In December, the price of Bitcoin and Ethereum fell by 19.0% and 17.3% respectively (data up to 20th December), a continued decline from November. Short-term macro sentiment around risk-assets and crypto seemed to diminish as net weekly flows into digital asset management products in the 3rd week of December turned negative for the first time since August.

Access CryptoCompare's latest Digital Asset Management Review for all the latest insights.

Key takeaways:

- Bitcoin's AUM fell 19.9% to $39.0bn in December. This meant Bitcoin products' market share dropped from 70.6% in November to 67.8%, the lowest share of 2021.

- Average daily trading volumes across all digital asset investment products marginally fell by 1.4% to $659mn.

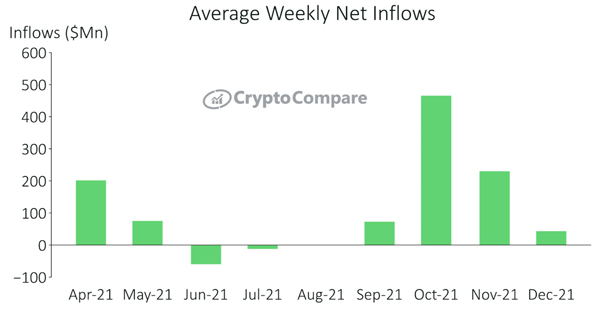

- Total flows into digital asset products turned negative in the 3rd week of December for the first time since August. However, weekly flows in December still averaged positive, with total flows averaging $43.3mn.

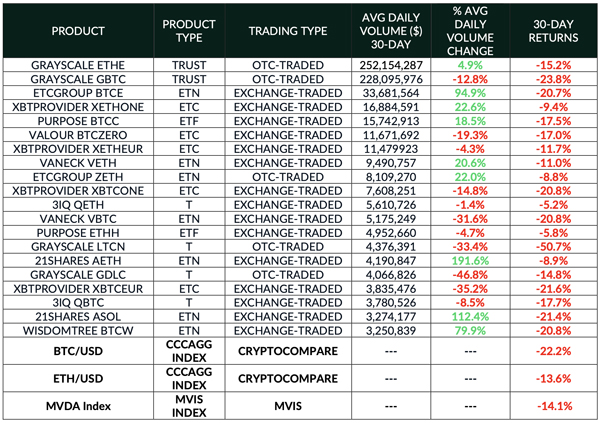

- Grayscale's Ethereum Trust product (ETHE) became the most traded digital asset product for the first time since September with average daily trading volumes for the product rising 4.9% to $252mn.

| DOWNLOAD REPORT |

Trading Volumes

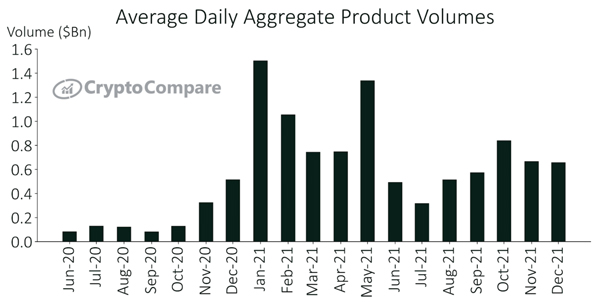

Aggregate daily volumes across all digital asset investment product types fell by an average of 1.4% from November to December. Average daily volumes now stand at $659mn.

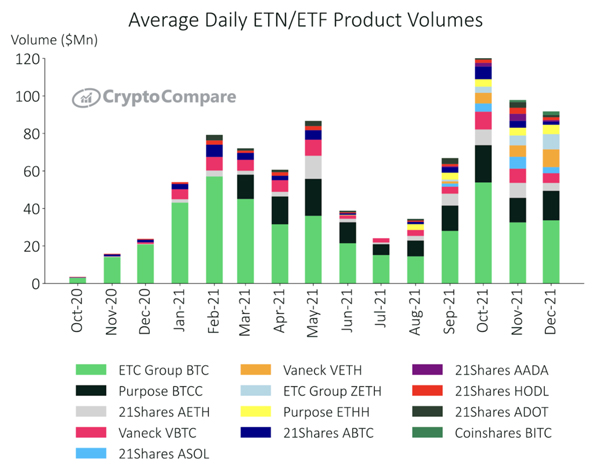

Among the top ETNs/ETFs, ETC Group’s BTCE product traded the highest daily volume in December at $33.7mn (up 3.4%), followed by Purpose’s Bitcoin product (BTCC) at $15.7mn (up 20.5%) and VanEck's Ethereum product (VETH) at $9.49mn (up 54.7%).

WisdomTree's recently launched Ethereum product (ETHW) experienced the largest percentage increase in trading volume, up 302% to $1.25mn.

AUM – Assets Under Management

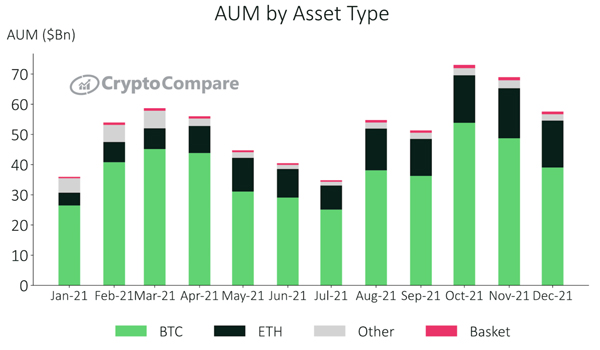

In December, Bitcoin’s AUM fell 19.9% to $39.0bn. As a result, it lost market share from November (now 67.8% of total AUM vs. 70.6% last month).

Ethereum’s AUM also fell 6.3% to $15.6bn while Other and Baskets' AUM were $2.1bn (down 19.9%) and $887mn (down 15.7%), respectively.

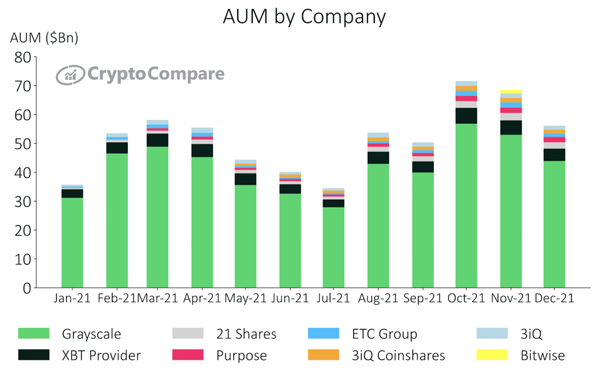

Grayscale products represent the vast majority of AUM at $43.9bn (76.2% of total) followed by those of XBT Provider ($4.3bn, 7.5% of total) and 21Shares ($2.2bn, 3.8% of total).

Average weekly net inflows were positive in December for the fourth month in a row. Inflows averaged $43.3mn, a decrease of 77.9% since November.

Price Performance

BTC-based products experienced losses over the last 30 days, ranging from -17% to -24% while ETH-based products saw losses ranging from -5% to -15%.

All products experienced negative losses over the last 30 days, with the worst performer being Grayscale's Litecoin (LTCN) product, with a 51% loss.

ETP News

November 29th

Invesco Enters Crypto ETP Space with Bitcoin Launch

November 30th

Grayscale Investments® Launches Grayscale Solana Trust

December 1st

21Shares Announces Listing of Polygon Crypto ETP on Euronext Paris and Amsterdam

December 7th

Bitcoin Capital and Ficas Team Up to Launch Crypto ETFs on Six

December 14th

21Shares Launches Mid-Cap Crypto ETP

December 17th

SEC Delays Decision on Grayscale and Bitwise Spot Bitcoin ETFs