Both traditional and crypto markets had mixed movements in February. Interestingly, the relationship between equities and crypto markets, which have been strongly correlated over the last few months, looked to decouple as most digital assets recorded positive returns in February, whilst equity indices experienced a decline in February.

Access CryptoCompare's latest Asset Report for all the latest insights.

Key takeaways:

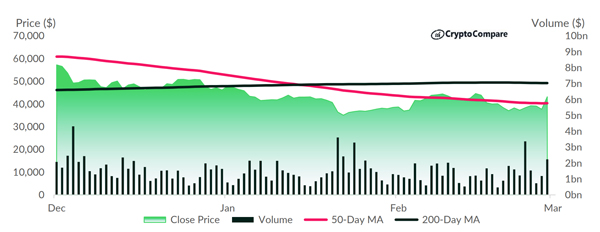

- Bitcoin’s price rose 12.2% in February, breaking a three-month trend of consecutive losses. The increase, which was concentrated on the 28th of February, saw Bitcoin break its 50-day MA and close the month at $40,329.

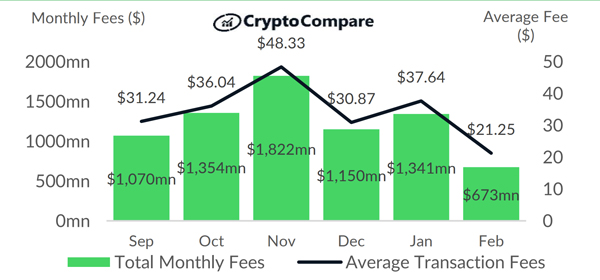

- Transaction fees incurred on the Ethereum network decreased by 46.7% to $715mn in February, the largest monthly fall recorded in the last 12 months. It is the first time monthly fees have fallen below $1bn since August 2021, when total fees reached $685mn

- The number of holders (wallets that have held ADA for more than a year) grew 32.1% to reach an all-time high of 408k in February, while the number of cruisers (wallets holding ADA for 1 month – 12 months) grew 13.4% to 3.62mn.

- Solend, a decentralized protocol for lending and borrowing rose 7.94% to reach a TVL of $583mn, making it the 5th largest protocol on the Solana ecosystem.

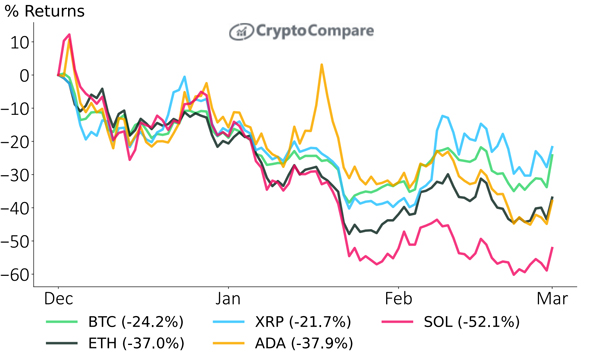

Three Month Returns Slump To Losses of More Than 20%

Three-month returns have now slumped to losses of more than 22.0% for all five assets, the most significant being SOL, recording a three-month performance of -52.1%. This was followed by ADA with -37.9% and ETH with -37.0%

Bitcoin Sees Positive Returns After 3 Months of Consecutive Losses

Bitcoin’s price rose 12.2% in February to $43,189, reaching a market capitalization of $824bn at the end of the month. This broke three consecutive months of losses for the largest cryptocurrency. Despite this, monthly volumes across the two largest markets (BTC/USDT and BTC/USD) fell 14.4% to $113bn and 15.6% to $38.5bn respectively.

Ethereum Fees Fall Below $1bn

In February fees spent on the Ethereum network declined after increasing the month before, as total fees paid fell 49.8% to $673mn. Average fee per transaction also fell by 43.5% to $21.25.