Market integrity is a major concern within the digital asset industry, partly due to the immaturity of the sector and its decentralized and fragmented structure - something that has become even more abundant since the collapse of FTX.

CryptoCompare's latest research report, "Countering Market Abuse", sponsored by market surveillance firm, Eventus, delves into some of the abusive market practices that appear within cryptocurrency markets, including wash trading, spoofing, and front-running, whilst offering solutions that should be considered by the industry going forward.

Key findings from the report are summarised below. The full report can be accessed here.

Wash Trading on 'Exchange A'

Wash trading can be identified by assessing exchange market behaviours, including the correlation between volumes and volatility, and patterns in trade data. We analysed the volume-volatility correlation for over 100 exchanges, finding that 23 had a correlation of less than 0.1 over the past 100 days.

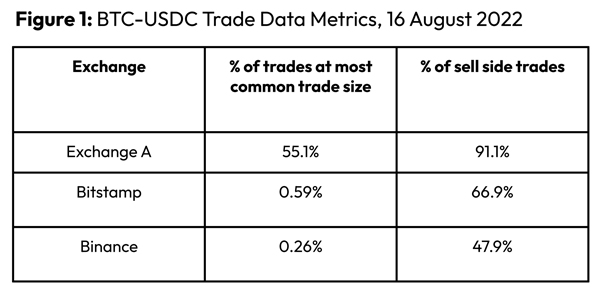

One exchange, "Exchange A," stood out as reporting suspiciously high volumes, with $2.5tn in August 2022, up from $33.8bn the previous month. An hour-long snapshot of BTC-USDC trading on Exchange A on August 16th showed unusual behaviour, with a majority of trades happening at a very small trade size and the majority of transactions being sell-side trades.

This suggests that the exchange may have been engaging in wash trading. When comparing this snapshot to other exchanges, the results are significantly different.

Identifying BTC-USDT Order Book Spoofing With CryptoCompare's API

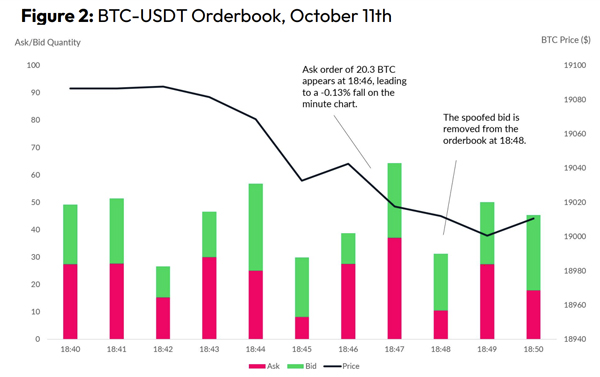

For the following analysis, we examined any orders above 20 BTC within 0.10% depth on an anonymous exchange.

On October 11, 18:00 - 19:00 GMT, the price of Bitcoin fluctuated within the $19,050 - $19,100 range. At 18:46, a trader placed an ask order of 20.8 BTC at a price level of $19,036 while BTC was trading at $19,043. Within a minute, the price of BTC fell 0.13% to $19,018. Order book data at 18:48 shows that the ask order was removed by the trader without being filled, therefore suggesting this could be an instance of spoofing.