In December, the total assets under management (AUM) for digital asset investment products saw a slight increase of 0.35% to $19.7bn (as of December 20th), however, AUM is currently down 55.2% from its peak in January 2022. This marks the second consecutive month that AUM has hovered around levels not seen since December 2020.

Due to the current state of panic in the market following the collapse of FTX, and rumours of similar problems at Binance, average weekly net outflows from digital asset investment products reached -$9.5mn in December, the highest level recorded since June 2022.

Download the full report for further insights into the digital asset industry.

Key takeaways:

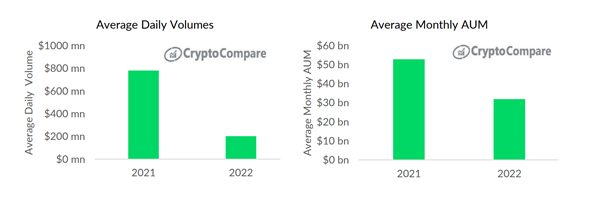

- Average daily volumes have fallen by 74.1% to $203mn in 2022, compared to $781mn in 2021. Average monthly AUM also saw a similar decline of 39.5% to $31.9bn, compared to $52.8bn in 2021.

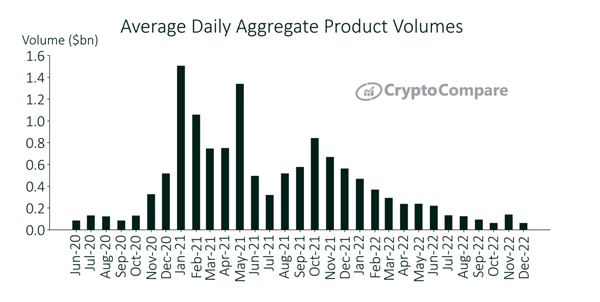

- Average daily aggregate product volumes across all digital asset investment products continued to fall in December after a slight recovery in November, declining 56.1% to 61.1mn (up to the 20th of December). Aggregate product volume is currently 87.0% lower than its peak in January 2021

- In December, average weekly net outflows from digital asset investment products reached their highest level since June, with -$9.5mn of outflows. Bitcoin products were the only products that saw positive inflows, totalling $0.1mn.

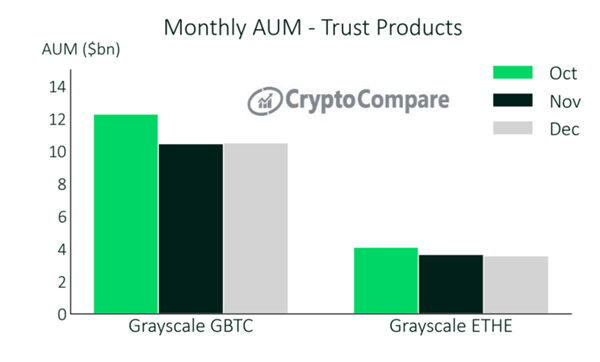

- Increased selling pressure and low demand for GBTC, particularly following the recent negative publicity surrounding Grayscale's parent company, Digital Currency Group (DCG), has caused Grayscale’s GBTC Trust discount to widen. The fund currently has $10.5 billion in assets under management and its discount to the price of Bitcoin has been increasing, reaching a high of 48.9% on December 13th.

Digital Asset AUM & Product Volumes Experience Significant Decline in 2022

In 2022, AUM and average daily volumes saw a significant decline due to various macroeconomic headwinds and major systematic events that affected the entire industry. Average daily volumes have fallen by 74.1% to $203mn in 2022, compared to $781mn in 2021. Average monthly AUM also saw a similar decline of 39.5% to $31.9bn, compared to $52.8bn in 2021.

Average Daily Aggregate Product Volumes Decline 56.1% MoM

Average daily aggregate product volumes across all digital asset investment products continued to fall in December after a slight recovery in November, declining 56.1% to 61.1mn (up to the 20th of December).

Grayscale’s Bitcoin Fund Hits New Record Discount of 48.9%

In a letter to investors in December, Grayscale revealed that it is considering returning a portion of its GBTC funds to investors. The letter came after the Securities and Exchange Commission (SEC) denied Grayscale's request for approval of its Bitcoin exchange-traded fund (ETF).

The fund currently has $10.5 billion in assets under management and its discount to the price of Bitcoin has been increasing, reaching a high of 48.9% on December 13th

Outflows Continue For Digital Asset Investment Products

In December, there was a significant increase in the number of funds being withdrawn from investment products. This is likely due to the issues surrounding FTX and concerns about the security of centralised exchanges like Binance, leading to investors reducing exposure to cryptocurrencies.

The average weekly net outflows from investment products reached -$9.5mn, the highest recorded outflows since June 2022. Bitcoin products were the only products that saw positive inflows, totalling $0.1mn.