In addition to our usual monthly Exchange Review, we wanted to provide some context to the incredible rally the digital asset markets have seen in 2021. Bitcoin reached the $40,000 milestone yesterday and after a brief pullback to $38,000, it's back over $40,000 and is climbing towards the next significant psychological milestone of $50,000.

This rally has been supported by record trading activity:

Below are some of the key highlights from our December Exchange Review.

Key Highlights

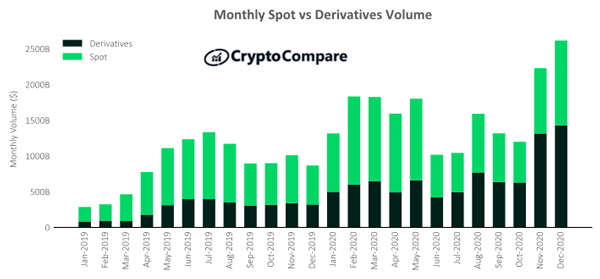

Derivatives Volumes Reach All-Time Monthly High

Derivatives volumes increased 8.6% in December to an all-time monthly high of $1.43tn. Meanwhile, total spot volumes increased by 30% to $1.19tn. The derivatives market now represents almost 54.6% of the total crypto market (vs 60% in November).

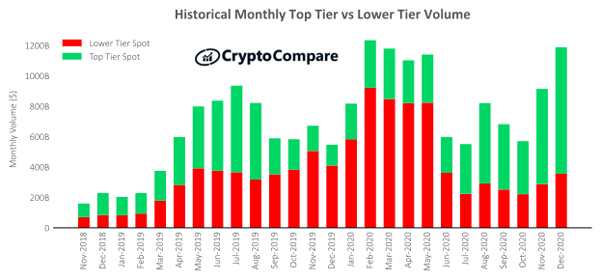

Top-Tier Spot Exchanges Gain Market Share and Set Daily Volume Record

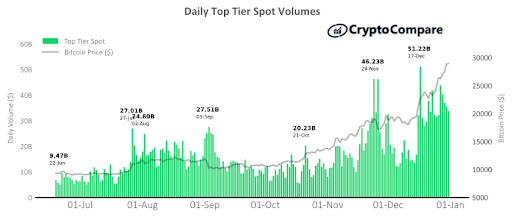

In December, Top-Tier volumes increased 32.2% to $818.3bn while Lower-Tier volumes increased 23.8% to $355.7bn. Top-Tier exchanges now represent 69.7% of total volume (vs 68.29% in November).

Top-Tier exchanges also traded a daily maximum of $51.2bn on December 17th, which represents a new all-time high. The previous record occurred last month where $46.2bn was traded on November 24th.

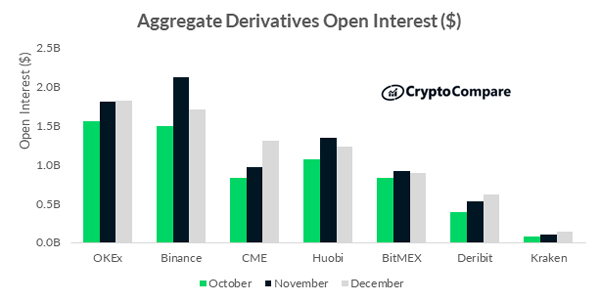

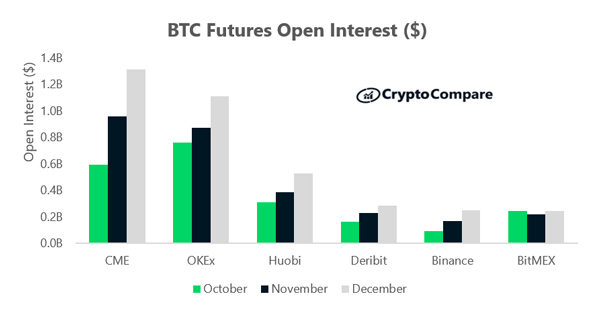

CME Had the Highest BTC Futures Open Interest in December

CME had the highest open interest for BTC futures at $1.31bn (up 36.5%) followed by OKEx at $1.11bn (up 27.6%).

However, on aggregate across all futures products, OKEx had the highest open interest of $1.8bn (up 0.6% vs November). This was followed by Binance ($1.7bn, down 20%) and CME ($1.3bn, up 36.5%).