In February, traditional and crypto markets reverted from the positive performance seen during the first month of the year, with equity indices falling between 3 - 4%. While BTC and ETH saw marginal positive returns, assets further down the risk curve (such as ADA and SOL) saw negative performance throughout the month.

The full report is accessible here.

Key takeaways:

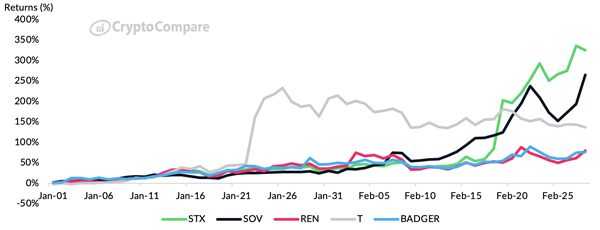

- With the launch of Bitcoin Ordinals in January, there has been an increased spotlight on the Bitcoin ecosystem and associated tokens. This has led to a rally in many such tokens, including Stacks.

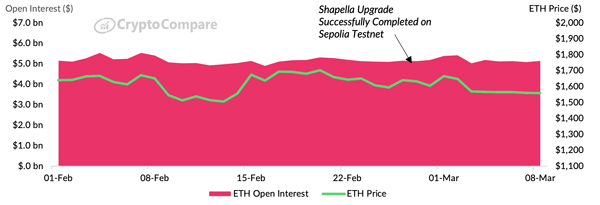

- In February, Ethereum experienced limited variation in both open interest and price, with both staying relatively stable. Ethereum recorded a 1.21% return, while open interest witnessed a minor growth of 4.53% in February.

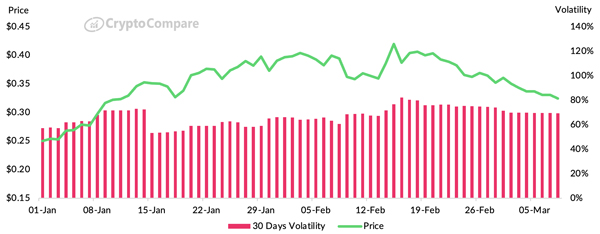

- In February, Cardano (ADA) recorded a negative return of 9.84%, fuelled by the recent development in the macro-environment that led to a 12.1% increase in volatility during the month. Average daily volumes also witnessed a sharp decline of 24.2% compared to January.

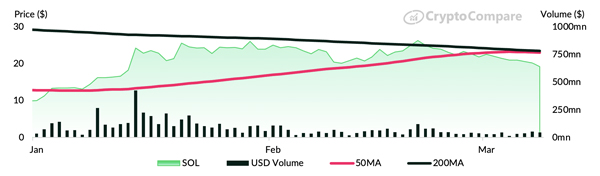

- Over the last 3 months, SOL has outperformed other covered assets, returning 54.6%. Despite the negative performance in February, SOL is still up 120% year-to-date. This is followed by BTC, ETH and ADA, which have returned 34.8%, 23.9%, and 10.3%, respectively, over the last three months.

Bitcoin Associated Tokens Rally Amid Ordinals Hype

Bitcoin Ordinals in January boosted attention on Bitcoin ecosystem tokens, causing a surge in Stacks and other assets. Stacks, a Bitcoin layer 2 for dApps and smart contracts, has seen its price increase 325% since January.

Other notable performers, including Sovryn, Threshold Network, and REN have recorded impressive year-to-date returns of 265%, 136%, and 79.8%, respectively as of February.

Rallying Bitcoin-Associated Tokens Amidst Ordinals Hype

Ethereum Latest Developments

In February, Ethereum experienced limited variation in both open Interest and price, with both staying relatively stable. Ethereum recorded a 1.21% return, while open interest witnessed a minor growth of 4.53% in February.

On the development side, Ethereum made significant progress with the Shapella Upgrade and EIP 4337. The Shapella upgrade was successfully launched on the Sepolia testnet and is expected to launch on Goerli on March 14th.

Ethereum Open Interest & ETH Price

SOL Struggles to Surpass Moving Average Levels

During the month of February, SOL briefly surpassed its 200-day moving average on February 20-21 for the first time since January 2022, when it was priced at $141. However, it dropped 12.4% to close the month at $21.88, ending below its 50-day moving average. Despite this, SOL remains one of the best performers of 2023, with a 120% increase year-to-date as of the end of February.

SOL Fails to Break Above Moving Average Levels

Cardano's ADA Struggles to Maintain Momentum

In February, Cardano (ADA) recorded a negative return of 9.84%, fuelled by the recent development in the macro-environment that led to a 12.1% increase in volatility during the month.

Average daily volumes also witnessed a sharp decline of 24.2% compared to January. The decline in price (trading at $0.34 at the time of writing) also led to a drop in Cardano’s market capitalisation, falling 9.64% to $12.2bn at the end of February.

Cardano's ADA Loses Momentum

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.