The crypto markets rebounded in October in hope of a less aggressive stance from the Federal Reserve after two consecutive months of decline, with Bitcoin and Ethereum rising 3.38% and 9.90% (as of October 25th).

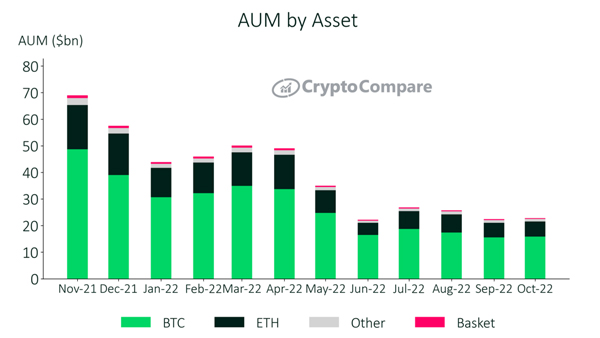

Digital asset products AUM also started to recover following a painful September, with total AUM rising 1.76% to $22.9bn (as of the 25th). This is the first increase in AUM since July this year, however, AUM is still significantly lower than what was seen at this year's market peak in March.

Download the full report for further insights into the digital asset industry.

Key takeaways:

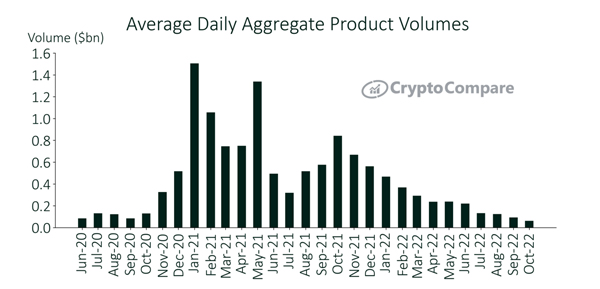

- In October, institutional digital asset products experienced the lowest-ever volume reported (data tracked since June 2020), with average daily trading volume falling 34.1% to $61.3m. It is the second month since September 2020 in which average daily volumes have fallen under $100mn.

- Almost all the products covered in this report recorded a large decline in average daily volumes, ranging from -24.3% to -77.5%. Interestingly, ETF products from Purpose saw a spike in trading volume with Purpose Bitcoin ETF (BTCC) and Ether ETF (ETHH) increasing by 298% and 172% respectively.

- Bitcoin-based products outperformed Ethereum products in October despite the historic merge. In the last 30 days, BTC-based products saw returns ranging from -4.7% to 2.7%. This contrasts with Ether products, which had returns ranging from -22.1% to 0.8%, despite ETH/USD experiencing returns of 9.91%.

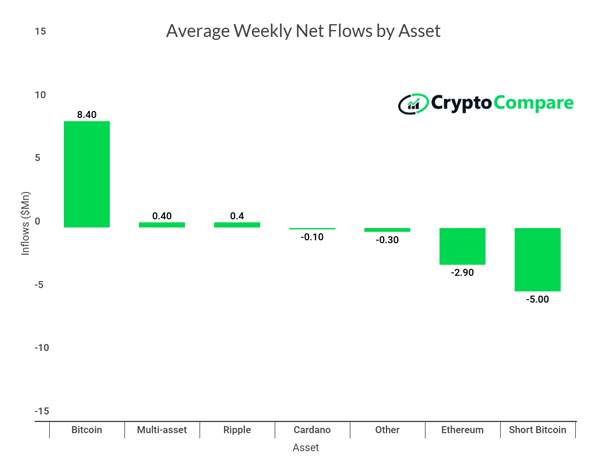

- Institutional preference for BTC-based products in October can also be seen via average weekly flows by asset class. BTC products experienced weekly inflows of $8.37mn, whilst ETH products experienced outflows of $5.03mn. This may be caused by the uncertainty surrounding the macroeconomic climate, as investors look to invest in safer crypto-based products.

Institutional Products Experience Lowest Volumes Recorded in Two Years

Average daily aggregate product volumes across all digital asset investment products fell 34.1% to $61.3mn in October, continuing a downward trend in volumes observed since November 2021 (except for a slight rise of 0.39% in May). It is the second month since September 2020 in which average daily volumes have fallen under $100mn.

Digital Asset Products AUM Starts to Recover Following a Painful September

In October, the AUM of Bitcoin and Ethereum-based digital asset products rose 2.55% and 3.35% respectively. Trust products rose 2.33% to $17.7bn in AUM, increasing its market share to a five-month high of 77.3%.

ETN and ETF products recorded a decline in AUM for the third consecutive month, falling 0.76% and 1.59% to $1.68bn and $2.12bn respectively. The decline still fares better compared to an agonising September that saw ETN and ETF products drop 10.5% and 21.1% respectively.

Bitcoin Products Outperform Ethereum Products Despite Historic Merge

BTC-based products had mixed results in the last 30 days, with returns ranging from -4.7% to 2.7%. This contrasts with Ether products, which had returns ranging from -22.1% to 0.8%, despite ETH/USD experiencing returns of 9.91%.

Institutional preference for BTC-based products in October is also shown through average weekly flows by asset class. BTC products experienced weekly inflows of $8.37mn, whilst ETH products experienced outflows of $5.03mn. This may be caused by the uncertainty surrounding the macroeconomic climate, as investors look to invest in safer crypto-based products