In June, the price of Bitcoin and Ethereum fell by 34.8% and 38.6% respectively (data up to 27th), a large decline that was driven by the uncertainties surrounding the possible insolvency of crypto lending companies, including the crypto native fund, Three Arrows Capital, which reportedly defaulted on a $670 million loan from digital asset brokerage Voyager Digital

Macro sentiment around risk assets continues to lead the narrative in the markets, with the Federal Reserve raising interest rates by 0.75% – the largest hike since 1994. This hawkishness has been reflected in the falling AUM of crypto products this month.

Download the full report for further insight into the digital asset industry.

Key takeaways:

- Crypto investment products AUM reached record lows in June, with the AUM of all major crypto investment product types falling sharply. ETFs experienced the largest drop, declining 52.0% to $1.31bn. Trust products, which have a market share of 80.3%, fell 35.8% to $17.3bn in June, while ETCs and ETNs fell 36.7% and 30.6% to $1.34bn and $1.61bn respectively.

- Weekly outflows for Bitcoin-based products averaged an all-time high record of $161mn in June, while Ethereum experienced significant average outflows of $33.2mn per week. Short Bitcoin products recorded the largest weekly inflows during June with an average of $3.10mn. Multi-asset-based products saw inflows averaging $2.13mn, but all other altcoins saw inflows of $330k weekly.

- Purpose and CoinShares funds recorded the largest outflow in BTC and ETH in June. The Purpose Bitcoin ETF (BTCC) sold 18,170 BTC while 3iQ CoinShares Bitcoin ETF (BTCQ) saw 7,384 BTC flow out of the fund (as of 24th June). Overall, the two registered drops of 56.7% and 57.1% in AUM in June, respectively.

- In June, all digital investment products saw a decline in AUM, except for 21Shares Short Bitcoin ETP (SBTC). The product, designed to provide inverse exposure to Bitcoin’s performance, recorded a 1.30% rise in AUM from May. The ETP currently has an AUM of $16.5mn, which is an all-time high for the product. It was also the only product that registered a positive 30-day return (30.8%) as of 23rd June

Bitcoin Continues To Gain Market Share Despite Falling AUM

In June, Bitcoin’s AUM fell 33.7% to $15.9bn, however, it continued to gain market share, currently at 73.6% of total AUM, up from 70.1% in May. Ethereum’s AUM dropped 46.7% to $4.54bn while ‘Other’ and ‘Baskets’ AUM fell 30.0% to $823mn and 33.6% to $337mn, respectively.

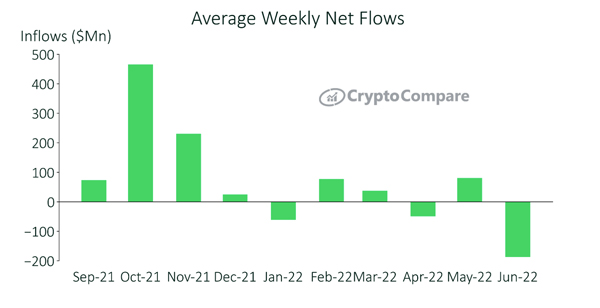

Average Weekly Net Outflows Reach All-time High

Following a widespread decline in price, average weekly net flows were negative in June (as of the 28th). Weekly net outflows recorded an all-time high average of $188mn compared to average weekly inflows of $80.0mn in May.

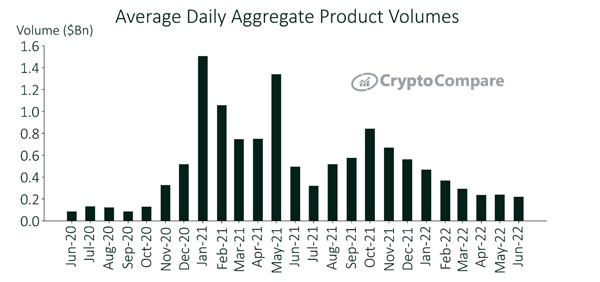

Digital Asset Investment Products Average Lowest Daily Volumes Since November 2020

Average daily volumes across all digital asset investment products fell by an average of 7.16% to $221mn from May to June. This is the lowest average daily volume recorded since November 2020.