In April, the price of Bitcoin and Ethereum fell by 16.3% and 14.4% respectively (data up to 27th April), a reversal following two months of positive returns for the two largest cryptocurrencies.

Macro sentiment around risk-assets has been the leading narrative in the markets, with the Fed’s hawkish behaviour, as well as the ongoing conflict in Ukraine, leading to increased levels of fear amongst market participants. Traditional risk-on assets like equities have also suffered in April, with the S&P 500 falling 7.96% in the same time period.

Access CryptoCompare's latest Digital Asset Management Review for all the latest insights.

Key takeaways:

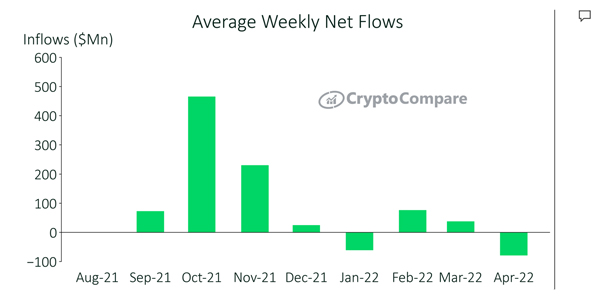

- Investors flooded out of crypto investment products in April, with average weekly outflows totaling $79.5mn. The largest recorded weekly outflow was the week ending April 8th with a total of $134mn leaving crypto-products. During this period, $132mn left Bitcoin products alone. April has seen the largest average weekly outflows in 2022 so far.

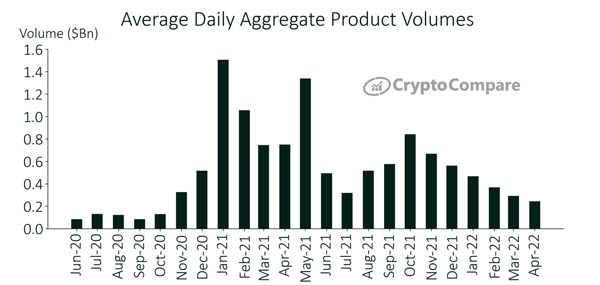

- Average daily trading volumes in April fell 16.3% to $244mn, recording six consecutive months of declining trading volumes. In total, volumes have fallen 71.0% since October 2021 ($841mn) and 83.8% since the all-time high reached in January 2021 ($1.51tn).

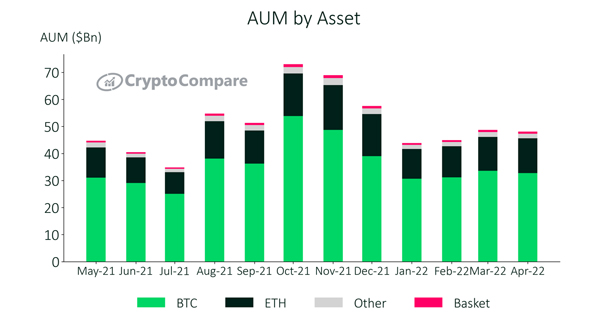

- Total aggregate AUMs across digital asset investment products fell marginally by 1.34% to $48.1bn from the end of March to the 27th of April. AUM has remained relatively stable so far this year – with March seeing the highest month-end AUM at $48.7bn. AUM reached a low of $43.9bn in January, a 10.0% difference.

- During the same time period in 2021 there was significantly more volatility amongst AUM, with a 38.7% difference between the lowest month-end AUM in January 2021 ($36.0bn) and the highest month-end AUM in March 2021 ($58.7bn).

AUMs Remain Stable in 2022

In April, Bitcoin’s AUM fell 2.51% to $32.7bn. There was no significant change in market share from March (now 68.1% of total AUM vs. 68.9% last month). Ethereum’s AUM rose 2.66% to $12.9bn while ‘Other’ and ‘Baskets’ AUM fell 7.22% to $1.68bn and 2.14% to $757mn, respectively.

April Experiences Largest Average Weekly Outflows in 2022

Average weekly net flows fell sharply negative in April. Weekly net flows averaged -$79.5mn, in comparison to average weekly inflows of $37.5mn in March.

Weekly outflows from Bitcoin-based products averaged $67.3mn in April. Multi-asset based products experienced the biggest inflows, averaging $4.23mn, followed by ‘Other’ based products at $1.67mn.

Trading Volumes Decline for a Sixth Straight Month

Aggregate daily volumes across all digital asset investment product types fell by an average of 16.3% from March to April. Average daily volumes now stand at $244mn.