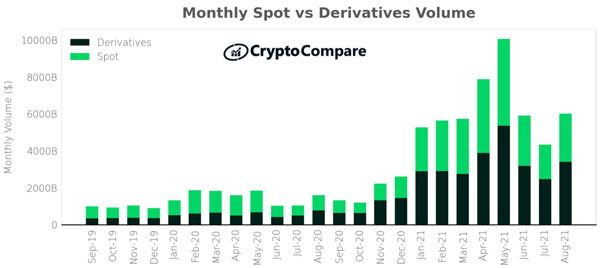

Derivatives Market Reaches Highest Volume Since May

Derivatives volumes increased by 37.8% in August to $3.4tn. The derivatives market now represents 56.6% of the total crypto market (vs 56.9% in July).

Binance Dominates Aggregate Open Interest

August saw aggregate open interest reach its highest level in three months, rising from a weekly average of $17.7bn in July to $24.4bn in August (37.7% increase). This aligns with the rise in price in cryptocurrency markets across the month of August.

Binance had the highest open interest across all derivative products on average at $9.7bn (up 51.8% since July). This was followed by Bybit ($3.3bn, up 39.4%) and OKEx ($3.1bn, up 18.2%).

Futures and perpetual futures open interest in ETH rose 41.0% in August to $5.6bn, an all-time high for ETH open interest. Aggregate open interest for Bitcoin rose to $12.4bn (up 22.4%) but still remains below the all-time high reached in April ($19.1bn).

.jpg)

August Exchange News

1inch

DeFi’s 1inch Network Launches on Ethereum Scaling Platform Optimism

Liquid

Japan's Liquid Global Exchange Hacked; $90M in Crypto Siphoned Off

Liquid closes US$120,000,000 debt financing from FTX

Kraken

Kraken Commits $250,000 to Advancing Ethereum’s Blockchain Upgrade Efforts

Gemini

Gemini Now Provides an Integrated Crypto Experience for Brave Users

FTX

FTX.US to Buy LedgerX in Bid for US Crypto Derivatives

Uniswap

Uniswap on Arbitrum (Alpha launch)!