CryptoCompare's Asset Report has been reformed to include only the most important insights on 4 of the largest layer-1 blockchains based on CryptoCompare data.

This includes information on price action, volumes, transactions and fees, mining activities, risk metrics, and more. Included in the report is a brief comparison to traditional asset classes (Gold and Equities) to gauge crypto’s potential role in a diversified portfolio.

Download the full report for further insight into the digital asset industry.

Key takeaways:

- In August, Bitcoin miners continued their selling activity, recording a net flow of -21.3k BTC. This was the fourth consecutive month that has seen negative miner net flows, with April being the only month this year where miners have accumulated BTC.

- Network activity on the Bitcoin blockchain saw a slight recovery in August, with transaction volume rising 10.5% to $2.39tn. The number of active addresses also increased 4.47% to 916k, while the number of new addresses rose 3.10% to 395k.

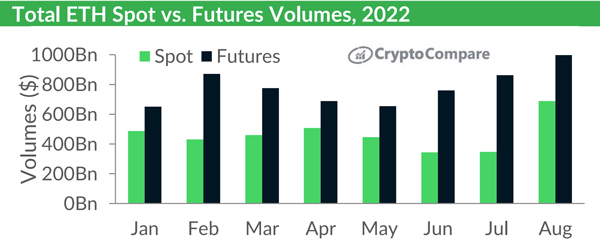

- ETH futures volumes have consistently surpassed spot volumes in 2022. Throughout August, $997mn worth of futures were traded, compared to $689mn in spot markets.

- August 2022 was the first month in 2022 where total monthly fees accumulated by the Ethereum network fell under $100mn. The fall in fees illustrates the lack of activity during this bear market, however, it is surprising to see activity fall in the month prior to The Merge – the total number of transactions fell by 6.23% to 33.5mn.

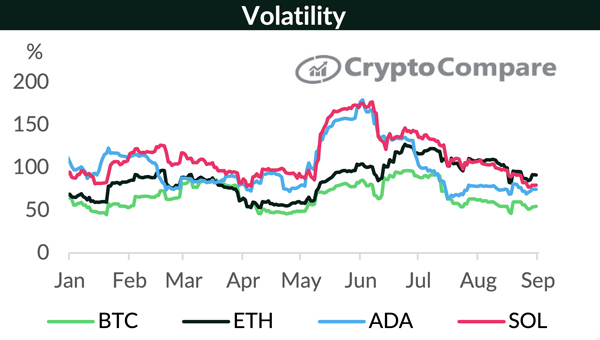

Crypto Volatility Continues To Decline

Volatility across cryptocurrency markets continued to decline in August from the highs reached in May. Ethereum and Solana were the most volatile assets, with 30-day volatility of 91.4% and 79.4% respectively. Bitcoin’s volatility fell below 50.0% for only the third time this year, before rising slightly and closing the month at a 54.6% volatility.

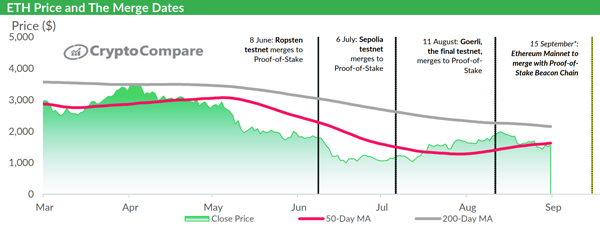

ETH Price and The Merge Dates

‘The Merge’ has been one of the leading narratives in the digital asset space over the last few months. After various postponements, The Merge was officially tested on Ethereum in June, when the Ropsten testnet officially transitioned to a Proof-of-Stake (PoS) system.

In the following months, the Sepolia and Goerli testnets also merged to PoS, leaving just the final Ethereum Mainnet to complete the transition to PoS. It is anticipated that this will take place on the 15th of September.

Total ETH Spot vs. Futures Volumes, 2022

In 2022, ETH futures volumes have consistently surpassed spot volumes. In the month of August, $997mn worth of futures were traded, compared to $689mn in spot markets.

Futures products are typically used for speculation as compared to spot. The relative strength of futures volumes illustrates the speculative trading activity in ETH markets.

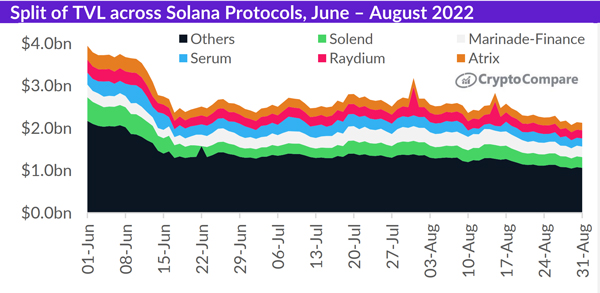

Protocol TVL Dominance On Solana Rises to Almost 50%

Total Value Locked (TVL) in the Solana blockchain has trended downwards in USD terms as cryptocurrency prices continue to fall. TVL has fallen 45.9% from $3.94bn to $2.13bn in the past three months.

However, the dominance of the five largest protocols has risen over this period, hitting a peak of 51.6% on the 9th of August. Solana benefits from a well-diversified set of DeFi applications ranging from DEXes to Lending, Liquid Staking, and Yield services.