CryptoCompare is delighted to announce the release of its latest Outlook Report, reflecting on the state of the digital asset markets in Q3, whilst looking forward to Q4 and beyond.

The third quarter of the year has been led by a macroeconomic narrative of high inflation and increasing interest rates that have encouraged reduced risk-taking among market participants. As a result of this, digital assets have failed to act as an inflation hedge, seeing negative returns that are heavily reactive to macroeconomic data.

This report aims to capture, explain, and analyse these events and put into context what they might mean for cryptocurrencies over the next quarter and beyond. We cover macroeconomics, stablecoins, DeFi and more.

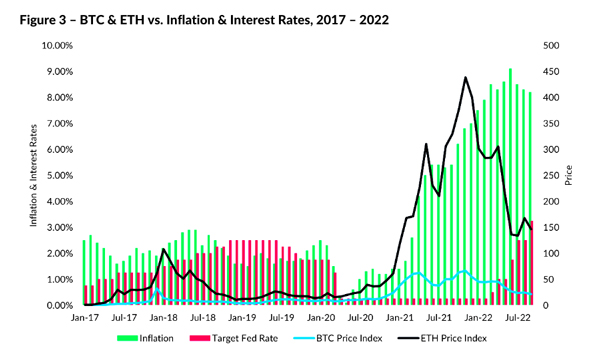

- Bitcoin and cryptocurrencies have so far failed to act as an inflation hedge, a long-proposed narrative by digital asset natives. In 2022, BTC and ETH have performed inversely to inflation and nominal interest rates.

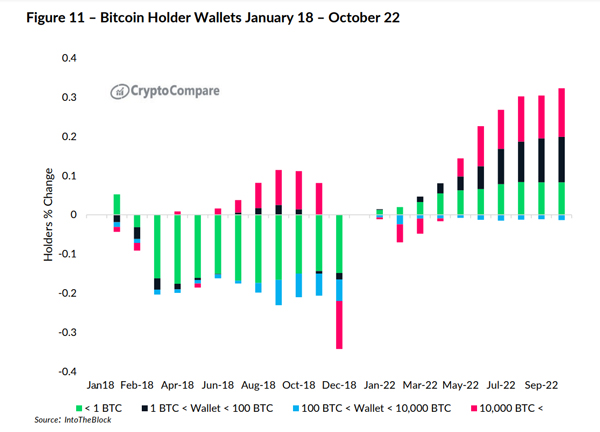

- As opposed to the last bear market, where all holders across different wallet sizes were panic-selling, in this bear market, we have seen a consistent accumulation in almost all accounts. Accounts above 10,000 Bitcoins have seen an increase which is likely due to increased institutional adoption.

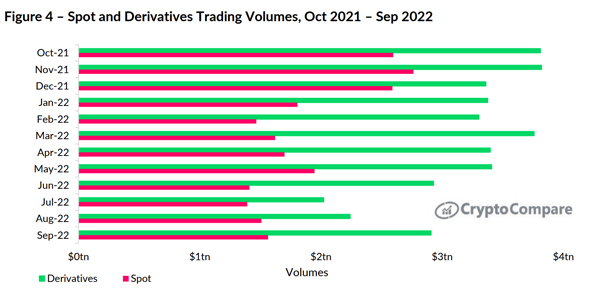

- Derivative futures volumes have not seen as much of a decline as spot volumes during this bear market – futures volumes have fallen 23.8% to $2.91tn since peak volumes in November 2021, compared to a 43.4% decline in spot markets to $1.56tn. Given the high amount of speculation in digital asset markets, it is unsurprising that derivatives have not seen as much of a decline as spot volumes.

- Lower volumes were a prevailing narrative in previous bear markets, with the industry's future being questioned due to low activity. The average daily volume during the last bear market (2017) was $12bn, while current average daily volumes stand at $78bn, an increase of 546%.

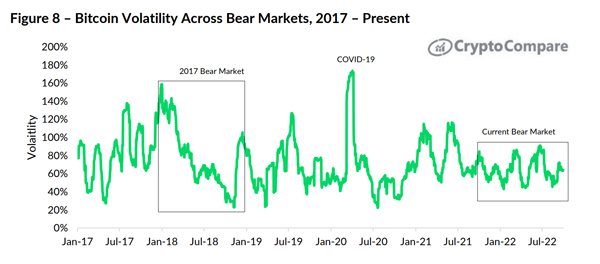

- Bitcoin's volatility has been steadily stabilising in a bounded range compared to the last bear market. During the last bear market, the average annualised volatility for BTC was 79%, whilst the current average volatility is 63%.

Bitcoin & Cryptocurrencies Have So Far Failed To Act As Inflation Hedge

Bitcoin and cryptocurrencies have so far failed to act as an inflation hedge, a long-proposed narrative by digital asset natives. In 2022, BTC and ETH have performed inversely to inflation and nominal interest rates, as highlighted by the following figure.

Digital Asset Derivative Volumes Dominant vs Spot Markets

Holders of cryptocurrencies are placing increased importance on their characteristics as a risk-asset over their property as a finite-supply asset that could act as a hedge against inflation. This is unsurprising, given the high amount of speculation in digital asset markets.

Speculation is the primary reason why derivative futures volumes have not seen as much of a decline as spot volumes across markets during this bear market – futures volumes have fallen 23.8% to $2.91tn since peak volumes in November 2021, compared to a 43.4% decline in spot markets to $1.56tn.

Bitcoin Volatility Stabilises Compared To Previous Bear Markets

Bitcoin's volatility has been steadily stabilising in a bounded range compared to the last bear market. While this may suggest cryptocurrencies are maturing as an asset class, such patterns also typically precede a large spike in volatility - such as in November 2017.

During the last bear market, average annualised volatility for BTC was 79% while current average volatility is 63%. Under the context of the current market, we believe it's possible for a high-stress event to take place in the traditional financial system, which would cause sell-side pressure across major asset classes, leading to a spike in volatility and a potential move downwards.

Bitcoin Wallets Of Varying Sizes Accumulating During Market Downturn

As opposed to the last Bear Market, where all holders across different wallet sizes have been panic-selling, this Bear we see a consistent accumulation in almost all accounts. Accounts above 10,000 Bitcoins have seen an increase which is likely a result of increasing institutional adoption.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare.