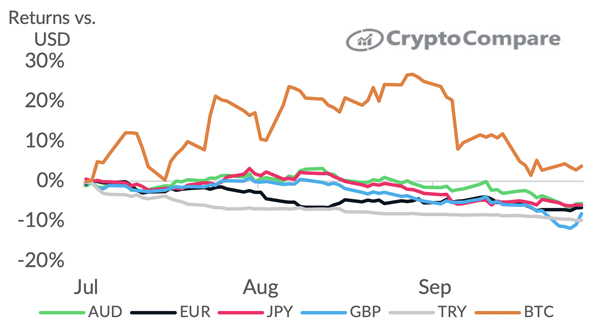

In September, both traditional and crypto markets saw a major fall as macroeconomic conditions continued their bearish sentiment. The total market capitalization for the four assets tracked has fallen 6.43% this month, reflecting the risk-averseness of the market after a spike in inflation figures and the increasing interest rates both in the US and the EU.

In September, BTC outperformed both the S&P500 and NASDAQ which saw negative returns of 9.34% and 10.5% respectively, its second month of negative returns in a row. ETH was the worst performer in September after the long-waited Merge proved to be a ‘buy the rumour, sell the news’ event.

Download the full report for further insight into the digital asset industry.

Key takeaways:

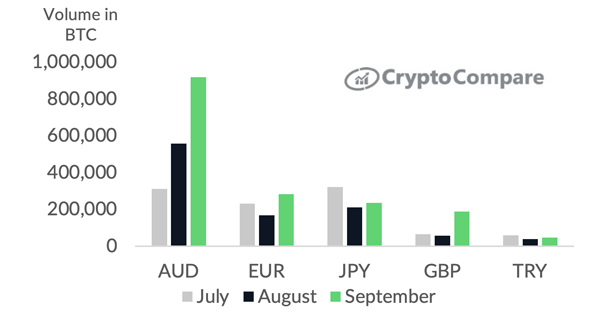

- As the global economy continues to reel from high inflation and the energy crisis, several currencies have seen their purchasing power and value decline against US Dollars. BTC trading volume against these has spiked in recent months, including the BTC-GBP pair, which rose 233% in September after the reserve currency fell to an all-time low of £1.03 against USD earlier.

- After the Merge, daily staked ETH has increased from an average of 11,650 ETH from 1st of August to September 15th to an average of 22,950 from September 15th to the end of the month, an increase of 97.0%.

- In September, SOL futures volumes across eight major exchanges declined 26.6%, the third month of consecutive declining activity in derivative markets. SOL futures volumes totalled $43.6bn in September, compared to $1.09tn, $932bn, and $25.0bn for BTC, ETH, and ADA respectively.

- The Vasil hard fork was hoped to ignite more activity in the Cardano chain, which has seen activity steadily decline over the last 6 months. The number of active users has decreased by 40.1% over a 6-month period from April to September, and 1.72% from August to September.

BTC Trading Volume Spikes Against Weakening Fiat Currencies

BTC trading volumes have spiked against certain FIAT currencies in recent months. For example, the BTC-GBP pair rose 233% in September after the reserve currency fell to an all-time low of £1.03 against USD earlier in the month.

BTC Trading Volume Against Weak Currencies

Several currencies worldwide have seen their value depreciate against USD due to rising inflation and poor macroeconomic conditions. Over the last three months, GBP, AUD, JPY, TRY, and EUR have all seen their price drop by 8.15%, 5.58%, 5.99%, 9.76%, and 6.61% against USD respectively. Bitcoin's price has risen 3.75% in the same period.

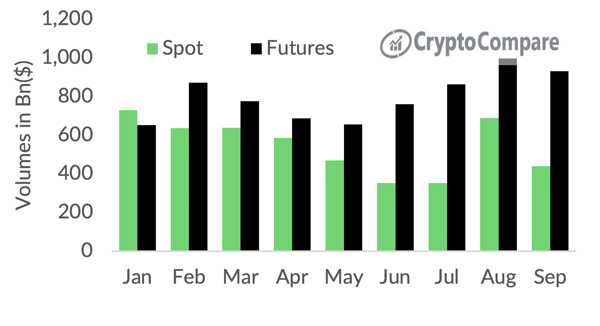

ETH Futures Volumes Continue to Outpace Spot

After the Merge, the price of Ethereum plummeted to $1,300 levels, trading below its 50-day moving average while volatility also increased. This led to a 36.2% decline in spot volumes to $439bn. Future volumes also saw a fall of 6.52% to $932bn, showing continued strength against spot markets.

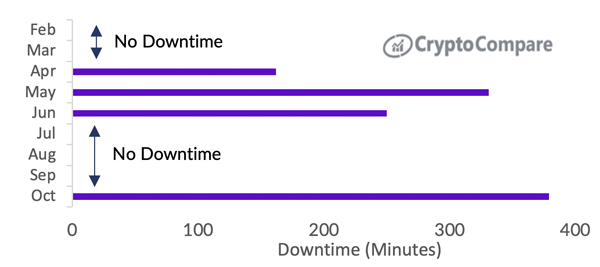

Solana Experiences Another Outage Lasting 6+ Hours

On October 1st, the Solana network experienced yet another outage, lasting 6 hours and 19 minutes, the longest single outage since January 22nd.

The Solana network has been heavily criticised for the constant outages it experiences. However, these are usually caused by high levels of activity which halt the Blockchain, typically relating to NFT or DeFi transactions.

Solana Network Downtime, Minutes

.jpg)