In March, the price of Bitcoin fell by 0.25% while Ethereum rose 4.43% (data up to 24th March), marking a possible inflection point for Bitcoin and a definitive trend reversal for Ethereum.

Macro sentiment around risk-assets has been the leading narrative in the markets, with expectations of rate hikes sharing center stage with the military conflict in Ukraine. These events have resulted in mixed sentiment surrounding cryptocurrencies. As a result, digital asset investment products have experienced outflows throughout the month, averaging $9.9mn in March.

Access CryptoCompare's latest Digital Asset Management Review for all the latest insights.

Key takeaways:

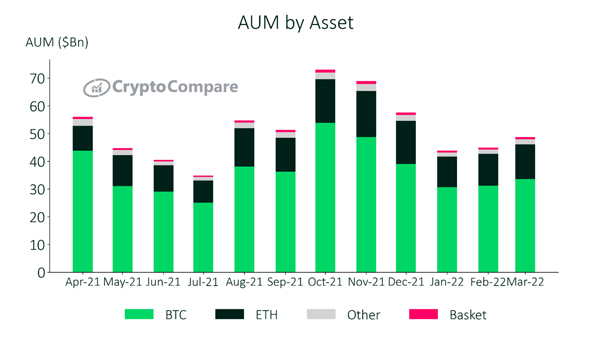

- Total aggregate AUM climbed 8.57% to $48.7bn in March, an 11.1% increase from the January lows of $43.9bn.

- Bitcoin and Ethereum backed products lagged behind others and basket, which saw the largest relative increase of 17.5% to $1.81bn and 9.46% to $773mn respectively.

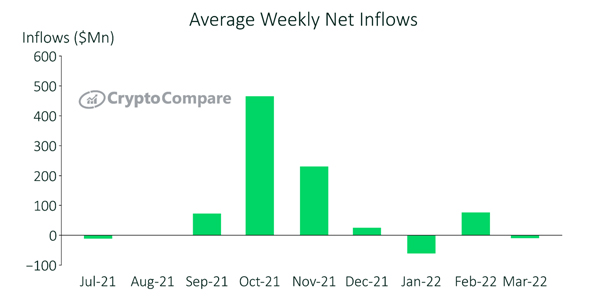

- Average weekly net inflows turned negative again in March, averaging $9.9mn, having reversed their downward trend for the first time in four months during February.

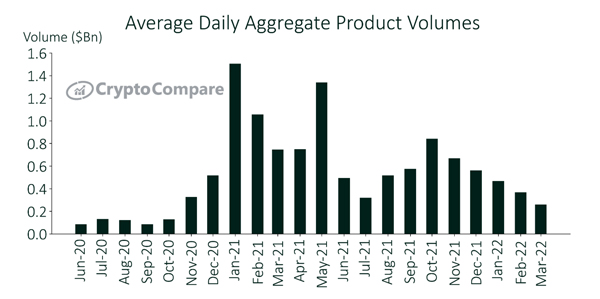

- Aggregate trading volumes fell 29.6% to $259mn in March. This was the fifth consecutive month in which trading volumes failed to break this downward trend.

AUM Continues To Recover From January Lows

Total aggregate AUM climbed 8.57% to $48.7bn in March, an 11.1% increase from the January lows of $43.9bn. Bitcoin and Ethereum backed products lagged behind others and basket, which saw the largest relative increase of 17.5% to $1.81bn and 9.46% to $773mn respectively.

Average Weekly Flows Turn Negative Again in March

Average weekly net inflows turned negative again in March, averaging $9.9mn, having reversed their downward trend for the first time in four months during February.

Product flows started the month with an inflow of $126.8mn (during the first week), however, the next two weeks saw a combined outflow of $156.5mn.

Trading Volumes Continue To Fall Despite Increase in AUM

Despite aggregate AUM increasing 8.57% to $48.7bn in March (as of the 23rd), average daily aggregate trading volume fell 29.6% to $259mn.

This was the fifth consecutive month in which trading volumes failed to break this trend. 3iQ’s Ethereum Product (QETH) saw the biggest fall of the month, dropping 61.1% to $892k.

|

|