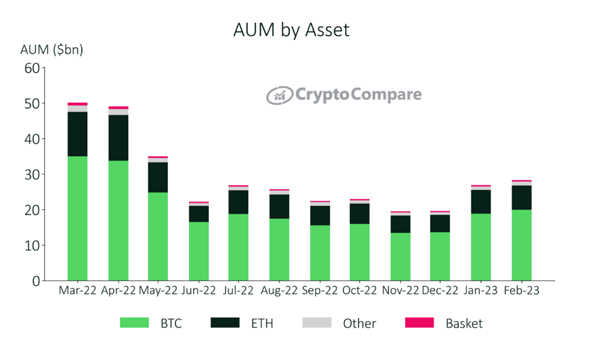

In February, the total assets under management (AUM) for digital asset investment products increased 5.25% compared to January, reaching $28.3bn. The recorded AUM, which is the third consecutive monthly increase and the highest AUM recorded since May 2022, signalled the positive sentiment of investors and the increased appetite for digital assets.

Grayscale's ETCG and LTCN products, and 3IQ’s QETH, led the way with returns of 21.9%, 13.0% and 12.7%, respectively. Proshares’s Short Bitcoin ETF recorded the highest negative returns among analysed digital products with returns of -5.2% followed by Grayscale’s GBTC which recorded -1.3% in returns.

Download the full report for further insights into the digital asset industry.

Key takeaways:

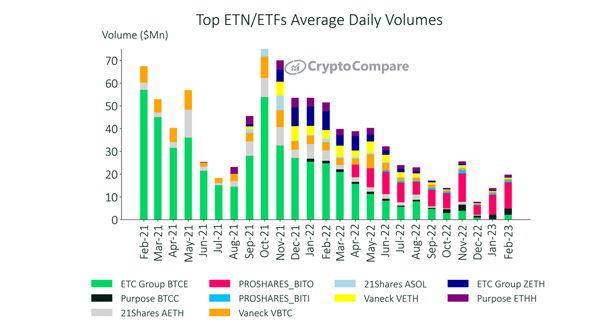

- In February 2023, average daily aggregate product volumes across all digital asset investment products saw a slight decline of 9.39% to $73.3mn. Volumes have increased by 21.5% compared to December, indicating a noteworthy improvement in activity within a short period. However, volumes are still down by 80.1% compared to a year ago (February 2022).

- CI Galaxy recorded the highest increase in AUM, rising 37.7% to $460mn, followed by 21Shares with a 33.4% increase to $1.38bn. Grayscale remained the dominant player with products recording a total AUM of $20.8bn; a 3.02% increase compared to last month, followed by XBT Provider ($1.54bn) and 21Shares ($1.38bn).

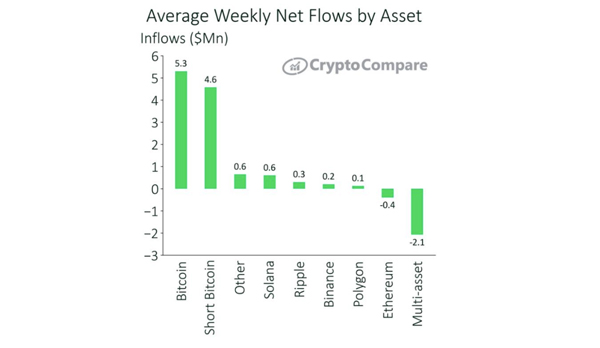

- Net flows continued their upward trend thus far in 2023, with average weekly net flows of $8.80mn in February. Even though this month's figure pales in comparison to the $38.5mn achieved in January, flows are still significantly higher compared to 2022 figures.

- BTC-based products remained dominant in terms of weekly net flows, with both BTC-based products and Short BTC products recording positive flows of $5.3mn and $4.6mn, respectively.

- Despite a slight recovery in January, the discount for Grayscale Trust Products continued to widen in February, following the parent company DCG's efforts to raise funds by selling its positions in the products. One of the most significant sales was approximately 25% of its Ethereum Trust (ETHE) at a discount of around 50% of the trust’s price, as reported by the Financial Times.

AUM Continues To Increase Despite SEC Enforcements and Macro Headwinds

The assets under management (AUM) for Bitcoin and Ethereum-based products saw an increase of 6.06% and 1.72%, respectively, reaching $20.0bn and $6.80bn. As a result, these products now account for 70.5% and 24.0% of the total AUM market share.

In addition, the AUM for "Other" and “Basket” assets also saw an increase of 14.7% to $1.16bn and 2.33% to $413mn, respectively. BTC-based products reached their highest market share since June 2022.

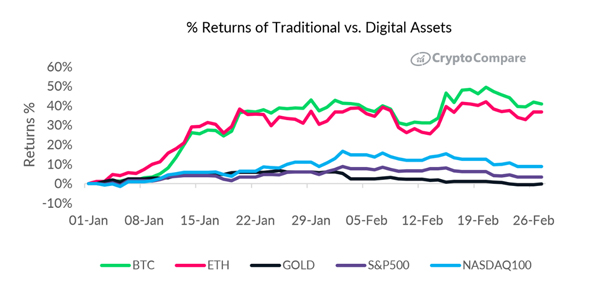

Digital Assets Continue To Outperform Traditional Counterparts

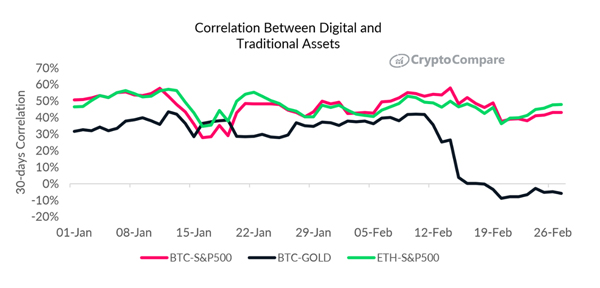

The AUM of BTC and ETH-based products has been steadily increasing since the beginning of the year, as digital assets continue to outperform traditional assets in 2023. Although the correlation between digital assets and traditional assets has been rising, it has recently stabilized and is expected to decrease as innovation fuels interest for digital assets.

In February, this was seen as the correlation between BTC and traditional assets declined, with BTC-GOLD seeing the sharpest change in correlation out of the tracked assets.

BTC Products Continue To Dominate Average Weekly Net Flows

During February, BTC-based products remained dominant in terms of weekly net flows, with both BTC-based products and Short BTC products recording positive flows of $5.3mn and $4.6mn, respectively.

Solana-based products sustained their momentum with positive net flows, receiving $0.6mn in inflows. On the other hand, Ethereum-based products experienced negative net flows of $0.4mn as well as multi-asset products with negative net flows of $2.1mn.

Trust Product Volumes Fall as ETNs Rise

In February 2023, average daily aggregate product volumes across all digital asset investment products saw a slight decline of 9.39% to $73.3mn. The decrease in volumes exemplifies a general downward trend in activity among crypto products.

Despite this trend, ETNs and ETFs saw a rise of 44.6% to $23.0mn with Bitcoin-based products continuing to dominate volumes. Proshares’s (BITO) saw the highest trading volumes followed by Purpose’s Bitcoin product (BTCC) and ETC Group’s (BTCE), trading $11.5mn (up 33.1%), $2.85mn (up 41.6%), and $2.09mn (up 803%) respectively.

Grayscale's Bitcoin product, GBTC, saw its volumes decline 21.1% to $31.4mn in February. Grayscale's Ethereum product saw a similar trend recording a 21.1% decline in volume to $15.8mn.