The digital asset markets continued to decline in December, however, volatility waned compared to the month prior. Bitcoin closed the year down 64.2%, its second worse annual performance in its 13-year history. December also saw significantly lower volumes than the months prior, with Bitcoin recording a 42.6% month-on-month decline in USDT volumes across centralised exchanges.

The full report is accessible here.

Key takeaways:

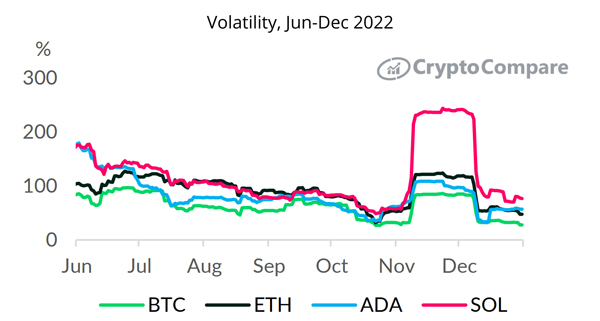

- Volatility returned to normal in December, after soaring to record-breaking highs in November. BTC was the least volatile asset during this period, closing the year with a 27.9% 30-day volatility, marginally above its annual low of 26.8%.

- In December, volumes declined by the largest amount in over a year. Most notably, SOL-USDT volumes fell 80.6% to $1.42bn from November, while BTC-USDT and ETH-USDT volumes also fell 42.6% and 57.0%, respectively, to $114bn and $24.9bn.

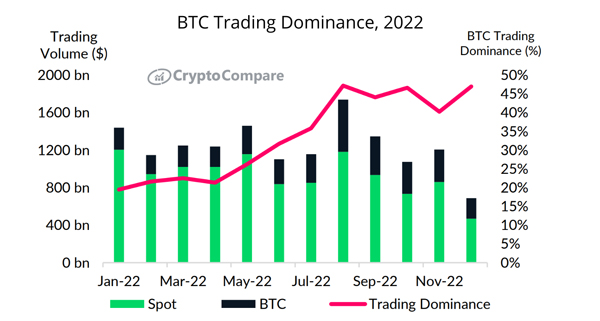

- Bitcoin trading volume represented 47.0% of the total spot volume on centralised exchanges in December, the second-highest dominance this year, 0.20% behind the market share in August. The low downside volatility and the stronger relative performance of Bitcoin against other cryptocurrencies has made it the preferred asset for traders and investors this

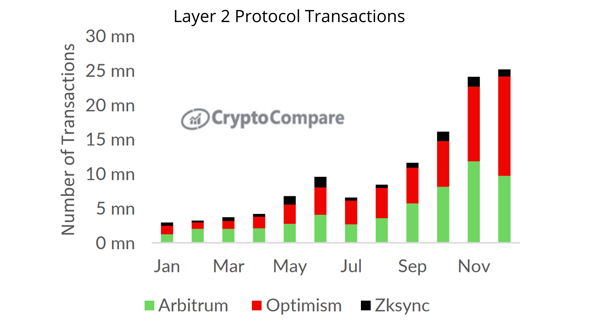

- In December, the number of daily transactions on some of the top layer 2 protocols saw an increase of 4.43%, with a significant 758% year-on-year increase in 2022.

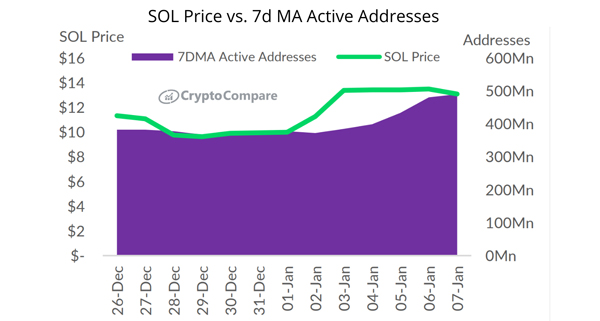

- Solana’s ecosystem has started the year positively, with an increase in the 7-day average active addresses from 378.2mn at the end of the year to 490.5mn as of the 7th of Jan – a 29.7% increase. This can partly be attributed to increased activity from the airdrop of BONK to Solana NFT holders.

- Cardano ended the year 2022 at $0.25, falling 81.2% from the start of the year. This recorded the second largest drawdown in its history, behind the 94.3% drop during the 2018 bear market, when Cardano fell from $0.71 to $0.04. This also marked the third decline in yearly performance for the asset in its history.

Volatility Wanes in December After November Highs

Digital assets continued their downward trajectory in December, albeit with significantly less volatility than the month prior. In December, volatility returned to normal levels after soaring to record-breaking highs in November. BTC was the least volatile asset during this period, closing the year with a 27.9% 30-day volatility, marginally above its annual low of 26.8%.

BTC Trading Dominance Nears Yearly Highs

Bitcoin trading volume represented 47.0% of the total spot volume on centralised exchanges in December, the second-highest dominance this year, 0.20% behind the market share in August. In 2022, the price of bitcoin fell 64.2% to $16,531, recording its second-largest yearly decline in its history.

However, the low downside volatility and the stronger relative performance of Bitcoin against other cryptocurrencies has made it the preferred asset for traders and investors this year.

Layer 2 Protocols Continues to Grow

In 2022, the layer 2 protocol ecosystem experienced significant growth due to the increased adoption of rollups and the improved robustness of ZKproofs. In December, the number of daily transactions on some of the top layer 2 protocols saw an increase of 4.43%, with a significant 758% year-on-year increase in 2022.

This growth was also reflected on layer 2 token prices, with Optimism’s OP recording 53.4% annual returns: the second-best return for any crypto asset in 2022.

Solana’s Increase in Active Addresses in January

Solana’s ecosystem has started the year positively, with an increase in the 7-day average active addresses from 378.2mn at the end of the year to 490.5mn as of the 7th of Jan – a 29.7% increase.

This can be attributed to both the increased activity from the airdrop of BONK to Solana NFT holders as well as a sense of optimism on the network, following Vitalik’s aforementioned support and continued developer activity.