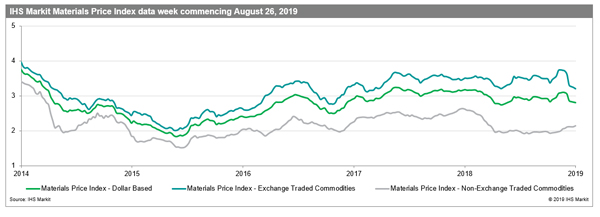

Commodity prices, as measured by the IHS Markit Materials Price Index (MPI), fell another 0.5% last week, their sixth consecutive weekly decline. Commodity prices have now moved to their lowest level since January. While US and Chinese policymakers dialled back on the harsh trade rhetoric of recent weeks and helped rally equity and bond markets, commodities continued to sag, on worries about demand.

Iron ore prices fell again, dropping 1.7% for the week. Chinese iron ore port stocks rose 3.3% as weak demand, well stocked mills and falling finished steel prices discouraged buying. Chinese steel inventories stand 27% higher y/y, suggesting iron ore’s recent rout may continue. Likewise, non-ferrous prices are suffering from disappointing Chinese demand and fell 0.3% last week, despite nickel rising 4.4%. Nickel prices have jumped by 50% since June on fear (now realized) that Indonesia would bring forward its proposed ban on nickel ore exports to the start of 2020. Fiber prices dipped 2.3% on falling demand and a softening cost base. The MPI’s energy sub index slipped 0.9% on declines in both oil and coal prices as traders reduced long positions in expectation of continued volatility.