Both traditional and crypto markets had positive movements in March. Bitcoin and stock indices moved very tightly this month, with returns of 5.4%, 5.2%, and 5.1% for BTC, S&P500 and Nasdaq, respectively.

Solana was the biggest gainer in March following a 18.4% price increase to $123. No crypto assets saw negative returns, and all five saw reduced volatility from February, ranging from a high of 81.8% (SOL) to a low of 62.1% (ETH), edging ever closer to Nasdaq's volatility of 39.2%.

Access our latest Asset Report for all the latest insights.

Key takeaways:

- Solana’s price rose 23.2% in March, reaching $123 at month end, after previously falling to $99.8 at the end of February. This is the first time Solana has seen double digit return since October 2021 and the first time it has broken its 50-day moving average in 2022.

- Total fees paid on the blockchain broke a four-month downward trend, increasing 18.3% to $15.2mn. This was coupled with an average fee per transaction increase of $1.84 to $1.91. Monthly transaction on the blockchain also increased from February to March, reaching 7.98mn – the highest month we’ve seen on Bitcoin in 2022.

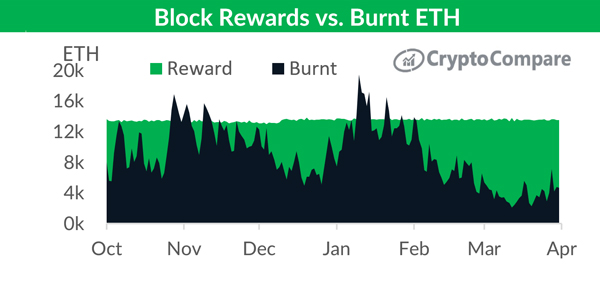

- For the second consecutive month, Ethereum fees have continued to fall, this time sharply declining 37% down to a total of $424mn, following the 12month record fall of 46.7% which occurred the month prior. Low fees resulted in less ETH being burnt, as a result, the network was inflationary for the whole month.

- Cardano ended the month at $1.19, the first time in six months the cryptocurrency closed the month with a positive return, up 18.4%.

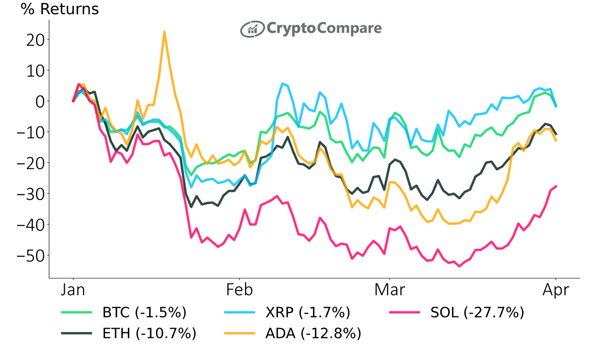

Majority Of Digital Assets Significantly Down Over 3 Month Period

Over the last three months, both BTC and XRP have almost recouped their losses, with returns of -1.5% and 1.7% respectively. All other assets are still significantly down, with SOL down the most, recording a three-month loss of -27.7%.

Ethereum Fees Fall Below $1bn

For the second consecutive month, Ethereum fees have continued to fall, this time sharply declining 37% down to a total of $424mn, following the 12month record fall of 46.7% which occurred the month prior. Low fees resulted in less ETH being burnt, as a result, the network was inflationary for the whole month.

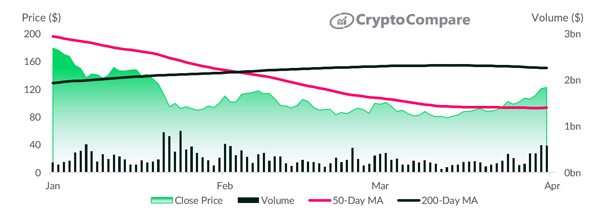

Solana Leads In March Reaching Double Digit Returns

Solana’s price rose 23.2% in March, reaching $123 at month end, after previously falling to $99.8 at the end of February. This is the first time Solana has seen double digit return since October 2021 and the first time it has broken its 50-day moving average in 2022.