In October, the price of Bitcoin and Ethereum rose by 42.0% and 35.4% respectively following anticipation for the launch of the first Bitcoin ETF by ProShares on October 19th.

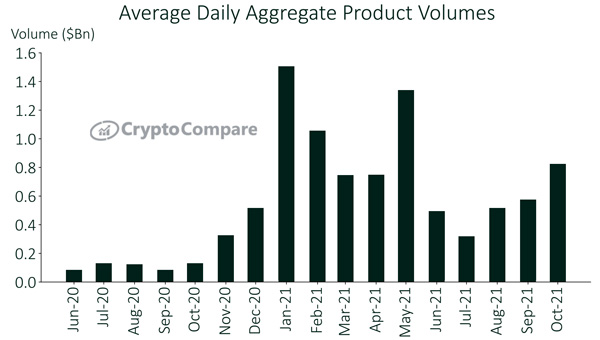

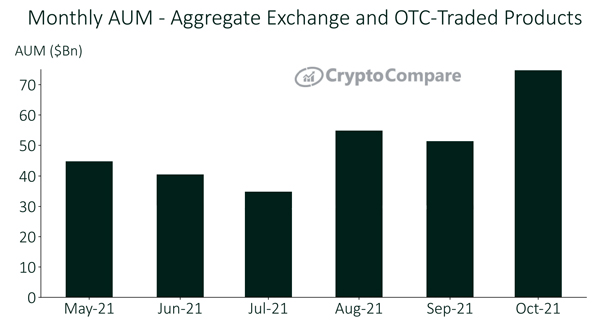

Rising prices and increased weekly inflows caused AUM to increase by 45.5% in October. Average daily volumes also rose in October to $802mn (43.6% increase) as higher prices led to more volatility, creating a potentially more profitable market environment for cryptocurrency traders.

Click here to download the latest CryptoCompare Digital Asset Management Review.

Key takeaways:

- Total AUM grew 45.5% in October to a new all-time high of $74.7bn, surpassing the previous all-time high of $58.7bn in March 2021.

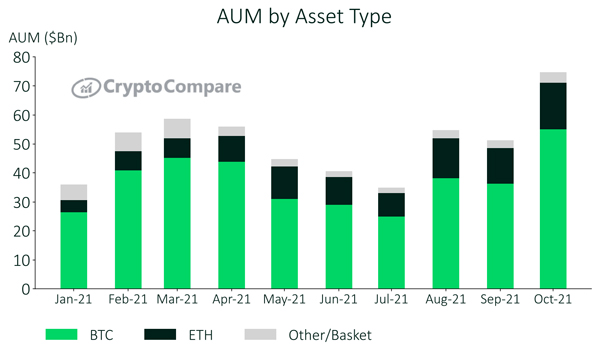

- Total AUM in Bitcoin-based products grew 52.2% to $55.2bn, another all-time high. Ethereum based products also reached a new all-time high in October, increasing 30% to $15.9bn.

- Grayscale’s GBTC Bitcoin Trust volumes increased by 12% to $388mm, compared to the month prior. As a result, it regained the top spot as the most traded digital asset product.

- Aggregate daily volumes across all digital asset types now stand at $826mn after increasing by an average of 43.4% from September to October.

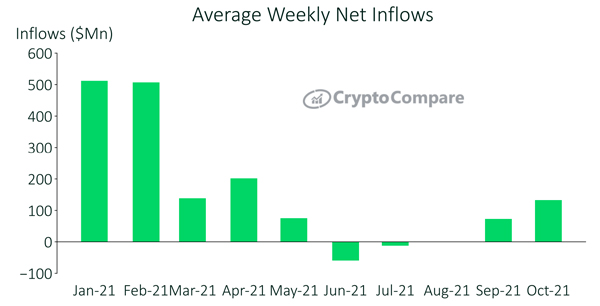

- Flows into Bitcoin-backed digital asset products continued to rise in October, recording an average of $121mn per week so far this month. This includes a $225mn inflow in the week of 11th October, the largest inflow since early May.

- Individual companies’ AUM also reached new all-time highs – with Grayscale, XBT Provider, and 21Shares products growing to $56.8bn (42.3% increase), $5.5bn (42.7% increase) and $2.3bn (32.5% increase) respectively.

Trading Volumes

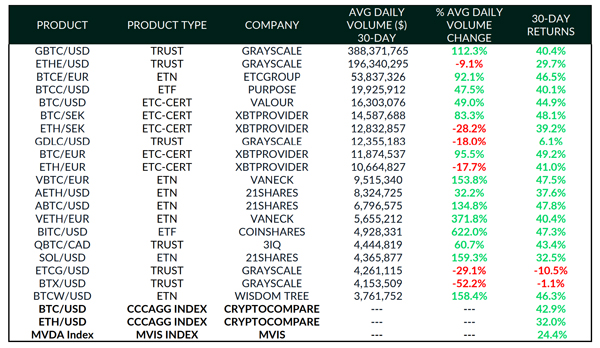

Aggregate daily volumes across all digital asset investment product types increased by an average of 43.4% from September to October. Average daily volumes now stand at $826mn.

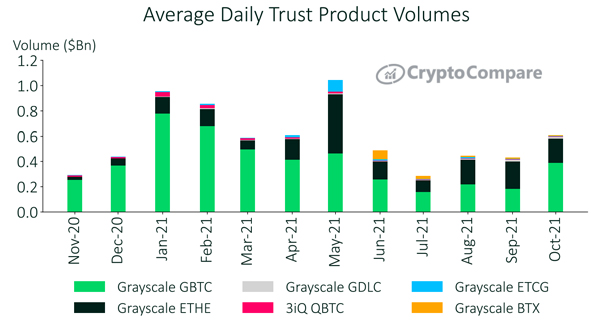

Grayscale's Bitcoin trust product (GBTC) regained its majority market share of trust product volume in October at 63.1%.

Average daily volume for Grayscale's GBTC rose 112% to $388mn however Grayscale's ETHE and GDLC decreased 9.1% (to $196mn) and 18.0% (to $124mn) respectively. All trust product volume rose by an average of 39.6% to a total of $616mn.

AUM – Assets Under Management

Since September, total AUM across all digital asset investment products has increased 45.5% - reaching a new all-time high of $74.7bn. (as of October 21st)

The previous all-time high of $58.7bn was reached in March 2021.

In October, Bitcoin’s AUM rose 52.2% to $55.2bn. As a result, it gained market share for the first time in three months (now 73.9% of total AUM vs. 70.7% last month).

Ethereum’s AUM rose 30.0% to $15.9bn while Other/Baskets rose 26.5% to $3.6bn.

Average weekly net inflows were positive in October for the second month in a row, with inflows averaging $132mn, the highest level since April 2021.

Price Performance

Both BTC and ETH-based products experienced gains over the last 30 days, ranging from 40% to 49% for BTC products and 30% to 40% for ETH products.

Over the 30 day period, XBTProvider's BTC/EUR fund experienced the largest gain at 49%, whilst Grayscale's ETCG product experienced the largest loss at 11%.

ETP News

October 4th

Grayscale Adds Solana and Uniswap to Crypto Investment Fund

October 7th

CoinShares Invests in Switzerland-Based FlowBank

October 7th

21Shares Selects Copper to Secure its Cryptocurrency ETPs’ Assets

October 8th

21Shares Announces Listing of 5 Additional Crypto ETPs on Euronext Paris and Amsterdam

October 14th

Ark Invest Joins Bitcoin ETF Approval Queue With Plans to Trade Futures

October 18th

Invesco Drops Efforts to Launch Bitcoin Futures ETF

October 19th

Grayscale Files to Turn Biggest Bitcoin Fund Into an ETF

October 20th

Bitwise Launches Polygon Fund for Ethereum-Scaling Exposure

October 20th

VanEck to Join ProShares in Launching a Bitcoin Futures ETF