Tesla’s three most recent profitable quarters means it is now on the verge of qualifying for the S&P 500 index. Its share price jumped above $800 this week (from a March low around $400) and it has a market value of $150bn – almost 3 times the combined value of two famous US automakers, Ford and General Motors.

Joining the S&P 500 in our view will add credibility and increased investor demand - helping to propel the stock higher over time. Tesla, we feel, is increasingly a technology company due to its proprietary battery technology, use of cloud technology and other innovations.

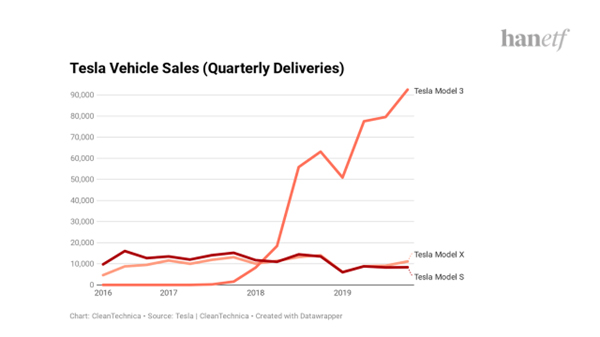

Tesla operates the largest battery factory globally and intends to license its battery software and spare capacity to other car makers. Consequently, we agree with the higher valuations analysts are placing on Tesla. Prior to COVID19 it had already begun to meet its production targets and display growing profits. We remain bullish on Tesla, particularly as EV vehicles are set to gain further popularity post COVID19. *(see chart below)

Observations on how the innovative tech market is performing under Coronavirus

Our view is that COVID19 is fast tracking/accelerating adoption rates across various forms of technology. Online services have held up remarkably well – despite prior concerns that the likes of Netflix and other streaming devices would cause Internet disruptions.

As the lockdown persists, many of the new ‘work from home habits’ - will become increasingly permanent fixtures in our everyday lives. This is good news for innovative technologies that are being embraced far quicker than predicted just a few months ago. In particular, medical innovations - from telehealth, medical wearables to AI/Robotic diagnostic devices - are likely to become mainstream across the global healthcare industry.

Cloud Technology and cybersecurity companies are also likely to continue benefiting from the massive spike in demand from remote workers. We expect many workers to continue working remotely (a few days a week) – helping to drive demand for related Cloud/Cybersecurity services including VPNs (Virtual Private Networks).

Already Cloud is the current Big Tech battleground, where we predict upwards of 60% of all IT expenditure is likely to go over the next 2-3 years (Gartner Research). Cloud offers pricing flexibility and an easy transition for most small and medium size enterprises – who enjoy immediate savings by limiting onsite hardware purchases and ongoing IT maintenance costs. It helps reduce IT overhead costs almost immediately. We expect online purchasing (E-retail) to be increasingly tied to social media platforms. Lastly, we see electronic and mobile payments (Fintech) gaining further mainstream acceptance.