It has been a turbulent couple of months for the digital asset ecosystem, marred by large losses and high-profile contagion events. In the month of June, all but one product – the 21Shares Short Bitcoin ETP – recorded negative returns. July has seen this trend reverse, with all products covered by this report seeing positive 30-day returns.

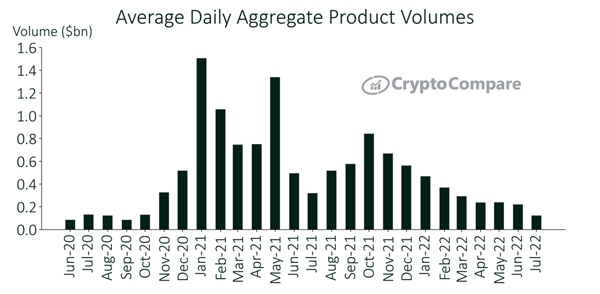

Average daily volumes across all digital asset investment products are still significantly below the levels seen in 2021, with average daily volumes falling 44.6% to $122mn in July. This is the lowest average daily volume recorded since September 2020.

Key takeaways:

- Ethereum-based products have been leading the bounce-back in July, driven by price movements in the underlying asset. Ethereum products have seen gains ranging from 25.9% to 37.8%, whilst Ethereum itself experienced 30-day returns of 13.6% (as of July 26th).

- In July, aggregate daily volumes across all digital asset investment products fell by an average of 44.6% to $122mn. This is the lowest average daily volume recorded since September 2020. This follows a trend of declining average daily volumes that started in November 2021.

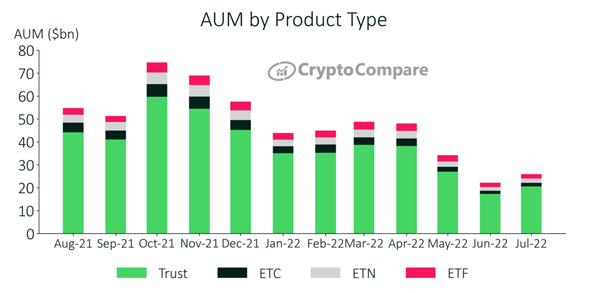

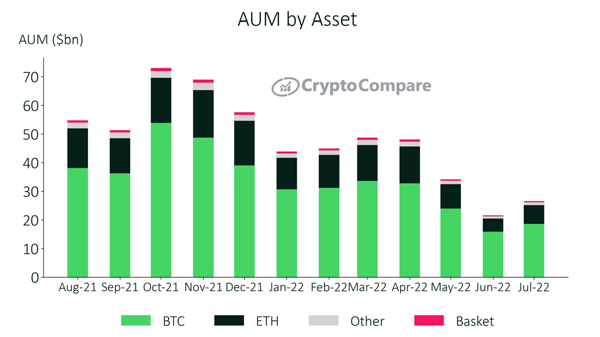

- Bitcoin’s AUM rose 16.9% to $18.6bn in July, however, it fell in market share, currently at 69.9% of total AUM, down from 73.6% in June. Ethereum’s AUM rose 44.6% to $6.57bn while ‘Other’ and ‘Baskets’ AUM rose 21.8% to $1.00bn and 19.6% to $404mn, respectively.

- The AUM of ETFs marginally rose by 0.64% to $1.93bn in July, as the SEC continues to deny approval for spot traded ETFs. Trust products continue to dominate the market, with the AUM of trust products rising 18.7% to $20.6bn (79.3% of total AUM).

Ethereum Investment Products Lead July Gains

Ethereum-based products have been leading the bounce-back in July, driven by price movements in the underlying asset. Ethereum products have seen gains ranging from 25.9% to 37.8%, whilst Ethereum itself experienced 30-day returns of 13.6% (as of July 26th). XBTProvider’s XETHEUR ETC product saw a 30-day return of 37.8%, making it the best performer of the month.

Average Daily Volumes Reach Lowest Level Since Sept 2020

In July, average daily volumes across all digital asset investment products fell by an average of 44.6% to $122mn. This is the lowest average daily volume recorded since September 2020.

Trust Products Continue to Dominate the Market

The AUM of ETFs marginally rose by 0.64% to $1.93bn in July, contrasting the AUM of trust products, which rose rising 18.7% to $20.6bn (79.3% of total AUM). The majority of AUM for trust products continued to reside in Grayscale’s Bitcoin (GBTC - $14.4bn– up 12.1% since June) and Ethereum (ETHE – $4.70bn – up 42.4%) products.