In September, both traditional and digital asset markets continued to decline as the US Federal Reserve announced its decision to raise interest rate by 75bps.

The price of crypto assets plummeted, with Bitcoin and Ethereum falling 4.77% and 15.9% respectively in September (as of the 28th).

Download the full report for further insights into the digital asset industry.

Key takeaways:

- For the first time since September 2020, average daily volumes for all Exchange Traded Products (ETPs) listed in this report dropped below $100mn, falling 79.9% from 2022's high recorded in January.

- Short Bitcoin Products had the largest gains across all products with ProShares Short Bitcoin Strategy ETF (BITI) and 21Shares Short Bitcoin ETP (SBTC) seeing an increase of 43.9% and 25.4% respectively.

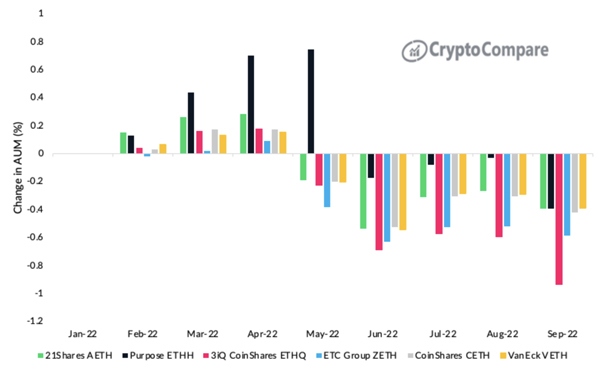

- After Ethereum's transition to Proof of Stake, Ethereum-based digital asset products witnessed one of their most challenging months with all products dropping more than 10.0% in the last 30 days.

- The major AUM drop among all products was recorded by 3IQ CoinShares ETHQ product, which lost 83.9% of its AUM during September.

Weekly Ethereum Net Flows Continue To Decline

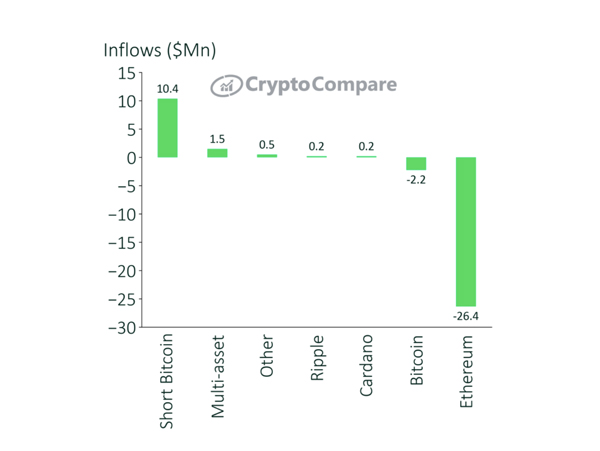

Weekly net flows for Bitcoin-based products continued to record outflows, averaging $2.23mn in September. Ethereum products, on the other hand, recorded the largest negative net flows of $26.4mn, the largest out of any asset.

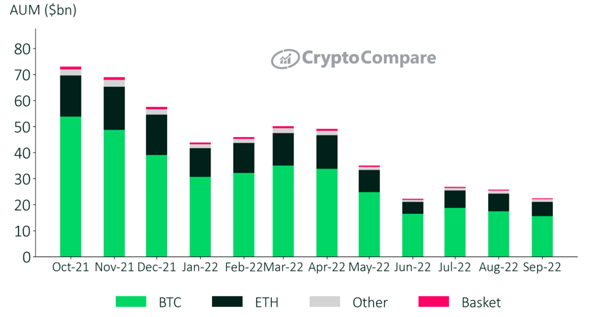

AUM of Bitcoin and Ethereum Decline

In September, the AUM of Bitcoin-based digital asset products fell 10.7% to $15.6bn, declining its market share to 69.4%. Meanwhile, the AUM of Ethereum based digital asset products fell 19.3% to $5.49bn, now accounting for 24.5% of total AUM.

The AUM of 'Other' and 'Basket' based products fell 8.48% and 12.8% to $1.03bn and $343mn, respectively.

The Sharp Decline in Ethereum ETNs/ETFs Products

Amid the current bear market and poor sentiment across all assets and products, September proved more difficult for the Ethereum digital asset products. All the Ethereum based exchange-traded products (ETPs) tracked in this report have seen a major breakdown, led by 3iQ CoinShares ETHQ, which lost 83.9% of its AUM, declining its market share from 1.89% in August to only 0.35% in September.