CryptoCompare is delighted to release CryptoCompare’s latest Stablecoins & CBDCs Report. In this report, CryptoCompare provides insight into the latest developments in the stablecoin and CBDC sector, focusing on analysis that relates to market capitalisation, trading volume, peg deviation and more.

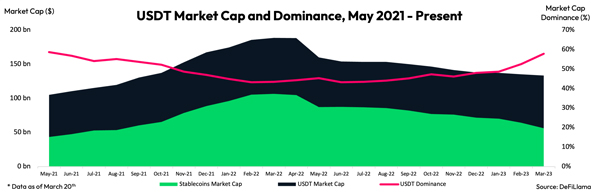

In March, the total market capitalisation of stablecoins fell 1.34% to $133bn (data up to 20th March), the lowest stablecoins market cap since September 2021 and the twelfth consecutive month of decline. The fall in market cap follows the depeg of multiple stablecoins after the collapse of USDC’s banking partner– Silicon Valley Bank.

You can access the report here.

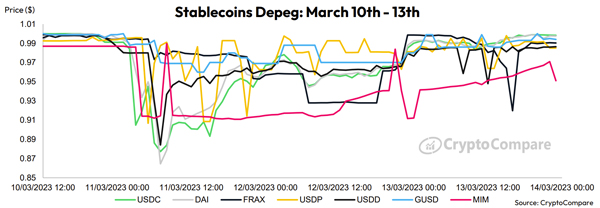

- On March 10, USDC started depegging following the collapse of its partner bank, Silicon Valley Bank, which held $3.3bn of its stablecoins reserves. The stablecoin fell as low as $0.877 on the 11th of March. Other stablecoins that hold USDC in their reserves as collateral were also affected with DAI, MIM and FRAX falling as low $0.865, $0.911 and $0.920 on the 11th of March respectively.

- Stablecoins market dominance is currently at 11.4%, falling from 12.6% in February and recording its lowest end-of-month market share since April 2022. The decline in stablecoin dominance highlights the rally in the prices of crypto assets amidst the recent depeg of USDC and other stablecoins.

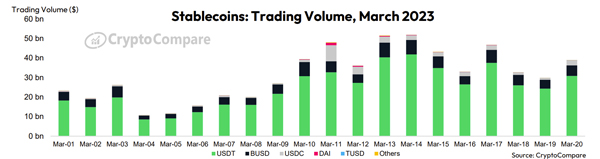

- On March 14, stablecoins trading volume reached $51.9bn as USDC and other stablecoins recovered their peg. This was the highest daily volume recorded since November 10 (during FTX's collapse). Stablecoins including DAI, MIM and LUSD also recorded their highest volume on centralised exchanges during the turmoil.

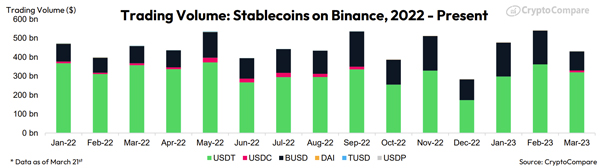

- In March, the market capitalisation of TUSD rose 82.6% to $2.04bn. The surge follows Binance's resumption of TUSD trading pairs on the exchange and its conversion of $1bn worth of its ‘SAFU Fund’ in BUSD to TUSD and USDT. TUSD is also the only BTC and ETH trading pair with zero fees on the exchange.

- With rival stablecoins BUSD having stopped minting new tokens, and USDC facing uncertainty following the collapse of its partner bank, USDT continues to strengthen its stablecoin dominance. The market dominance of USDT now stands at 57.5%, the highest market share since 20th June 2021. The market cap of USDT has increased by $5.76bn since the depeg of USDC on March 10th.

Stablecoin Daily Trading Volume Reaches Highest Level Since FTX Collapse

Trading volumes with stablecoins reached $51.9bn on the 14th of March, as crypto assets rallied after stablecoins recovered their peg following FDIC’s guarantee for all deposits in Silicon Valley Bank.

This was the highest daily stablecoins volume recorded since the 10th of November – amidst the collapse of FTX. During the turmoil, volume traded with USDC reached $8.12bn on March 11th, the highest daily volume since June 2022, as traders panicked following the depeg of the stablecoins.

USDT Market Dominance Reaches Highest Level Since June 2021

With BUSD halting the minting of new tokens, and USDC facing uncertainty following the collapse of its partner bank, USDT continues to strengthen its stablecoin dominance. As a result, USDT's market share now stands at 57.5%, its highest share since 20th June 2021.

USDT's market capitalisation also rose 8.06% in March (as of the 20th) to $76.6bn and has increased by $5.76bn since the depeg of USDC on March 10th. This is the highest market cap for the stablecoin since April 2022.

Multiple Stablecoins Depeg As USDC’s Partner Bank Collapses

On March 10, USDC started depegging following the collapse of its partner bank, Silicon Valley Bank, which held $3.3bn of its stablecoins reserves. The stablecoin fell as low as $0.877 on the 11th of March. Other stablecoins that hold USDC in their reserves as collateral were also affected, with DAI, MIM and FRAX falling as low as $0.865, $0.911 and $0.920 on the 11th of March respectively.

TUSD Market Cap Rises As Binance Resumes Trading Pairs

Binance USD (BUSD)’s market capitalisation continued to slide following SEC’s action against the stablecoin last month, falling 22.2% to $8.29bn.

TrueUSD (TUSD) was the largest gainer by market cap in March, rising 82.6% to $2.04bn after Binance resumed the trading of TUSD, USDC, and USDP pairs on the exchange. The stablecoin also benefitted from Binance replacing the BUSD in its 'SAFU Fund' worth $1bn with TUSD and USDT.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.