The majority of digital asset markets were outperformed by traditional assets in December following a market-wide decline. ETH's price retreated the most (-20.6% to $3,676) - reflecting the wider financial uncertainty associated with Omicron and its effect on inflation.

Despite the recent market movements, the top cryptocurrencies by market capitalization saw strong returns in 2021, all returning over 50%.

This is well above competing, traditional assets such as Gold, which had negative returns of 3.8% in 2021. Similarly, the stock indices S&P500 and NASDAQ 100 returned just 26.9% and 21.4.7% in 2021.

However, with higher returns comes significantly higher volatility – in December, the investigated crypto assets had volatilities between 65.3% (BTC) and 112% (ADA), compared to just 20.6% and 28.8% for the aforementioned traditional assets.

Download CryptoCompare's Asset Report for all the latest insight.

Key takeaways:

- The number of addresses holding ETH grew 3.9% to an all-time high of 68.8mn in December. Traders (addresses holding the asset for less than 1 month) fell 10.7% to 4.64mn.

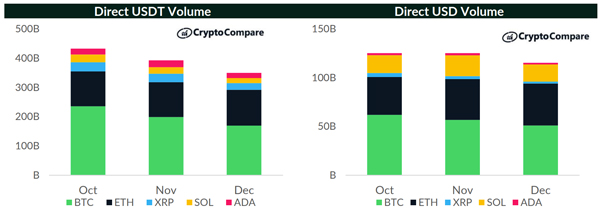

- December USDT and USD volumes fell across all top 5 assets except ETH, which rose 2.7% and 2.5% respectively to $122bn and $43.0bn. ADA volumes saw the largest fall across both markets, with a 25% and 27% decline to $17.4bn and $1.67bn respectively.

- In December, TVL in DeFi fell to $153bn and $11.2bn for ETH and SOL respectively (-13.8% and -22.4% decrease from November)

- Total fees incurred for all transactions in the Ethereum network fell for the first time in six months, with a 36.9% decline to $1.15bn. This comes to an average transaction fee of $30.87.

USDT & USD Volumes Fall Across Top 5 Digital Assets Except ETH

December USDT and USD volumes fell across all top 5 assets except ETH, which rose 2.7% and 2.5% respectively to $122bn and $43.0bn. ADA volumes saw the largest fall across both markets, with a 25% and 27% decline to $17.4bn and $1.67bn respectively.

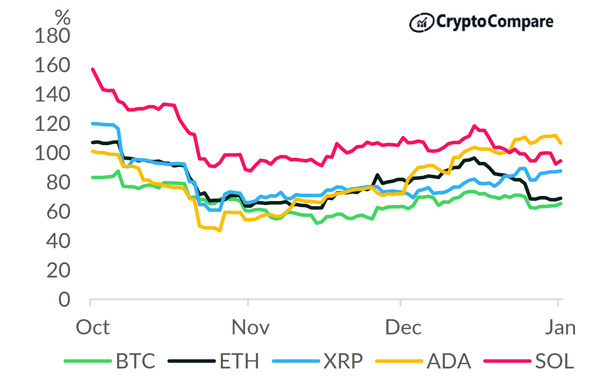

Top 5 Digital Asset Volatility Increases In December

Volatility across the top 5 assets generally increased over the month of December. BTC became the least volatile asset at 65.3%. ADA became the most volatile asset at 112%, which is notably higher than its low of 54% in October.

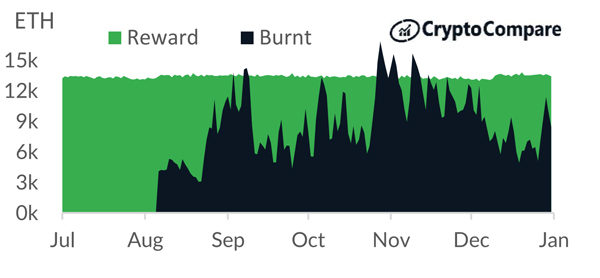

Ethereum Experiences No Deflationary Days in December

Ethereum was inflationary for the whole month of December, as the network burnt a daily average of 7.98k ETH throughout the month, (down 33.9%). This was compared to average daily rewards of 13.4k ETH (1.0% monthly increase).