Over the last three months, all covered digital assets lost approximately a third of their value as the cryptocurrency space continued to be marred by high-profile contagion events. Over this period, ADA was the best performing asset, returning -31.7%.

Market sentiment shifted in July, however, with both traditional and digital asset markets rebounding. Ethereum was the best performing high-profile asset by a considerable margin, returning 57% month on month as anticipation for the merge continues to build.

Download the full report for further insight into the digital asset industry.

Key takeaways:

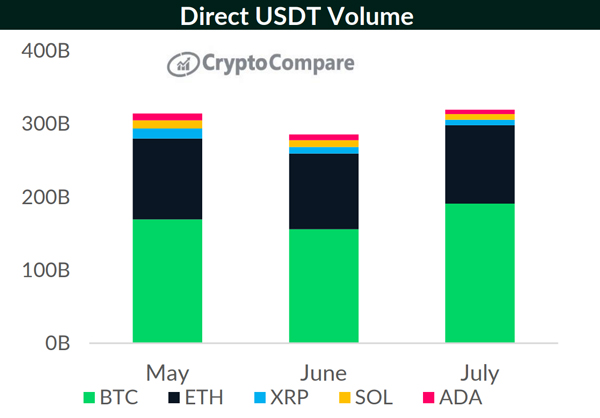

- In July, total USDT volumes across the five assets grew by 22.7% to $319bn. Interestingly, USDT volumes increased for just BTC and ETH, suggesting market participants are tilting towards these assets, which are deemed safer within the crypto landscape.

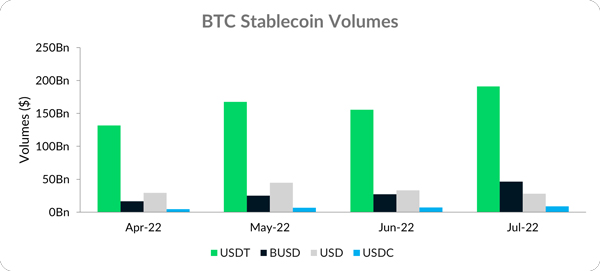

- Binance USD (BUSD) saw its volumes spike in July. BTC/BUSD and ETH/BUSD volumes saw a significant increase, surpassing USD volumes in the month. Over this period, BTC/BUSD volumes increased 69.2% to $46.4bn, while ETH/BUSD volumes rose 10.3% to $23.0bn.

- ETH’s price rose 57.0% in July to $1,680, closing the month with a market capitalization of $205bn. Total Value Locked in Ethereum DeFi also increased, rising 24.0% to $57.9bn, mainly attributed to ETH’s increase in price.

- Total fees incurred for all transactions in the Ethereum network continued to decline despite an increase in network activity, falling by 47.6% to $108mn in July and recording its lowest figure in over a year.

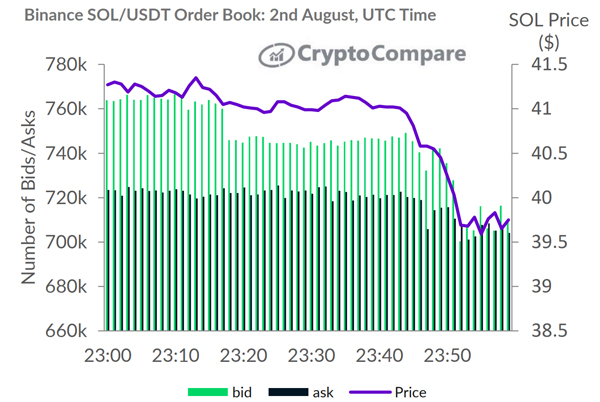

- Following the recent Solana wallet exploit, the SOL price dropped from a high of $42.43 to a low of $37,48, a fall of 11.6%. Our Order Book data clearly visualises the decline in bids immediately after the hack – with bids on the Binance SOL/USDT pair falling 7.1% from 764k bids to 709k in the hour following the hack.

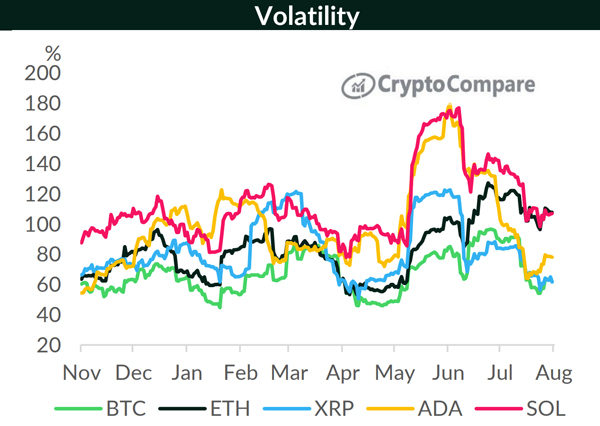

Crypto Volatility Continues To Decline

Volatility across cryptocurrency markets continued to decline in July from the high levels since in May. ETH and SOL were the most volatile assets with a 30-day volatility of 108% and 107% respectively. This contrasts with XRP and BTC, which had the lowest volatilities out of the assets investigated, at 61.8% and 62.1% respectively.

USDT Volumes Rose 22.7% In July To $319bn

In July, total USDT volumes across the five assets grew by 22.7% to $319bn. Interestingly, USDT volumes increased for just BTC and ETH, suggesting market participants are tilting towards these assets, which are deemed safer within the crypto landscape.

Binance USD Volumes Spike in July

Binance USD (BUSD) saw its volumes spike in July. BTC/BUSD and ETH/BUSD volumes saw a significant increase, surpassing USD volumes in the month. Over this period, BTC/BUSD volumes increased 69.2% to $46.4bn, while ETH/BUSD volumes rose 10.3% to $23.0bn.

Solana Declines 11.6% Following Wallet Exploit

On the 2nd of August, approximately 8,000 Solana wallets faced an attack that drained millions of dollars worth of SOL & USDC tokens from users' wallets.

Following the event, the SOL price dropped from a high of $42.43 to a low of $37,48, a fall of 11.6%. Our Order Book data clearly visualises the decline in bids immediately after the hack – with bids on the Binance SOL/USDT pair falling 7.1% from 764k bids to 709k in the hour following the hack.