Momentum returned to the markets in August, however, interest has been moving away from Bitcoin in the short term as Ethereum-based products continue to capture the attention of market participants with the merge on the horizon.

Ethereum products led the bounce-back in July and continued to outperform in August. AUM for Bitcoin-based products fell 7.16% to $17.4bn whilst Ethereum-based products saw gains of 2.36% to $6.81bn.

Download the full report for further insight into the digital asset industry.

Key takeaways:

- No Bitcoin products covered in this report saw AUM or volume gains in the month of August. We could be seeing interest move away from Bitcoin in the short term, as Ethereum-based products hold the attention with the much-anticipated merge on the horizon.

- Following the numerous high-profile crashes seen earlier this year, traders may be looking to diversify their crypto portfolio further to offer insurance against any more possible black swan events. This can be seen in the data, as products based on assets that come under the umbrella of ‘Other’ saw the largest AUM gains, rising 12.3% to $1.13bn.

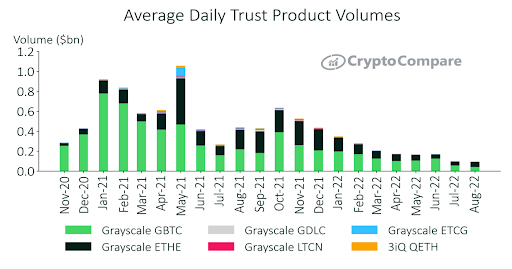

- For the first time since December 2021, Grayscale’s Bitcoin trust product (GBTC) lost its position as the most traded trust product. The average daily volume of the fund totaled $42.3mn (down 24.4%).

- Grayscale’s Ethereum trust took the top spot with an average daily volume of $48.7mn (up 23.2%). In contrast, traders appear to be more bearish on Bitcoin, as 3iQ’s Bitcoin product (QBTC) also saw average daily volumes fall, by 55.2% to $462k.

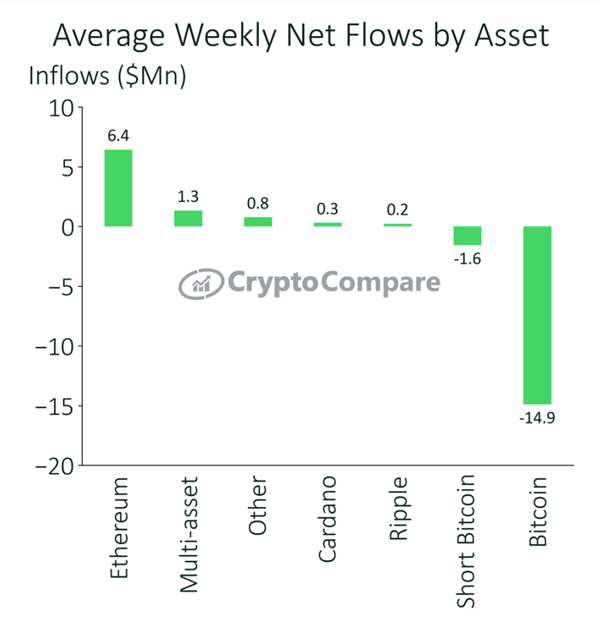

Weekly Ethereum Flows Outpace Bitcoin

Weekly outflows for Bitcoin-based products averaged $14.9mn in August. In contrast, Ethereum products recorded the largest weekly inflows of $6.4mn per week. Multi-asset-based products saw inflows averaging $1.3mn and other altcoins saw inflows of $800k.

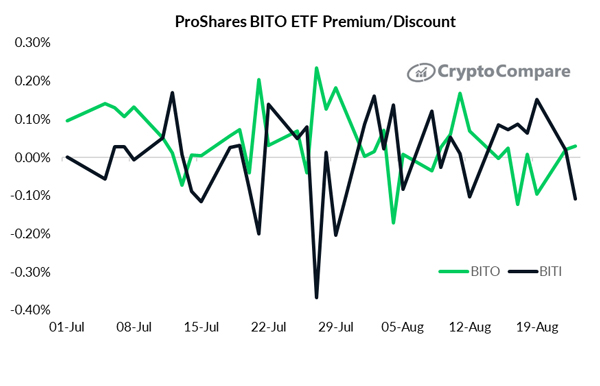

ProShares BITO ETF Premium/Discount

The BITO ETF traded at a discount for much of August, with a spike in premium coming around the middle of the month, suggesting traders were selling the ETF more than buying.

However, we can see that the BITI ETF traded at a premium for much of August, suggesting traders were looking to take a short strategy towards Bitcoin and therefore bearish sentiment prevailed.

Trading Volumes

For the first time since December 2021, Grayscale’s Bitcoin trust product (GBTC) lost its position as the most traded trust product. The average daily volume of the fund totalled $42.3mn (down 24.4%). Grayscale’s Ethereum trust took the top spot with an average daily volume of $48.7mn (up 23.2%).