In November, digital asset management firms saw their AUM decline by an average of 14.5%, the lowest monthly AUM recorded since December 2020. This decline was fuelled by fears surrounding the exposure that those firms have to FTX and the implications of the recent incidents on market stability.

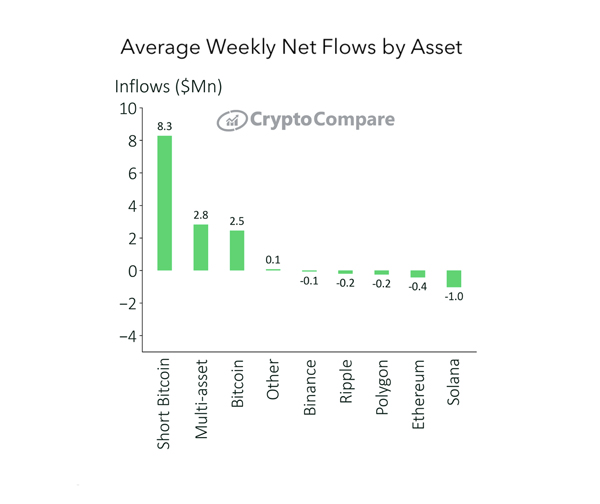

Average weekly inflows saw a notable rise in November, driven by the increased interest in BTC & ETH short-investment products. This signifies the negative sentiment caused by the collapse of FTX, and the market expectation of further price drops.

Download the full report for further insights into the digital asset industry.

Key takeaways:

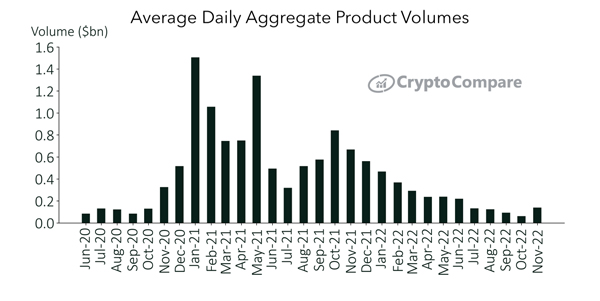

- Average daily aggregate product volumes across all digital asset investment products saw a significant rise of 127% to $139mn in November, the highest volumes recorded since June 2022.

- Grayscale’s Bitcoin trust product (GBTC) recorded an average daily volume of $72.9mn, a 155% increase compared to October, while the Grayscale Litecoin-based product LTCN recorded the highest increase in volumes of 428% to $450k.

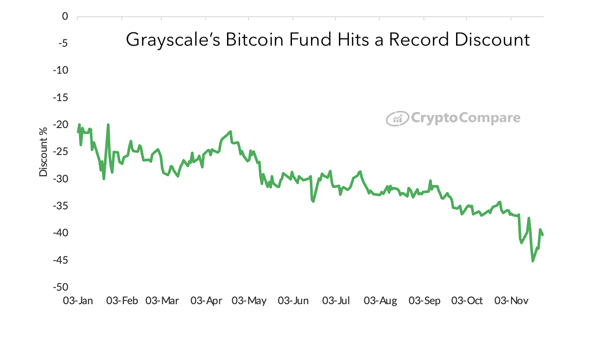

- Grayscale’s Bitcoin Fund Hits a Record Discount of 45.1% Following FTX Collapse.

- Ethereum products recorded negative net flows of $0.43mn, continuing the asset’s streak of negative net flows, which started in September following the Ethereum Merge.

Average Daily Aggregate Product Volumes Rise

Average daily aggregate product volumes across all digital asset investment products saw a significant rise of 127% to $139mn in November, the highest volumes recorded since June 2022, breaking the downward trend volumes have witnessed since May 2022. This is explained by the significant rise in trading activity caused by FTX-related events.

Grayscale’s Bitcoin Fund Hits a Record Discount of 45.1%

Since February 2021, the entire crypto market has been watching closely as the GBTC discount increases and market stability declines. The discount represents the gap between the security price and the Net Asset Value (NAV) of the underlying BTC held by the trust.

Following FTX’s liquidity problems on the 8th of November, GBTC‘s discount saw an increase of 12.0%, followed by further increases leading to the discount reaching an all-time high of 45.1% on the 18th of November.

Weekly Net Flows for Ethereum Products Continue to Decline

Weekly flows for Bitcoin-based products continued to be positive for the third month in a row, averaging $2.45mn in November; a 33.3% and 74.5% drop compared to the net flows of September and October, respectively.

Ethereum products, on the other hand, recorded negative net flows of $0.43mn, continuing the asset’s streak of negative net flows, which started in September following the Ethereum Merge.

The largest net flows were recorded by the Short Bitcoin-based products, which averaged $8.30mn of flows per week, followed by the multi-asset-based product,s which averaged $2.80mn.