Throughout the first quarter of 2022 major crypto assets failed to seize the momentum seen in 2021. As a result, the total crypto market capitalization fell 5.37% to $2.09tn. These movements were mainly driven by the uncertain macroeconomic conditions during the quarter, including Russia’s invasion of Ukraine and surging inflation rates which are rising at the fastest pace since 1982.

These events have also seen the spotlight land on cryptocurrencies. Over the past few months, crypto donations have poured into Ukraine and many have questioned the use of crypto by Russian oligarchs. Unsurprisingly, this has led to calls for more regulatory clarity on the asset class with the Biden administration announcing an executive order to ‘ensure responsible development of digital assets.

In this report, we aim to recap these major events and the performance of crypto-assets while giving our views on the trends we anticipate to see going forward, covering stablecoins, DeFi, NFTs, and more.

- While BTC and ETH ended the quarter down, the Invasion of Ukraine on the 24th of February was an inflection point for major assets, with LUNA, ETH, and BTC each returning 57.9%, 26.4%, and 18.7% respectively in the five weeks following the invasion.

- Crypto native firms have received significant pressure to halt activities in Russia following its invasion of Ukraine. This has highlighted the political risks that the crypto industry remains exposed to, particularly among the centralized pockets of the industry.

- The DeFi landscape has shifted in the most recent quarter following an impressive surge in activity for DeFi protocols during 2021. Ethereum has maintained dominance (now at 55.6%), despite stagnant growth with a current TVL of $150bn (down 20.8% from the end of 2021,Q4).

- Looking forward, it is likely that the CBDC and stablecoin space will be paramount to the ongoing success and development in the industry. Market participants should closely monitor this space given the inherent role it plays in the overall ecosystem, with almost 10% of the total crypto market value being in stablecoins.

U-Turn in Macroeconomic Expectations

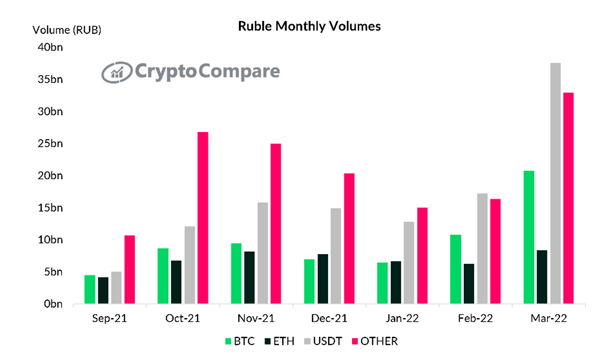

The Ruble has seen significant declines since President Biden announced the first tranche of sanctions on Russia, seeing a 10.7% depreciation against the US Dollar throughout the first quarter.

As illustrated below, Ruble-denominated crypto trading volumes have jumped as a result, despite some exchanges imposing restrictions. These large trading volumes will likely include those wishing to flee the ruble, as well as those who operate with Russian counterparties and wish to send funds internationally while the fiat currency is restricted.

Decentralised Finance & The 'Solunavax' Narrative

The DeFi landscape has shifted in the most recent quarter following an impressive surge in activity for DeFi protocols during 2021. Ethereum has maintained dominance (now at 55.6%), despite stagnant growth with a current TVL of $150bn (down 20.8% from the end of 2021,Q4).

This stagnation can be attributed in part to the weak performance of crypto assets during the quarter, but also to the fierce competition among alternative layer-1 protocols.

BTC and ETH Price Corrections

If a recession does indeed come to fruition as the inversion of the treasury yield curve suggests, we expect crypto markets to behave the same way they did following the COVID-19 pandemic; a sharp correction will occur given the asset class’ risk-on property. This would not be uncommon in crypto, with Bitcoin and other digital assets experiencing dozens of double-digit declines over the last few years.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.